Flavor Meets Data 🍔 Unveiling McDonald’s Hong Kong Order Habits (Part 2)

Golden Arches Revealed: Top 10 Best Sellers, Breakfast Drink Preferences, and Coffee Order Peak Hours at McDonald’s HK

In our previous exploration of McDonald’s coffee “retirement” report, we delved into the order volume figures for legacy and McCafé’s coffee products, the most popular beverages, and peak ordering times. Now, we’re back with Part 2, ready to unveil a treasure trove of data insights from Measurable AI’s proprietary e-receipt datasets, providing you with an even deeper look into the world of this fast food giant.

At Measurable AI, we build and own a unique consumer panel and are the largest transactional email receipt data provider for the emerging markets including Southeast Asia, Latin America, Middle East, and Africa. We are well regarded for our comprehensive dataset across the digital economy including food-delivery, ride-hailing, and e-commerce.

Check out Part 1 of our blog: McDonald’s Coffee “Retirement” Report Revealed ☕️ Big Data Analysis of Hongkongers’ Fast Food Ordering Habits

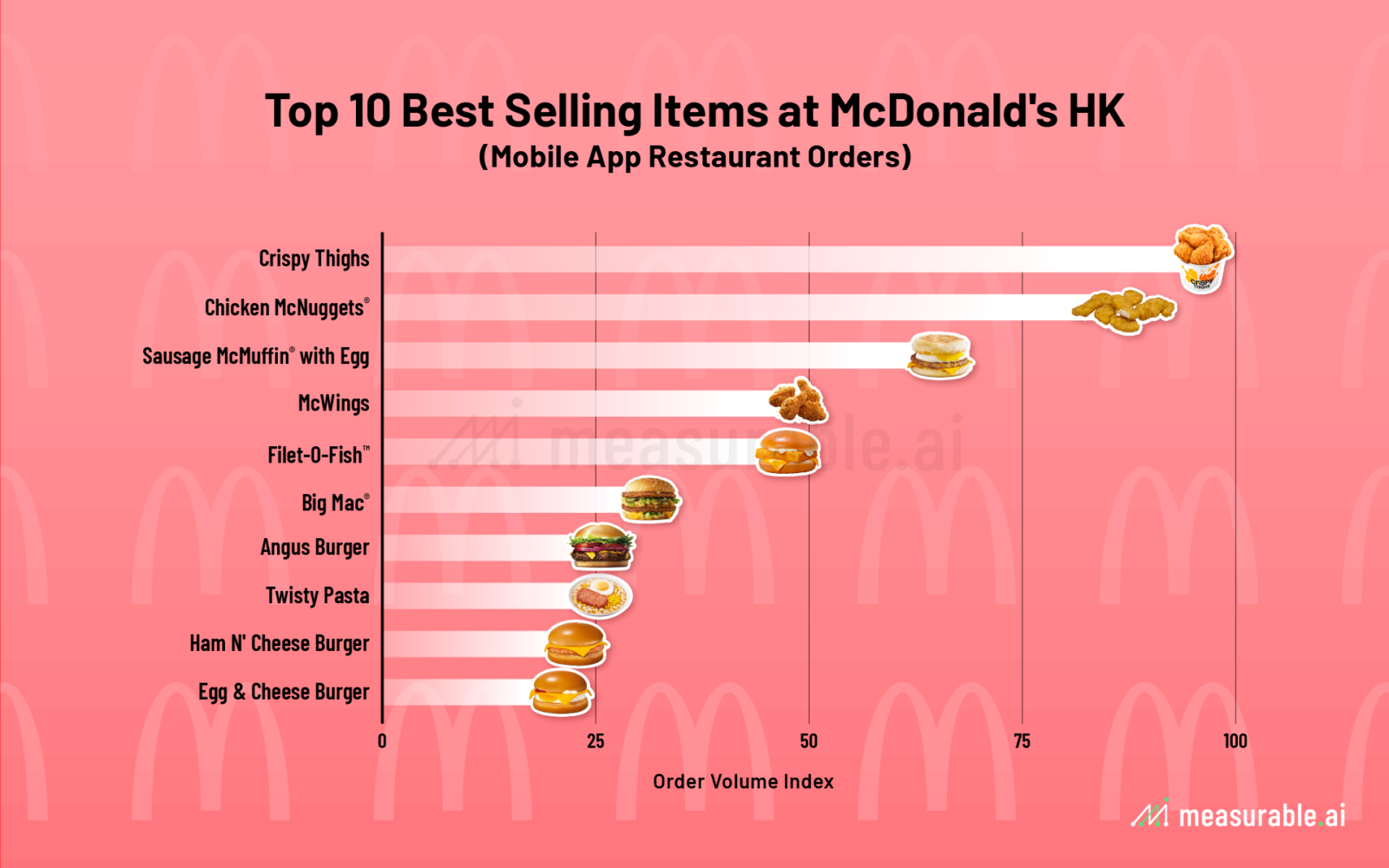

Top 10 Best Selling Items at McDonald’s HK

Let’s kick things off with a taste of the popular picks. Measurable AI has meticulously analyzed a year’s worth of McDonald’s mobile app orders (excluding McDelivery orders) to reveal Hongkongers’ favorites when it comes to McDonald’s.

