Data Bites: How McGriddles Stacked Up in McDonald’s Hong Kong

The much-anticipated arrival of McDonald’s McGriddles has taken Hong Kong by storm. Curious about the order trends during the trial phase? Wondering how McGriddles’ exclusive launch on Foodpanda impacted order volume? Measurable AI digs into the data to reveal the scoop on Hongkongers’ McGriddles obsession.

With our proprietary transactional e-receipts data, Measurable AI analyzed McDonald’s mobile app orders and Foodpanda orders to reveal the consumer insights behind the sweet, savory McGriddles craze.

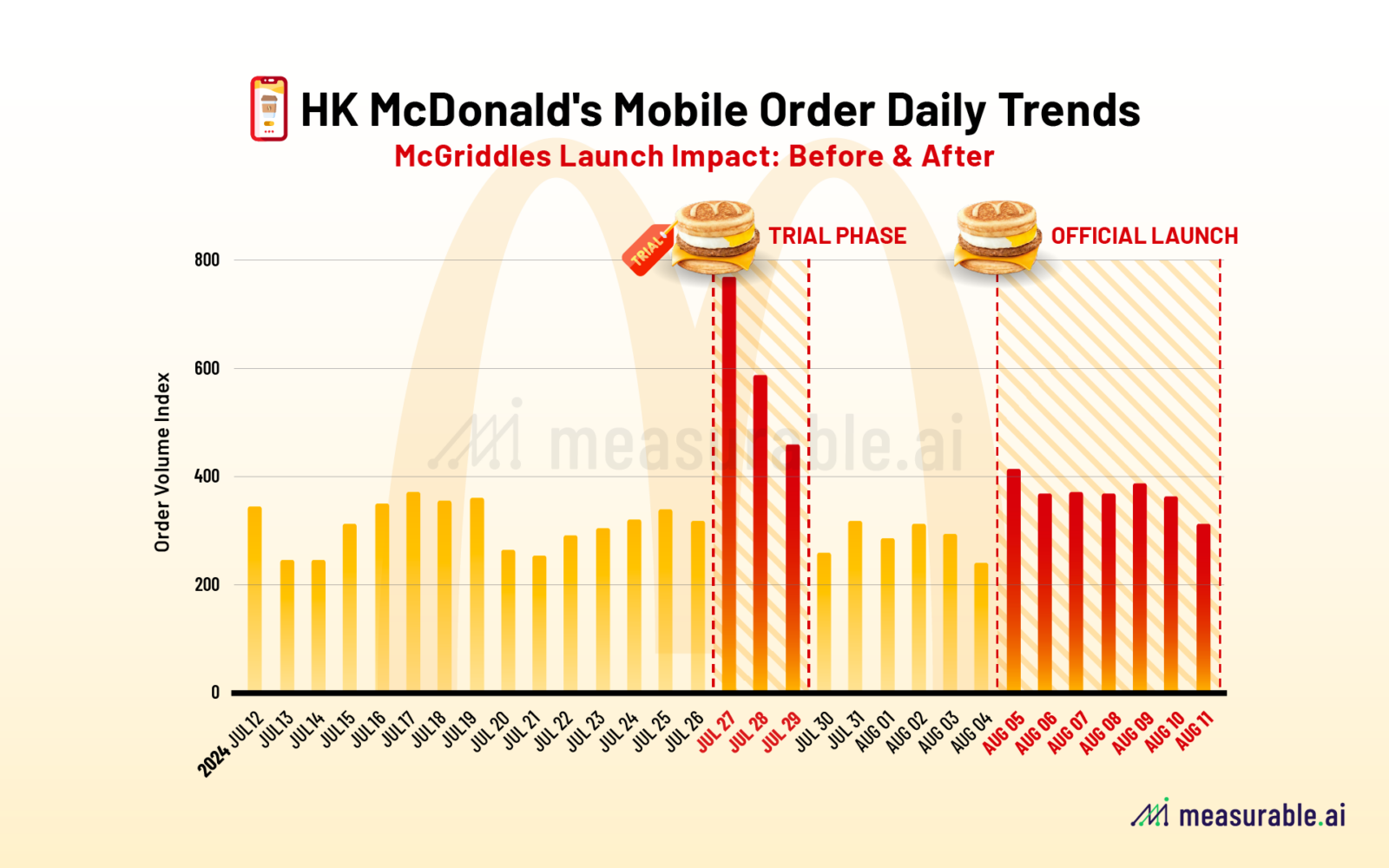

The McGriddles Effect: A Spike in McDonald’s Overall Mobile Orders

The launch of McGriddles had a noticeable impact on McDonald’s overall mobile order trends in Hong Kong. During the trial phase from July 27th to 29th, orders peaked significantly, with July 27th seeing double the order volume compared to the pre-launch period. While the official launch from August 5th to 11th saw a steady increase in order volume, it didn’t quite reach the trial period’s heights. This could be due to the limited availability during breakfast hours and the fact that customers could also order in restaurants, thereby making it less exclusive to McDonald’s app.

