McDonald’s the Most Loved on UberEats and Foodpanda in Taiwan

Online Food Delivery apps are changing the traditional fast food restaurant business. With their user-friendly experience, professional driver network, and rapid global expansion, many fast food chains have chosen to onboard the food delivery platforms to keep up with the on-demand economy.

At Measurable AI, we build and own a unique consumer panel and are the largest transactional email receipt data provider for the emerging markets. We are well regarded for our comprehensive dataset across the food delivery industry. Follow our insights blog or subscribe to our newsletter to learn more gain deeper and more accurate food delivery market intelligence.

Whose customers love Big Macs more?

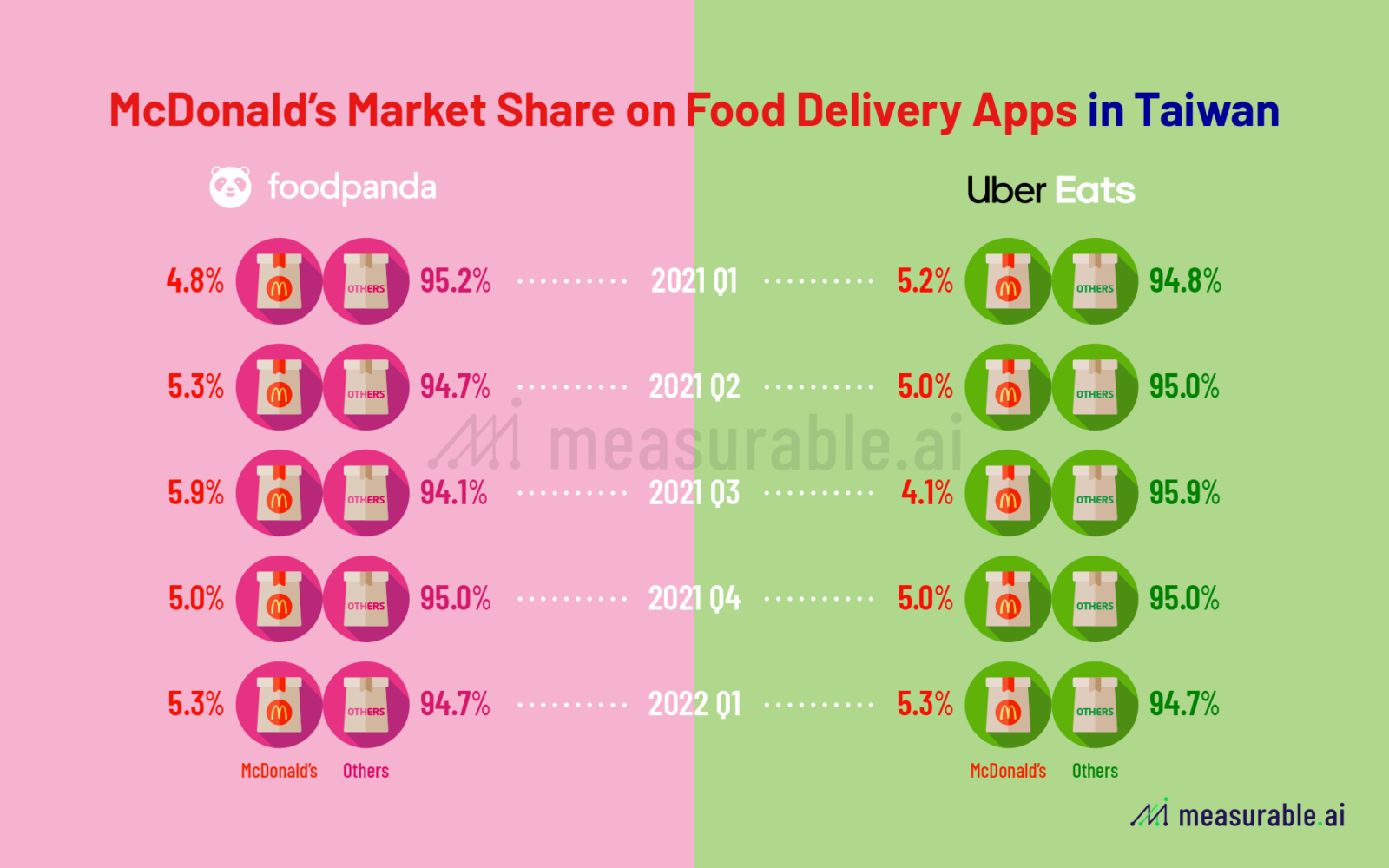

According to Measurable AI, McDonalds remains to be the most popular fast food choice in Taiwan. Among the variety of restaurants on both platforms, McDonald’s manages to account for around 5.3% of market share by revenue on both Foodpanda and Ubereats in the latest quarter Q1, 2022.

