Hong Kong Food Delivery Market: A New Triopoly

Hong Kong’s food delivery market was a three-way battle among Foodpanda, UberEats, and Deliveroo from 2018 to 2021. After UberEats exit, the market became a duopoly between Foodpanda and Deliveroo for the ensuing two years. In 2023, Meituan’s KeeTa entered the scene, once again making it a triopoly battlefield. At Measurable AI, we continuously monitor the market change in the online delivery industry with our proprietary transactional e-receipts data. Subscribe to our newsletter to get updates every month.

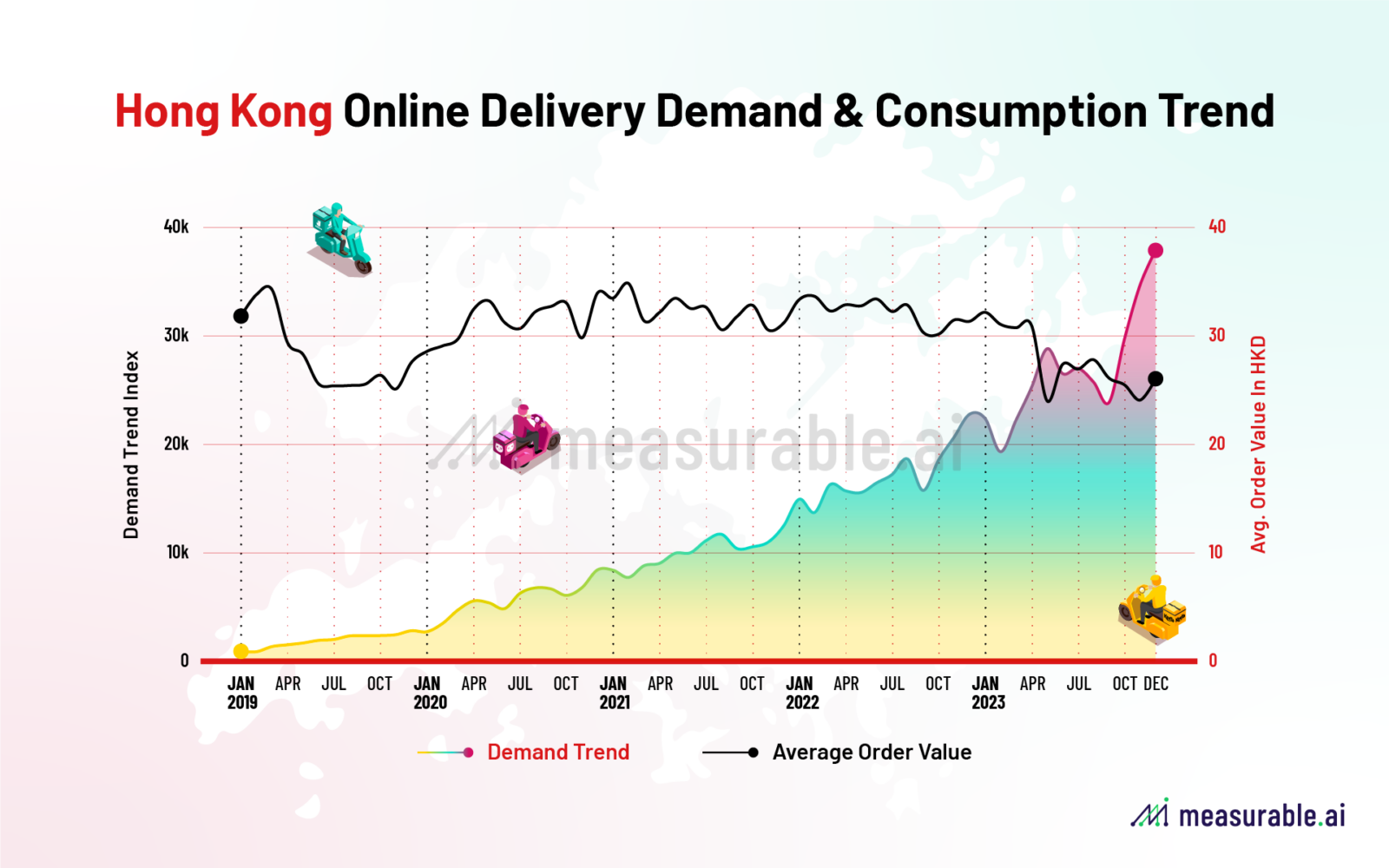

According to Measurable AI’s latest AltAsia online delivery report, the market demand in Hong Kong online delivery for food and groceries has continued its robust growth throughout the past five years. From 1Q23 – 1Q24, there has been an impressive growth in order volume, up by over 40% year-over-year (YOY), and the gross merchandise value (GMV) has witnessed a healthy increase of approximately 22% YOY, based on observed sales from Measurable AI’s transactional e-receipt panel.

New challenger KeeTa entered the Hong Kong market in May 2023. Our data reveals that its entry has redistributed some of the market share from existing competitors; yet the overall consumption trends and market demand in Hong Kong have maintained a solid uptrend.