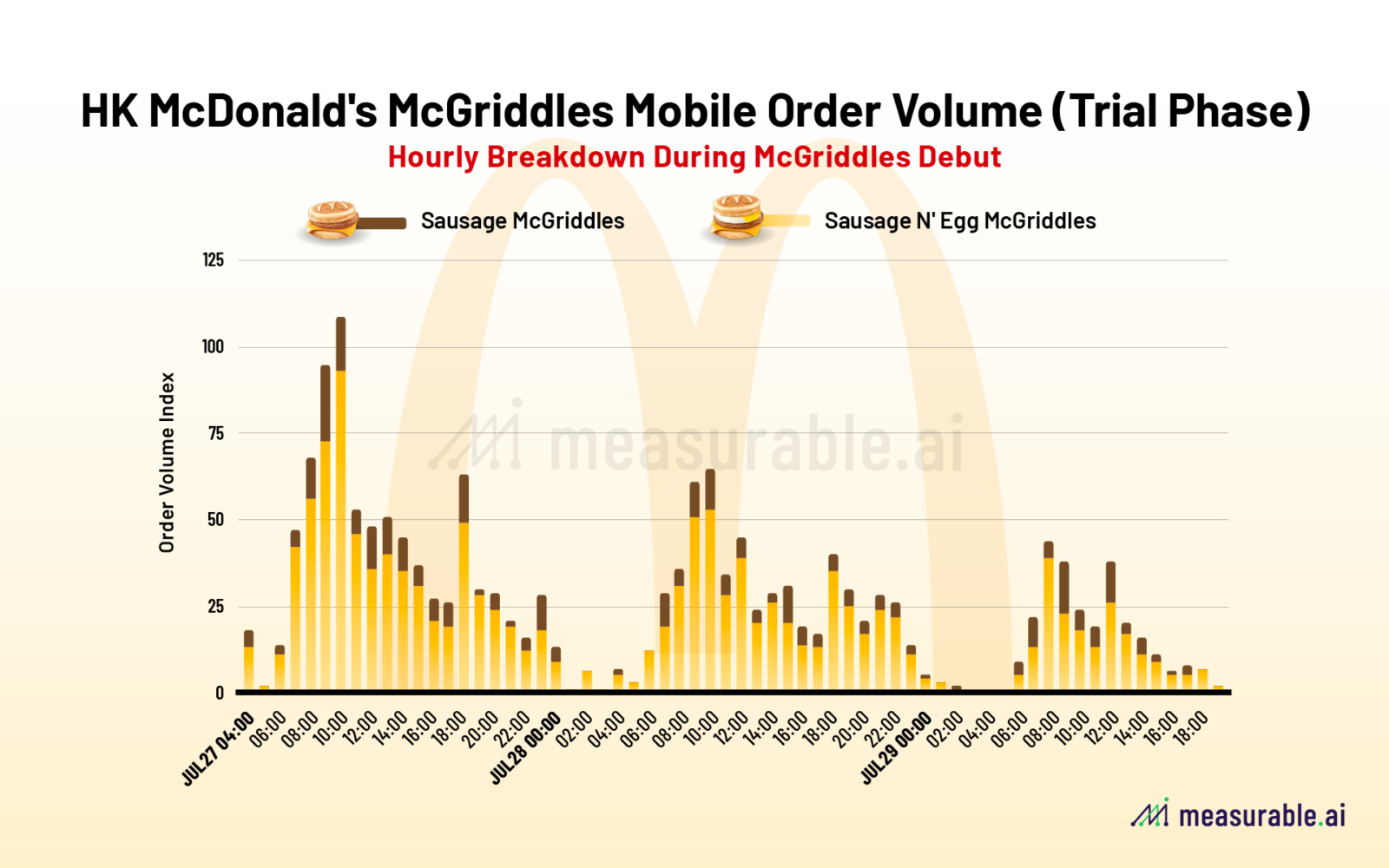

Peak Hours and Early Risers: A Closer Look at McGriddles Trial Phase Orders

During the trial phase from July 27th to 29th, McGriddles were available 24 hours a day through McDonald’s mobile app. The data reveals that the peak ordering time was between 9 AM and 11 AM on the first day, as many Hongkongers opted for McGriddles as their Saturday breakfast choice.

Interestingly, there was also a spike at 6 PM, with some dedicated fans placing orders as early as 4 AM to be among the first to try this much-talked-about item.

Fun fact: 80% of McGriddles orders included an egg!