At the pinnacle of this list sits the irresistible Crispy Thighs (麥炸雞). It’s evident that these chicken thighs have captured the appetites of countless Hongkongers, including fans of the local boy band MIRROR. In December 2022, McDonald’s teamed up with MIRROR once again, offering collectible idol cards redeemable after ordering Crispy Thighs items through the McDonald’s app. According to Measurable AI’s data, during the campaign period last year, Crispy Thighs’ order volume skyrocketed, increasing by more than tenfold compared to the previous month.

Not far behind are the iconic Chicken McNuggets® (麥樂雞). These bite-sized delights have been a popular choice for McDonald’s enthusiasts, a testament to their enduring appeal. Sausage McMuffin® with Egg (豬柳蛋漢堡™) ranks third on the chart, this classic burger has long been a staple for breakfasts, lunches and dinners.

Moving further down the list, we come to McWings (脆香雞翼) and Filet-O-Fish™ (魚柳飽), which jointly occupy the fourth and fifth positions in terms of popularity. In the sixth spot, we encounter the globally renowned Big Mac® (巨無霸®). For more insights, explore Measurable AI’s Big Mac Food Delivery Index.

Twisty Pasta (扭扭粉), a Hong Kong exclusive breakfast item, secures its pace on the list as the eighth-best selling item. This local favorite offers a range of flavors including options like Ham N’ Egg and Grilled Chicken, making it a must-try for early risers to warm their soul.