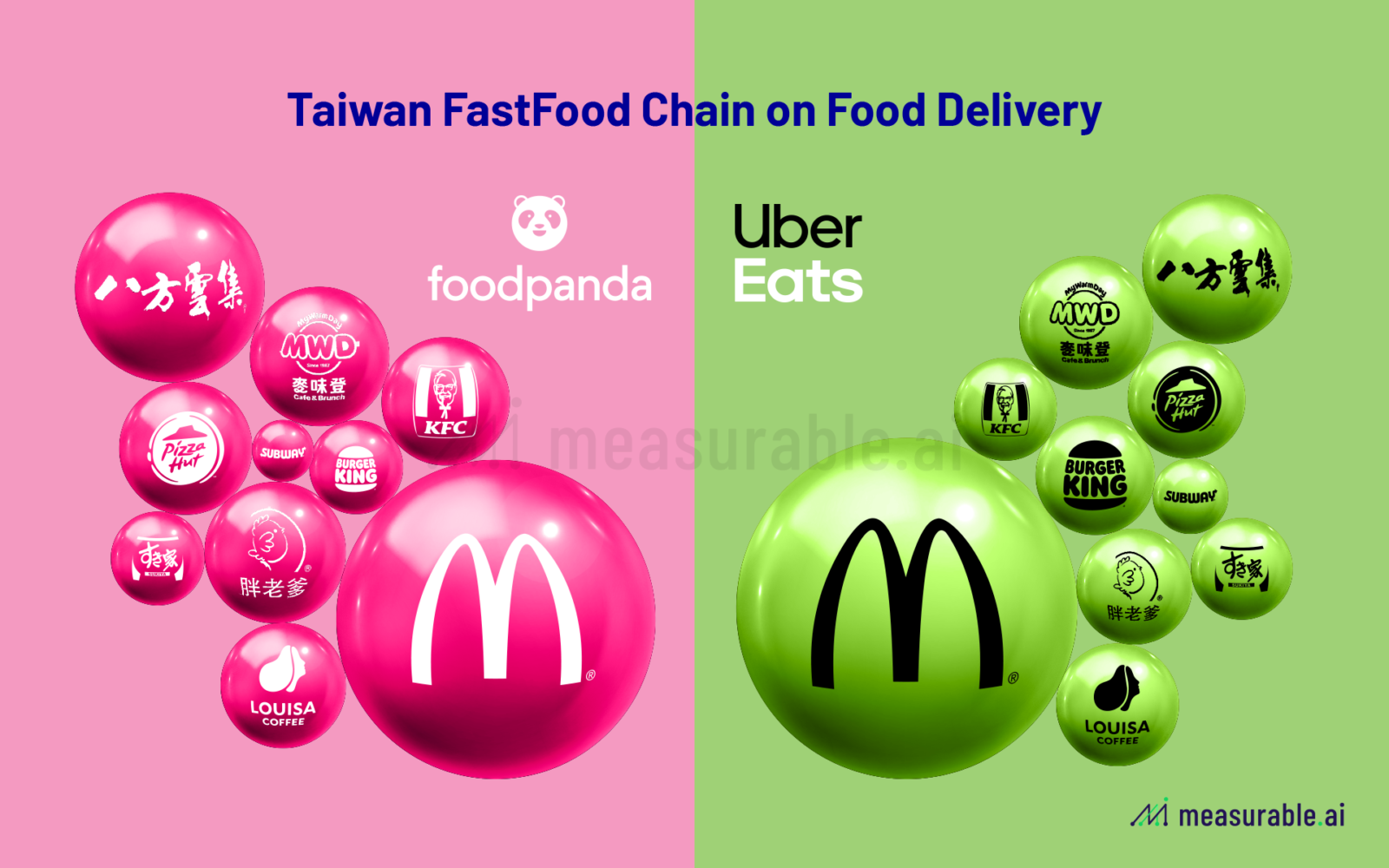

Under the fast food sector alone, McDonalds accounts for around 40% of market share among the top 10* fast food chain restaurants on Foodpanda, while on UberEats, it accounts for a whopping 47% among the same top 10 fast food chain restaurants.

McDonald’s Burgernomics

While the increase in total sales generated from the food delivery apps seems to be a good deal for fast food restaurant outlets, question arises whether it will cannibalize the fast food chain’s own delivery services? Apart from partnering with food delivery giants, McDonald’s has been delivering its own meals too (McDelivery) since 2007 in Taiwan. Such a service is still loved by the loyal hungry McDonald customers.

What % of delivery comes from McDelivery vs Ubereats vs Foodpanda? Based on Measurable AI’s e-receipts panel data, order volume from McDelivery remains surprisingly high amid the rapid growth of food delivery apps. Subscribe to our newsletter to learn more about our findings and upcoming reports on the highly contested Food Delivery industry.

Stepping away from McDonalds, other fast food brands have chosen different strategies for increasing revenues. Though most are available on both platforms, some have chosen sides. Starbucks has recently switched to Foodpanda for an exclusive partnership, following which its monthly order volume saw a spike. Another popular fast food brand, Mos Burger, also chose to remain exclusively with Foodpanda in Taiwan.