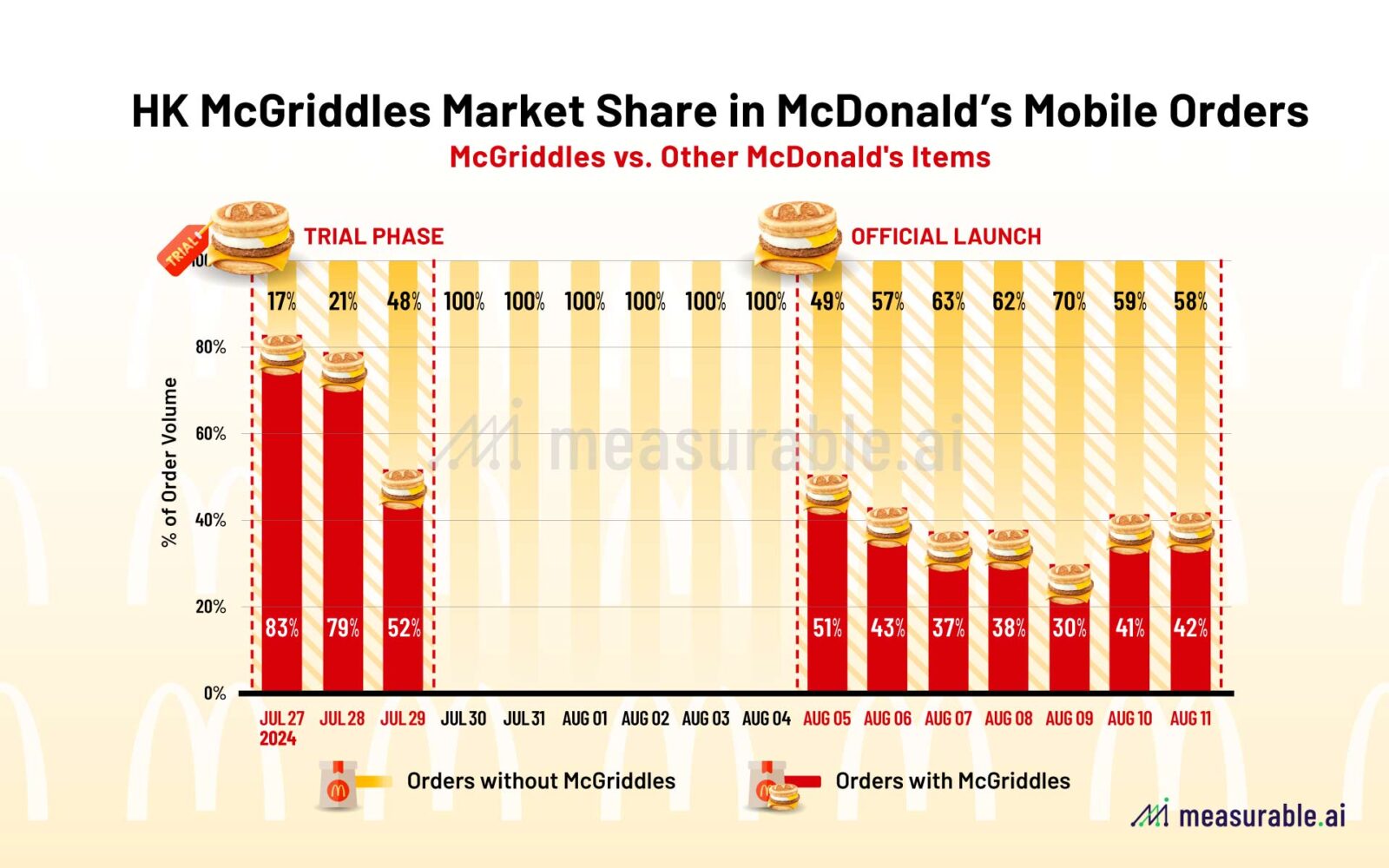

McGriddles Market Share: Dominating McDonald’s Mobile Orders

Measurable AI’s analysis shows that during the trial phase, McGriddles made up an impressive 74% of all McDonald’s app orders. Although this share decreased to around 40% during the first official week of launch, McGriddles still held a significant portion of the market, demonstrating its popularity among McDonald’s app users.

