Hong Kong Food Delivery Market Overview (2018 -2022)

Previously on the Hong Kong Food Delivery Market (Timeline)

2014 -2019:

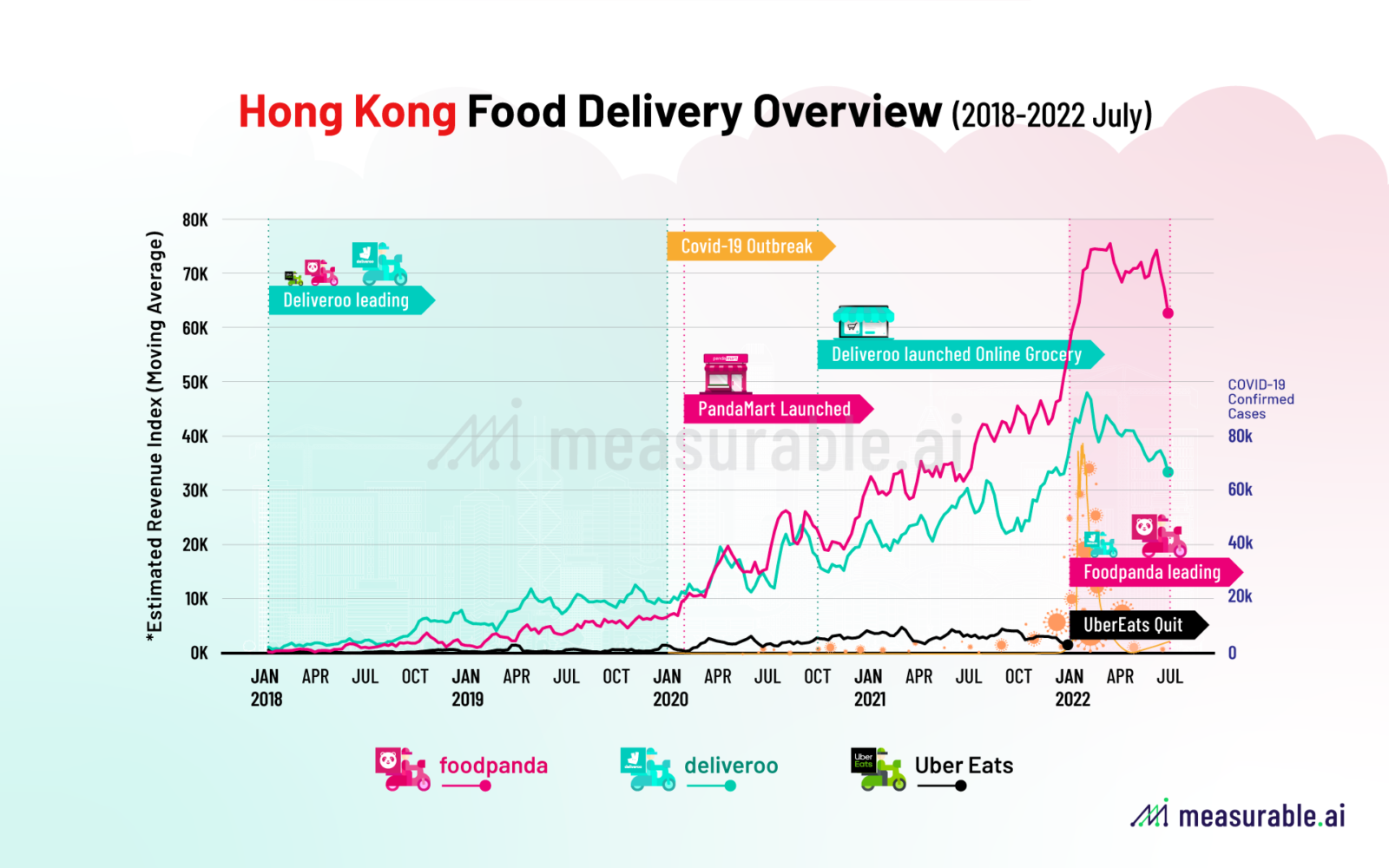

Back in 2014, Foodpanda was one of the first food delivery apps to enter the Hong Kong market, followed by Deliveroo in 2015 and UberEats in 2016.