Head-to-Head : Foodpanda vs Deliveroo vs KeeTa

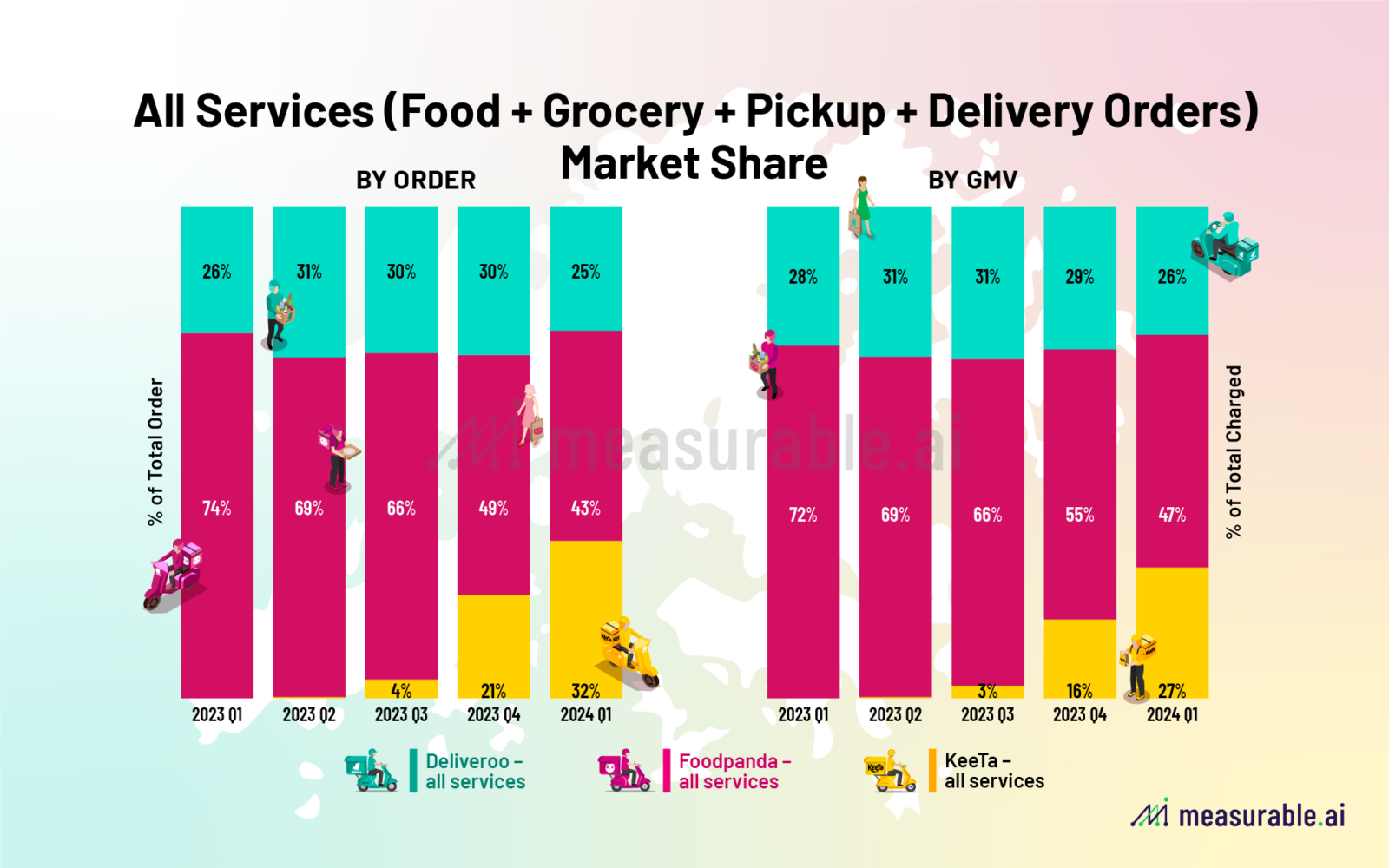

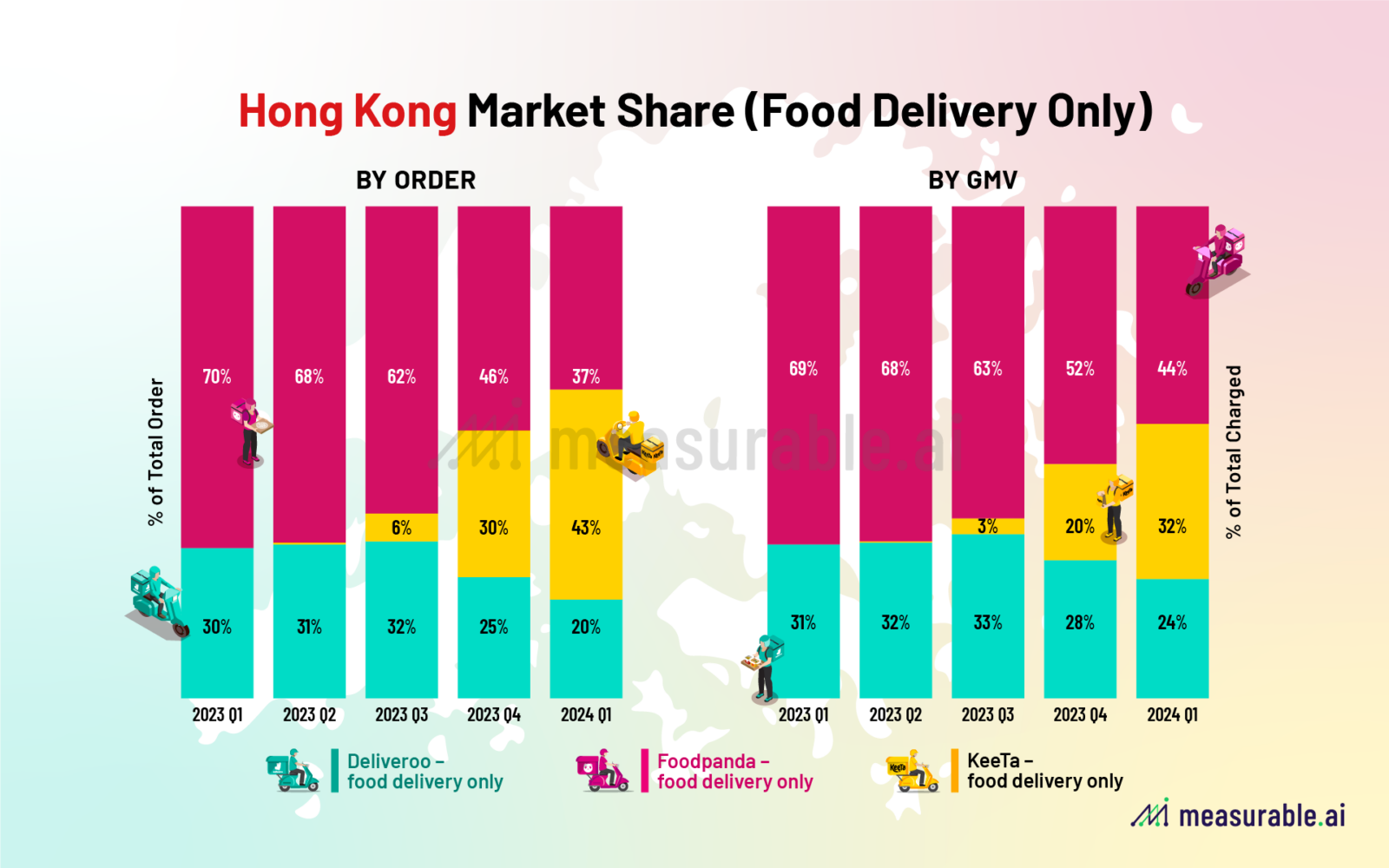

Amongst the current three players in Hong Kong, when we look at the market share in ALL SERVICES (food + grocery + delivery + pickup), Foodpanda remains No.1 by both order volume and GMV. Deliveroo’s marketshare didn’t grow too much in the past year, but it has managed to maintain its position from around a year ago, hovering at around 30%. KeeTa has achieved the most substantial growth since its entry into Hong Kong. By 1Q24, KeeTa’s market share by order volume in ALL SERVICES has grown to 32%, and by GMV it stands at 27%.