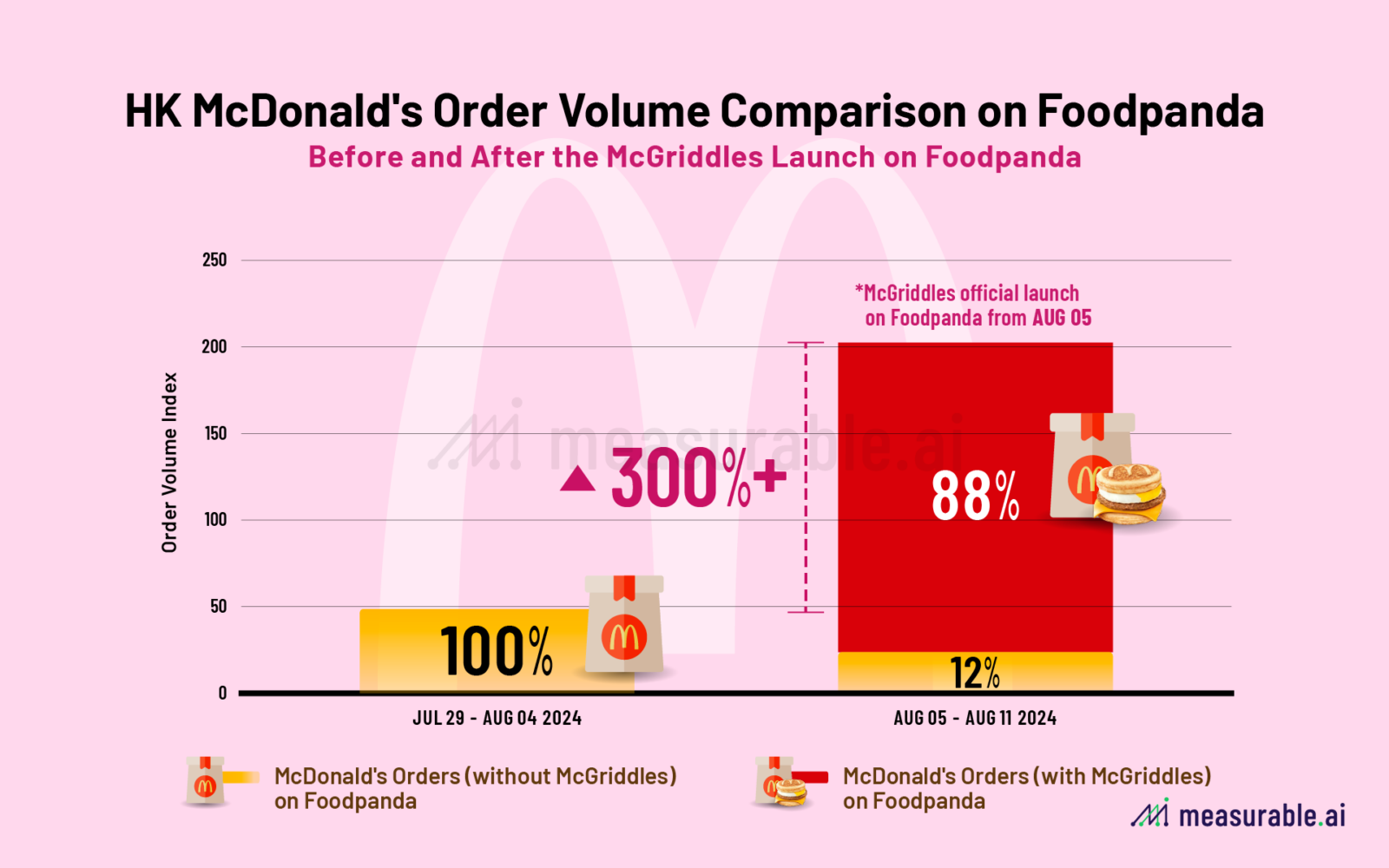

How Did the McGriddles Exclusive Launch on Foodpanda Impact Order Volume?

Foodpanda, the exclusive delivery partner for McGriddles, saw a significant impact from the launch. Featuring Japanese megastar Takuya Kimura, the McGriddles campaign resulted in McDonald’s order volume on Foodpanda more than three times higher compared to the previous week, which is a fourfold increase. McGriddles orders accounted for 88% of all McDonald’s orders on Foodpanda.