UberEats versus Foodpanda

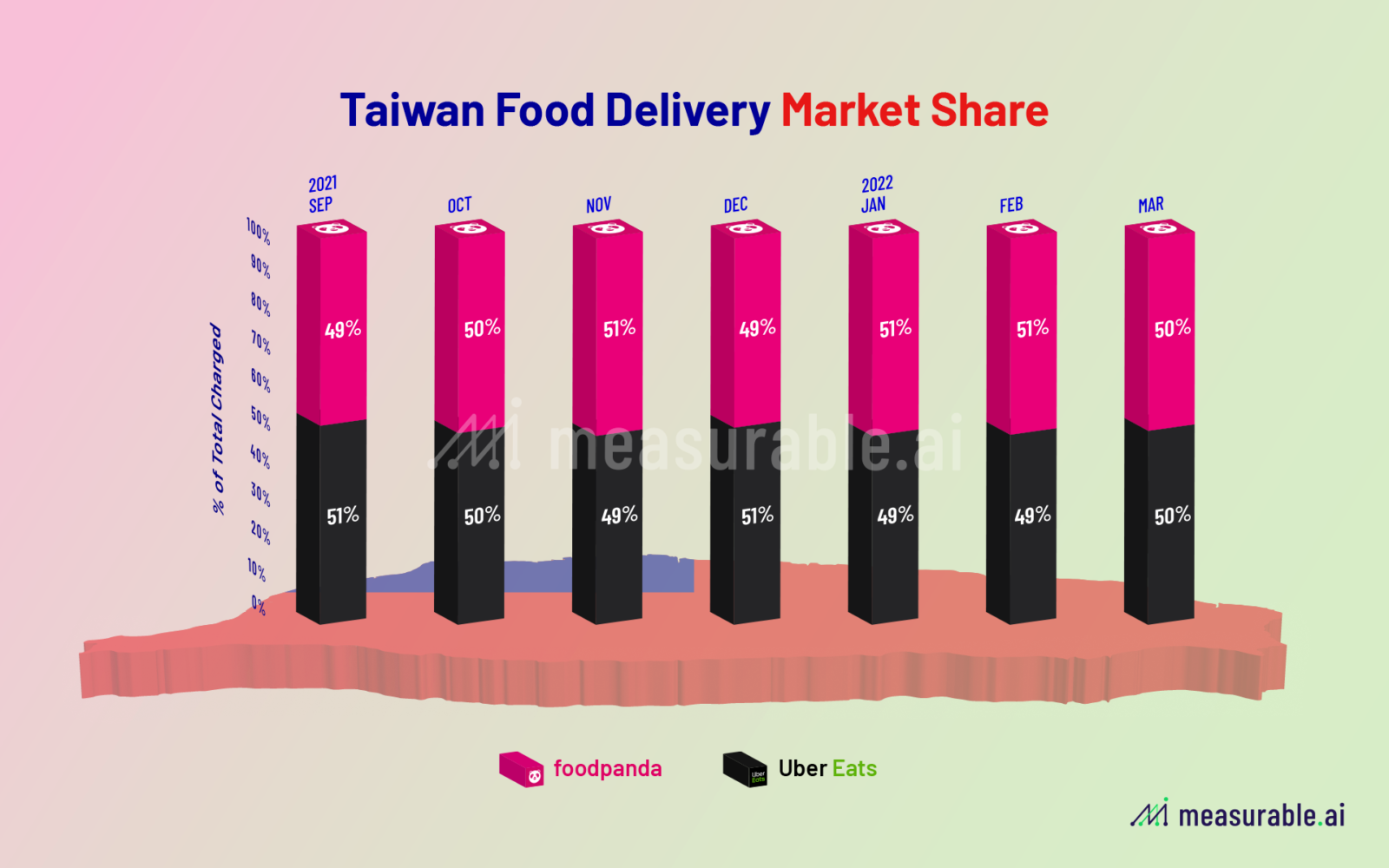

Our former report “Tale of Two Guys: Food Delivery Market in Taiwan” reveals that since 2019, UberEats had been leading the race in Taiwan’s food delivery market up until 2020, when the “two guys” started to encroach upon the market share. What’s the latest score for the Taiwan food delivery market share?

Based on Measurable AI’s very own transactional dataset, Foodpanda and UberEats are still head to head competitors. In terms of market share by total charged (which is the dollar amount of each order after discounts and promotions), in Q1 2022, each company shared exactly 50% of the market share. In the past 6 months, Foodpada managed to etch out a slight advantage at 51%.