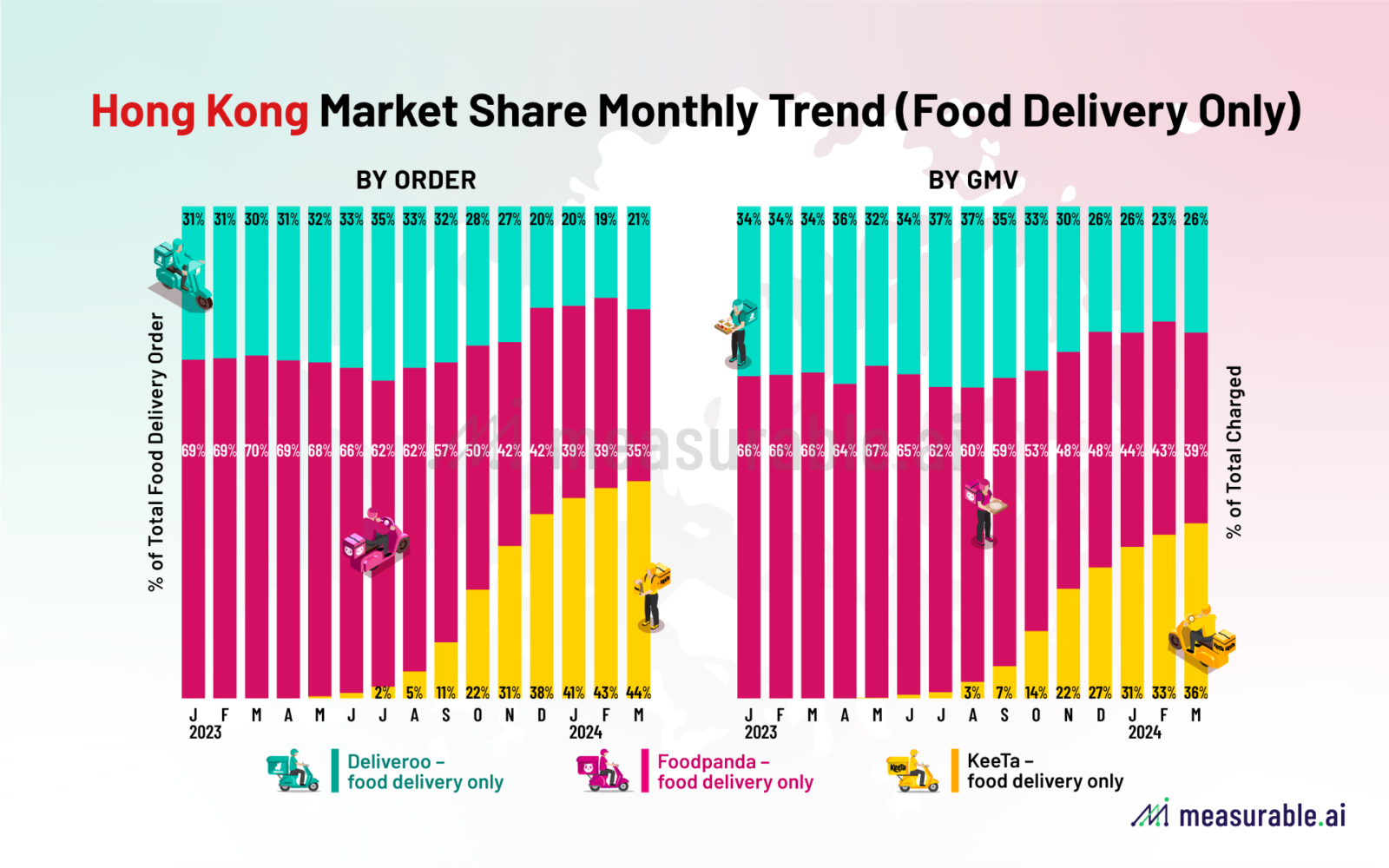

Currently, KeeTa does not offer grocery delivery and only recently introduced the pickup service in late February 2024. Measurable AI’s e-receipts panel shows that, as of 1Q24, KeeTa’s market share in FOOD DELIVERY ONLY—excluding grocery and pickup services—reached 32% by GMV and a notable 43% by order volume.