McGriddles Order Value: A Platform Comparison

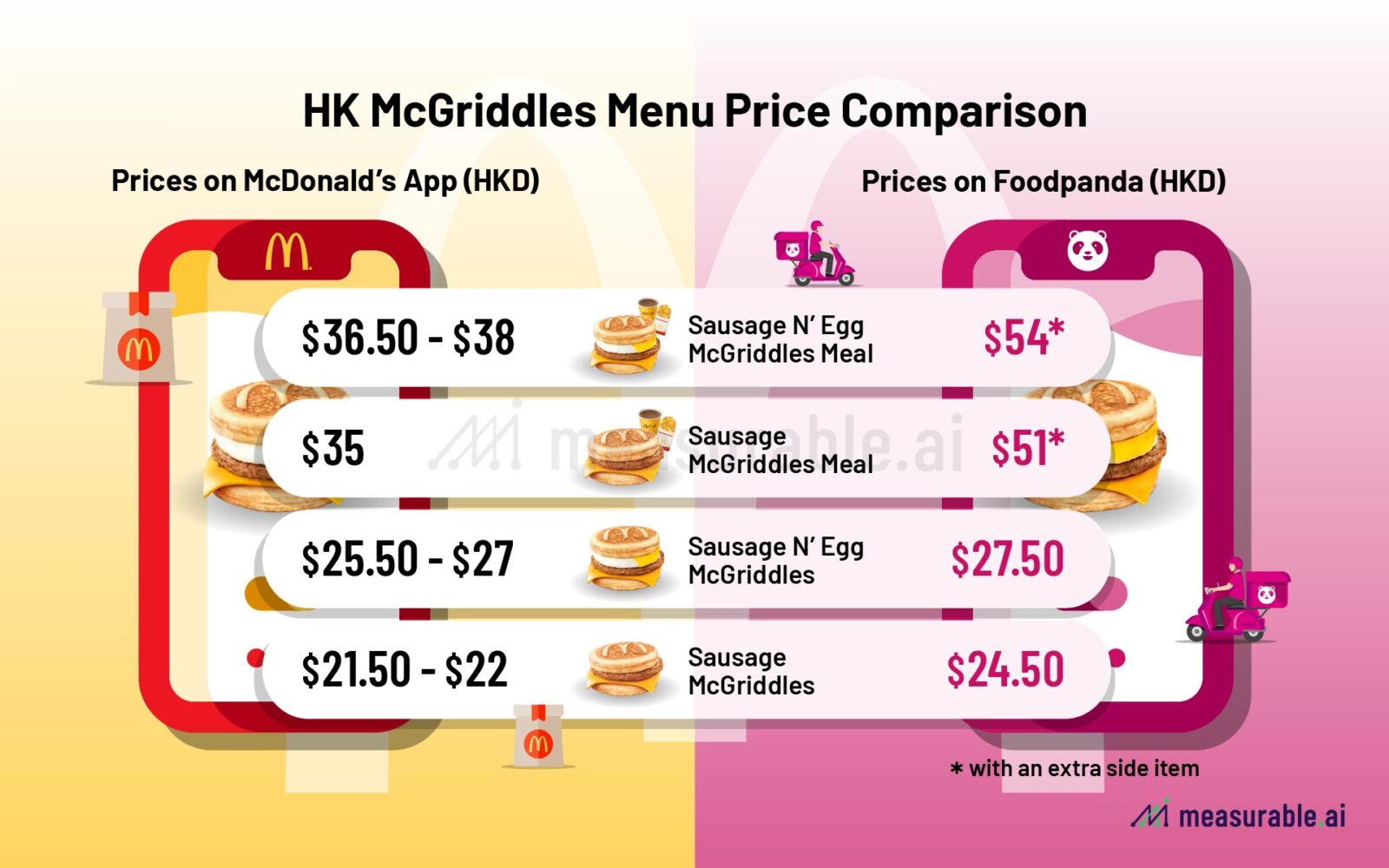

Price differences between platforms were also significant. On McDonald’s app or in-store, McGriddles meals were priced between $35 and $38, while on Foodpanda, they ranged from $51 to $54, with an additional side item included. Foodpanda further incentivized orders with promotions like $20 off purchases over $100 and an extra $20 discount with promo codes for orders over $150. But how did these pricing strategies impact order values?