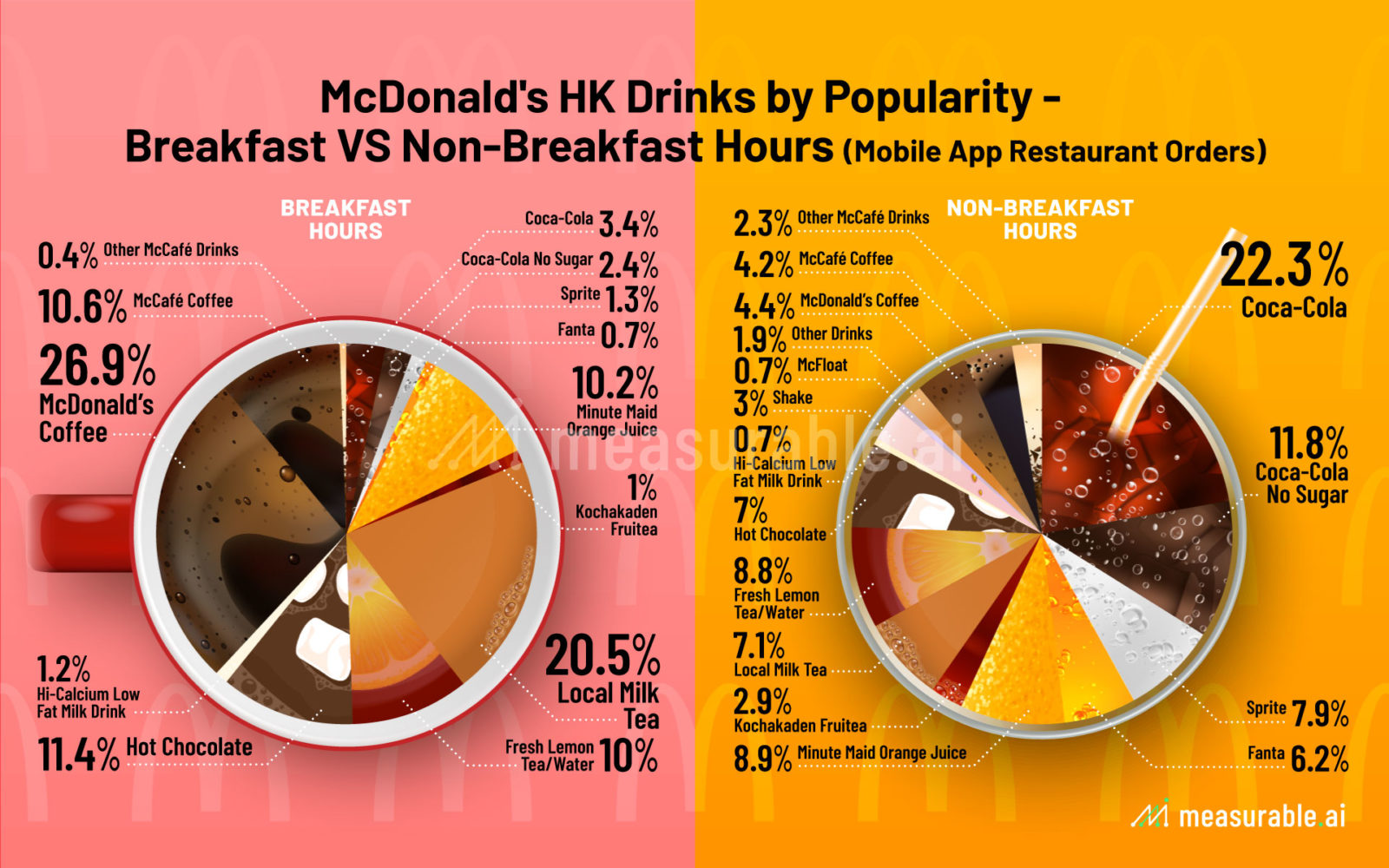

Drinks by Popularity – Breakfast VS Non-Breakfast Hours

In Part 1 of our exploration, we took a deep dive into McDonald’s mobile app order data, uncovering valuable insights into popular beverages among Hong Kongers. Now, we’re turning our attention to a specific aspect: the popularity of these beverages during breakfast versus non-breakfast hours, based on Measurable AI’s e-receipt panel.

Breakfast Hours:

During breakfast hours (6 AM to 11 AM), it’s McDonald’s Coffee that takes the lead, accounting for a substantial 26.9% of beverage orders. Although McDonald’s legacy coffee products are no longer available, Measurable AI’s data from the past year shows that they are the most popular drinks when the sun is just rising.

Local Milk Tea follows closely behind, at 20.5%, offering a Hong Kong-style flavor. Hot Chocolate warms up mornings with 11.4% of orders, while McCafé Coffee caters to coffee lovers with 10.6%. Minute Maid Orange Juice’s zesty appeal captures 10.2% of orders, while Fresh Lemon Tea / Water provides a refreshing choice at 10%.

Non-Breakfast Hours:

As the day unfolds, beverage preferences shift, soft drinks constitute a total of 48% of beverage orders during non breakfast hours (11 AM to 5 AM). Coca-Cola is the most popular choice, commanding 22.3%, while Coca-Cola No Sugar captures 11.8%. Sprite and Fanta collectively make up 14.1% of the share. These carbonated classics continue to be the go-to choices for quenching thirst and complementing McDonald’s meals throughout the day.

Local Milk Tea and Fresh Lemon Tea / Water, with a shared presence of 16%, maintain their popularity, appealing to both traditional and health-conscious palates. Hot Chocolate continues to bring its warmth, accounting for 7% of orders.

In the realm of coffee, McDonad’s Coffee and McCafé Coffee collectively make up 8.6% of non-breakfast hour beverage orders.