Pickup Delivery is the New Incentive

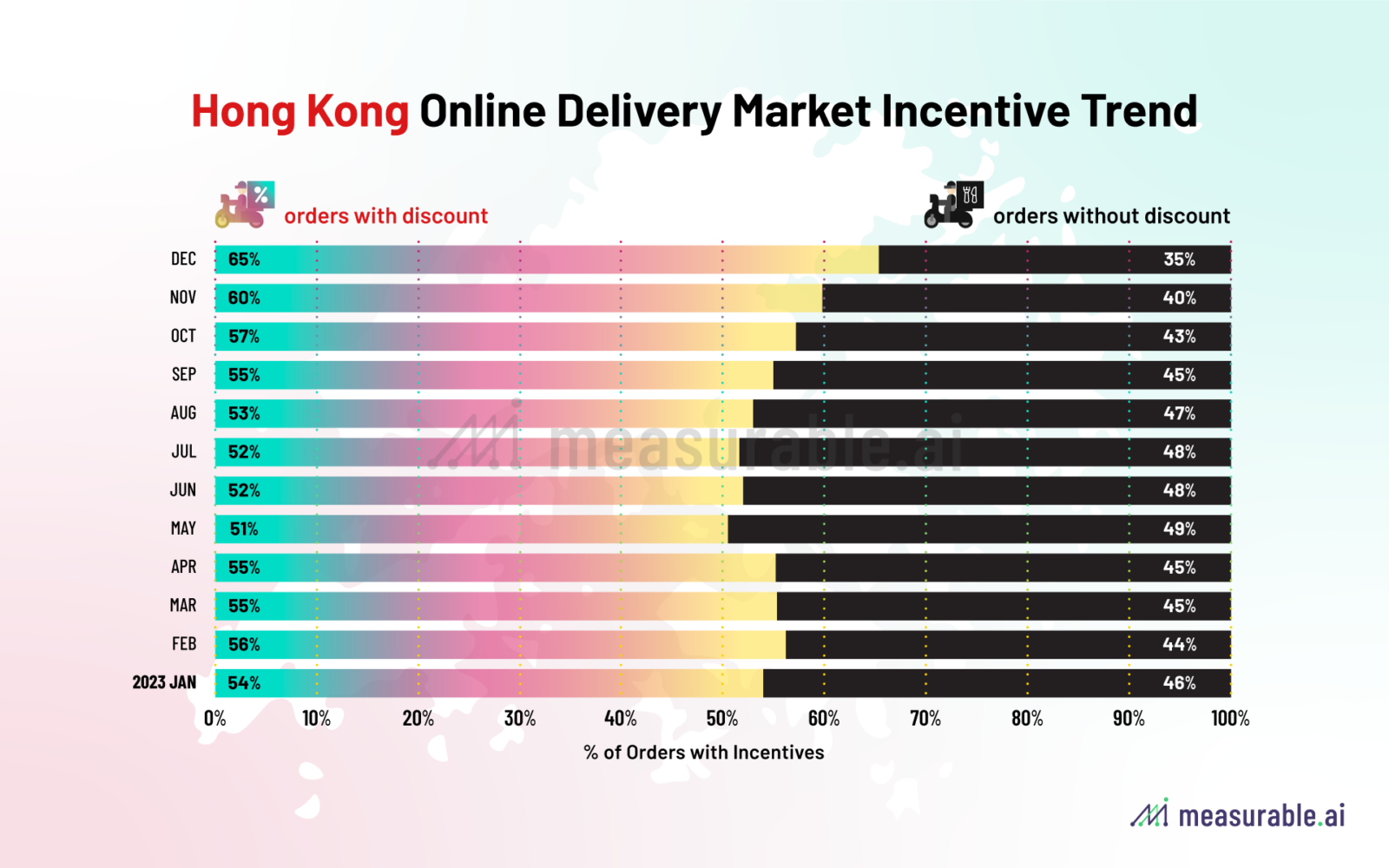

In Measurable AI’s latest 2024 AltAsia Online Delivery Report, our data reveals that the incentive trend in the Hong Kong online delivery market started to rise quickly again in 4Q23, due to the heated competition from the new entrant KeeTa. As of December 2023, we observed that over 60% of the orders in Hong Kong came with promotions. This is significantly higher than the other AltAsia markets mentioned in the report (download the full report here).