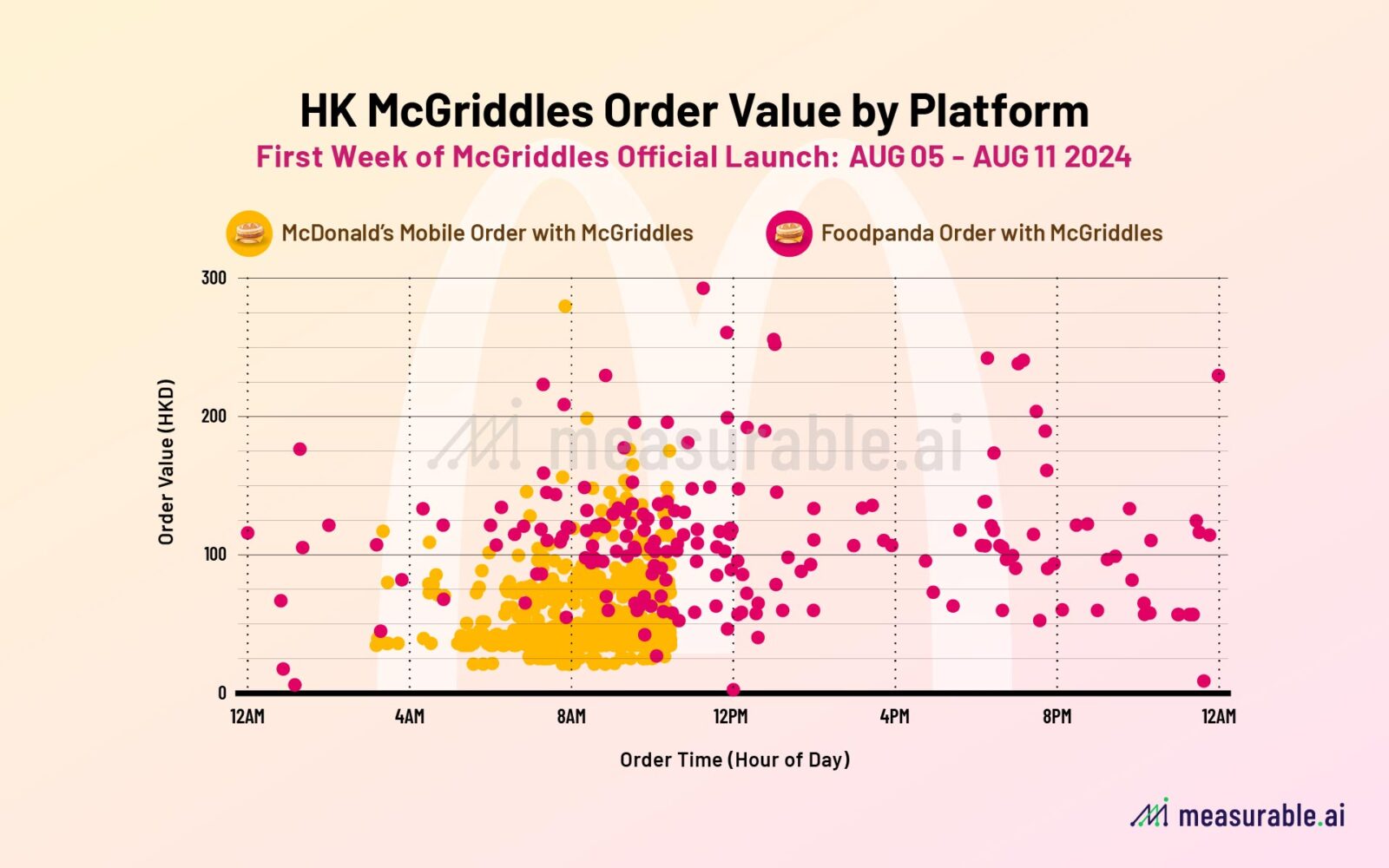

Measurable AI’s data reveals that McDonald’s app orders were most frequent between 7 AM and 11 AM, with an average order value of $49. In contrast, Foodpanda orders, available 24/7 during the first week of the McGriddles launch, showed a broader distribution and a much higher average order value of $112, reflecting the larger nature of delivery orders and the platform’s higher pricing.

What’s next?

The McGriddles launch in Hong Kong has not only stirred excitement among consumers but has also noticeably influenced order trends on both McDonald’s app and Foodpanda. How will this new product affect the competitive landscape of Hong Kong’s food delivery platforms? Could it shift the balance in the ongoing race between food delivery giants?

If you’re curious about how e-receipt data could reveal deeper insights into these trends, connect with Measurable AI today. Our detailed, actionable insights from granular data can help you understand the shifts in the market and uncover new strategies. What new opportunities could you discover with a closer look at Hong Kong’s food delivery data? The possibilities are yours to explore.

Follow our insights blog and newsletter to keep up with this heated competition. Or contact us at [email protected] if you are a hedge fund, corporation or in market research and looking for the most up-to-date transactional data insights for the digital economy.

About Measurable AI

At Measurable AI, we build and own a unique email receipt consumer panel and have become the largest transactional email receipt data provider for the emerging markets. We are well regarded for the granular insights that can be extracted from our comprehensive datasets across the digital economy, including e-commerce, food delivery, ride-hailing and fintech.

Check out our annual reports: 2024 AltAsia Online Delivery Report, 2019-2022 Food Delivery Annual Report for Asia, Asia & Americas Ride-hailing Report 2019-2023.

*The Content is for informational purposes only, you should not construe any such information or other material as investment advice. Prior written consent is needed for any form of republication, modification, repost or distribution of the contents.

Read More:

Hong Kong Food Delivery Market: A New Triopoly

Watch Out! KeeTa’s Rapid Rise in Hong Kong

All Eyes on Burgers in Hong Kong

Flavor Meets Data 🍔 Unveiling McDonald’s Hong Kong Order Habits (Part 2)

Hong Kong’s Noodle Rhapsody: Food Delivery Insights on TamJai and SamGor

![]()