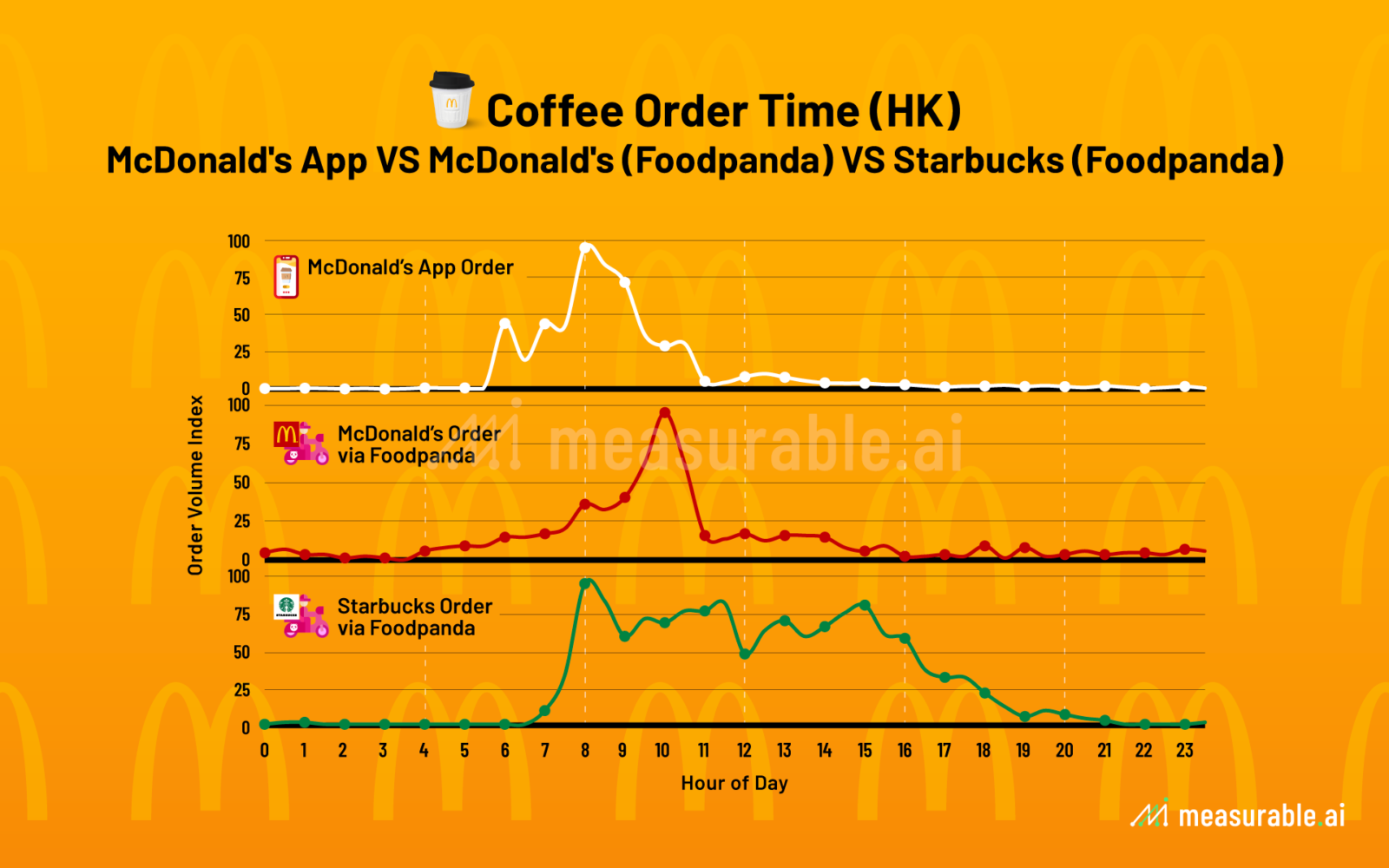

Coffee Order Time Rhythms: McDonald’s, Starbucks, and Foodpanda Insights

When it comes to the daily caffeine rush, the data speaks volumes about Hongkongers’ coffee preferences. As we delve deeper into the world of coffee order times with Measurable AI’s unique panel, we examine the trends across three platforms: McDonald’s mobile app, McDonald’s orders via Foodpanda, and Starbucks orders via Foodpanda.

One intriguing pattern that emerges is the synchronization of peak coffee ordering times between McDonald’s mobile app and Starbucks via Foodpanda. Both platforms experience a surge in coffee orders at 8:00 – 8:30 AM. It appears that a significant portion of Hong Kong’s early risers relies on these two giants to kick start their day with a fresh cup of joe.

The story takes an interesting twist when we look at McDonald’s orders via Foodpanda. While the morning coffee rush begins at 8 AM for the McDonald’s mobile app and Starbucks via Foodpanda, the data reveals a distinct peak hour for McDonald’s orders through Foodpanda at 10:00 – 10:30 AM. This suggests that those McDonald’s lovers opting for the convenience of food delivery service tend to delay their coffee fix by two hours.

This nuanced insight highlights the influence of delivery platforms on consumer behavior, showcasing how specific trends emerge in the fast-food and coffee delivery scene. For those keen on exploring such intriguing patterns, Measurable AI’s proprietary e-receipt datasets are a treasure trove of valuable consumer insights.

Follow our insights blog and newsletter to keep up with this heated competition. Or contact us at [email protected] if you are a hedge fund, corporation or in market research and looking for the most up-to-date transactional data insights.

About Measurable AI

At Measurable AI, we build and own a unique email receipt consumer panel and have become the largest transactional email receipt data provider for the emerging markets. We are well regarded for the granular insights that can be extracted from our comprehensive datasets across the digital economy, including e-commerce, food delivery, ride-hailing and fintech.

Check out our latest Reports: 2019-2022 Food Delivery Annual Report for Asia, Asia & Americas Ride-hailing Report 2019-2023.

*The Content is for informational purposes only, you should not construe any such information or other material as investment advice. Prior written consent is needed for any form of republication, modification, repost or distribution of the contents.

More data insight blogs:

Introducing Measurable AI’s Big Mac Food Delivery Index

Meituan’s Food Delivery Debut in Hong Kong: Keeta vs Deliveroo vs Foodpanda

Hong Kong’s Noodle Rhapsody: Food Delivery Insights on TamJai and SamGor

![]()