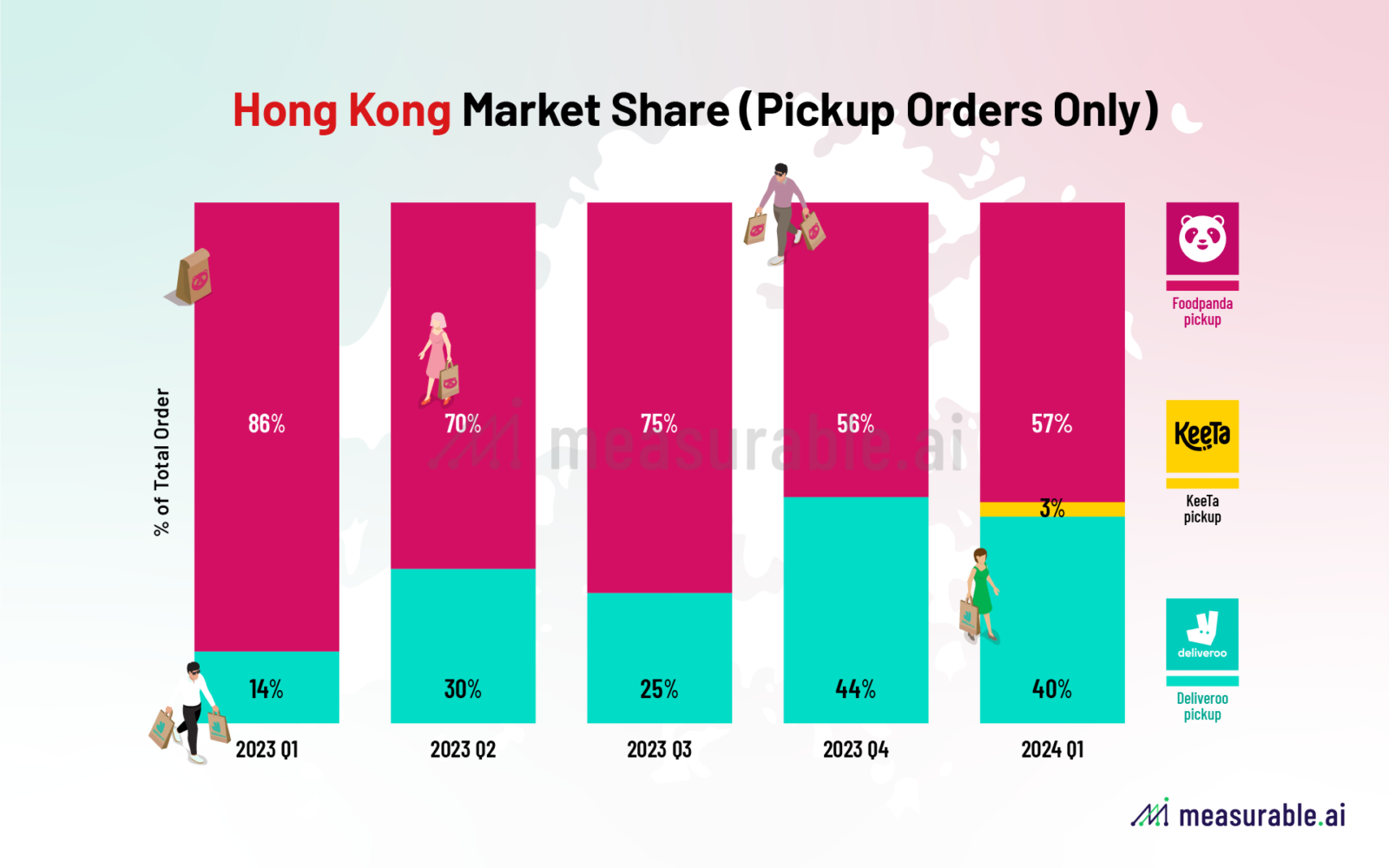

Unlike KeeTa’s traditional subsidy-heavy strategy, Foodpanda and Deliveroo are working on massive campaigns to encourage consumers to opt for self-pickup. In Hong Kong, self pick-up orders are growing very quickly on the food delivery platforms. Foodpanda saw approximately 35% of its orders in 2023 as pickups. As for Deliveroo, when it comes to self pick-up, there has been a substantial rise from about 15% in 1Q23 to over 40% by 4Q23.

It’s worth noting that the competition can also be heated in terms of the pickup orders. As we look into the market shares for pickup orders only, we noticed that Foodpanda remained strong in its leading position for pickup orders. Meanwhile, Deliveroo is catching up quickly from around 14% of the market share in 1Q23 to around 40% in 1Q24.

In some of these campaigns, users can enjoy up to 50% off when they pick up orders. This approach has a much lower operational cost for the platforms yet without taking away too much of the takerate from each order.

Our data also indicates that the incentive strategies, including Foodpanda and Deliveroo’s pickup orders and KeeTa’s subsidy-heavy orders, resulted in a much lower Average Order Values (AOV). When considering the overall AOVs, KeeTa’s AOV in Hong Kong remains the lowest at around HKD 102 (~ USD 13). In contrast, despite the increasing volume of pickup orders, the AOV for Foodpanda and Deliveroo remains robust, typically ranging between HKD 170 and 180 (~ USD 21.50 to USD 23) throughout the year.

KeeTa’s One Year in Hong Kong

Despite the stiff competition and threat from domestic competitor Douyin, Meituan’s international expansion continues unabated. Last month, Meituan announced its expansion into Saudi Arabia, right before KeeTa’s first anniversary in Hong Kong. Here’s a snapshot of KeeTa’s first year in Hong Kong (and a monthly trend of its growth):