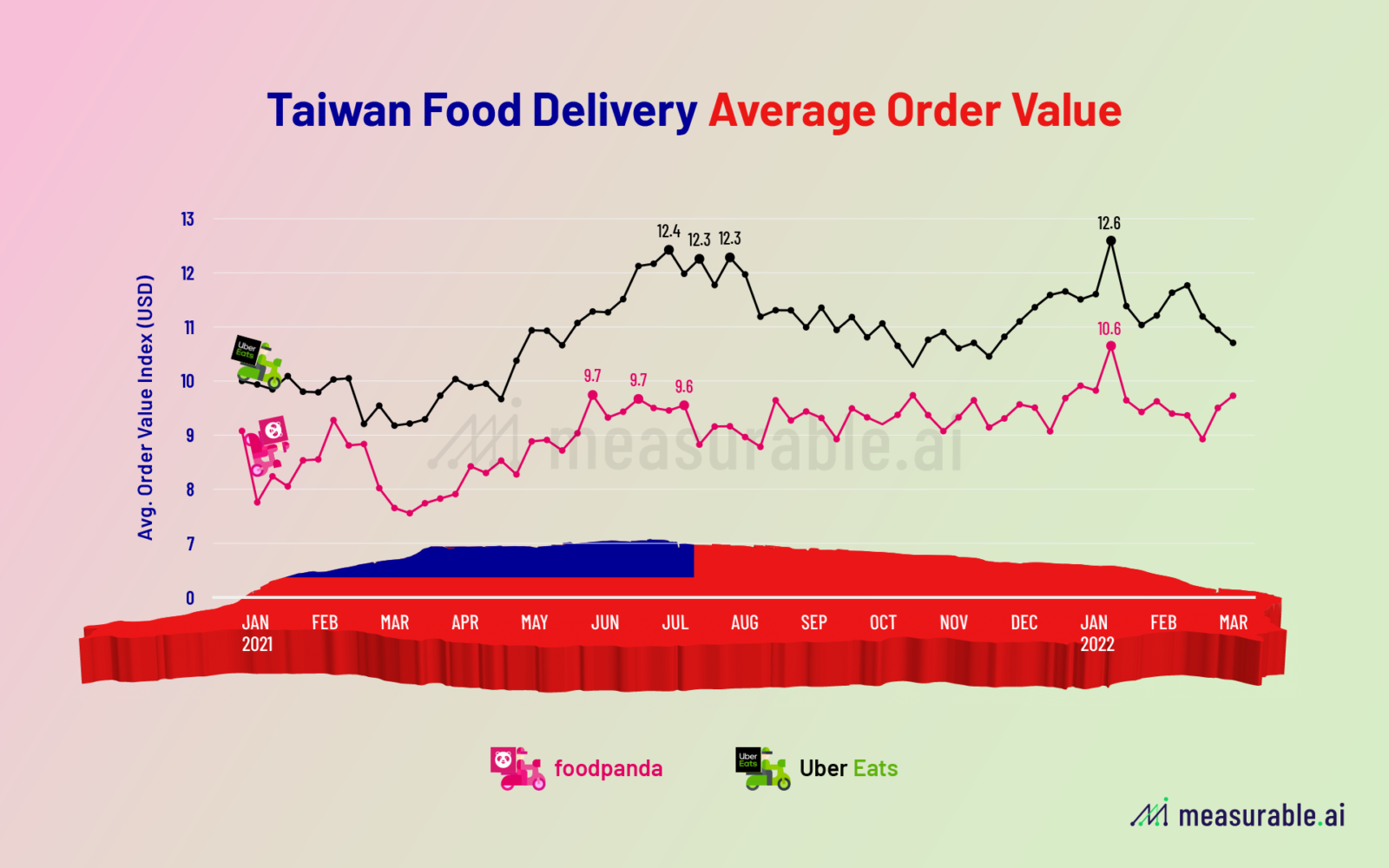

Measurable AI’s granular e-receipts data points also show that along the way UberEats users still spend more on each order than those on Foodpanda, though the gap is getting thinner. In the most recent 6 months(2021 September to 2022 March), UberEats users spent around USD 11.1 each order. Foodpanda customers’ average spend hovered around USD 9.5.

Follow Measurable AI’s insights blog or subscribe to our newsletter to learn more about the food delivery market intelligence based on real-time transactional data.

Interested in finding out more about the food delivery sector? Talk to us for more detailed, transactional datasets on the food delivery industry in more markets. Contact [email protected]

Previous articles we have authored unveiling insights on the food delivery markets in other regions:

Zomato vs Swiggy – Who Leads the Food Delivery Race in India?

Philippines Food Delivery Market Share: Who Delivers More Coconuts

A Roller Coaster that only goes up: Food-Delivery Companies in Asia (III)

ABOUT US

Charlie Sheng is a serial female entrepreneur, and a dedicated communicator for technology. She enjoys writing stories with Measurable AI’s very own e-receipts data.

You can reach her at [email protected]

Measurable AI is a leading alternative data provider for food-delivery, ride-hailing, and e-commerce in emerging markets. Covering Southeast Asia, Latin America, India, Middle East and more.

*The Content is for informational purposes only, you should not construe any such information or other material as investment advice. Prior written consent is needed for any form of republication, modification, repost or distribution of the contents.

![]()