- May 22, 2023: KeeTa launches its food delivery service in select districts

- September 2023: KeeTa begins rapid growth in market share by order

- October 2023: KeeTa expands to all districts in Hong Kong

- 4Q 2023: KeeTa’s market share by GMV for food delivery jumps to 20%

- February 20, 2024: KeeTa introduces self-pickup feature.

- 1Q 2024: KeeTa captures approximately 27% of the market share by GMV, and 32% by order, across all services.

Stay tuned as we continue to monitor the Hong Kong food delivery race between Keeta, Foodpanda, and Deliveroo in our upcoming blog post with Measurable AI’s unique consumer panel.

At Measurable AI, we build and own a unique consumer panel and are the largest transactional email receipt data provider for the emerging markets. We are well regarded for our comprehensive alternative dataset across the digital economy, particularly for our consumer insights relating to the food delivery industry. To unlock more detailed analysis including user loyalty/retention rate, overlap analysis, and incentive trend, please schedule a demo with us, and download our 2024 Digital Economy Annual Report.

About Measurable AI

Charlie Sheng is a serial entrepreneur, and a dedicated communicator for technology. She enjoys writing stories with Measurable AI’s very own e-receipts data. You can reach her at [email protected].

Check out our annual reports: 2024 AltAsia Online Delivery Report, 2019-2022 Food Delivery Annual Report for Asia, Asia & Americas Ride-hailing Report 2019-2023.

*The content is for informational purposes only, you should not construe any such information or other material as investment advice. Prior written consent is NEEDED for any form of republication, modification, repost or distribution of the contents.

![]()