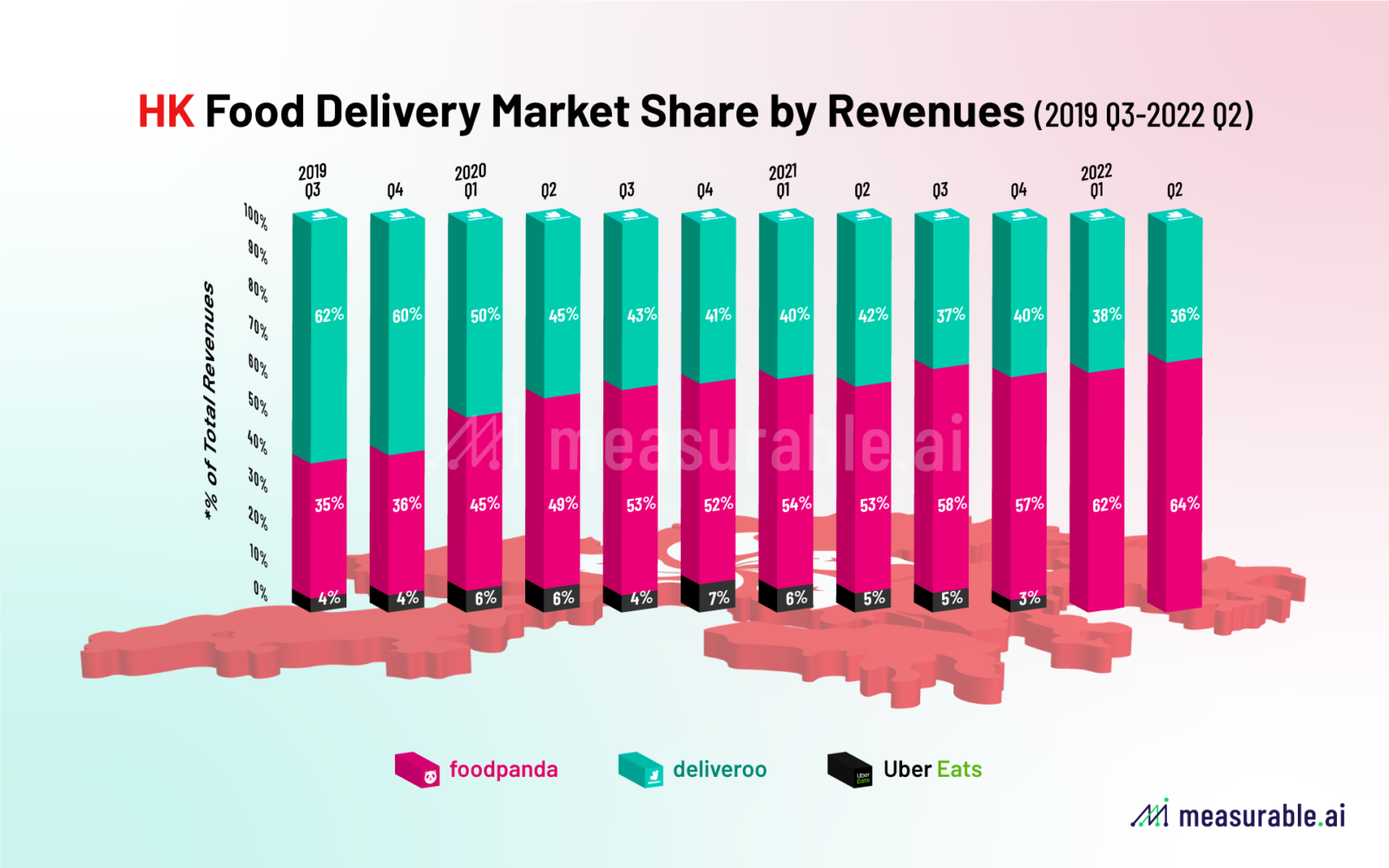

In the early years, Deliveroo was leading in the Hong Kong market. Based on Measurable AI’s transactional e-receipts data, in terms of monthly revenues, Deliveroo used to own over 60% of the market in Hong Kong in 2019.

2020 – 2021:

Since 2020, the global pandemic has boosted the food delivery industry enormously all over the world.

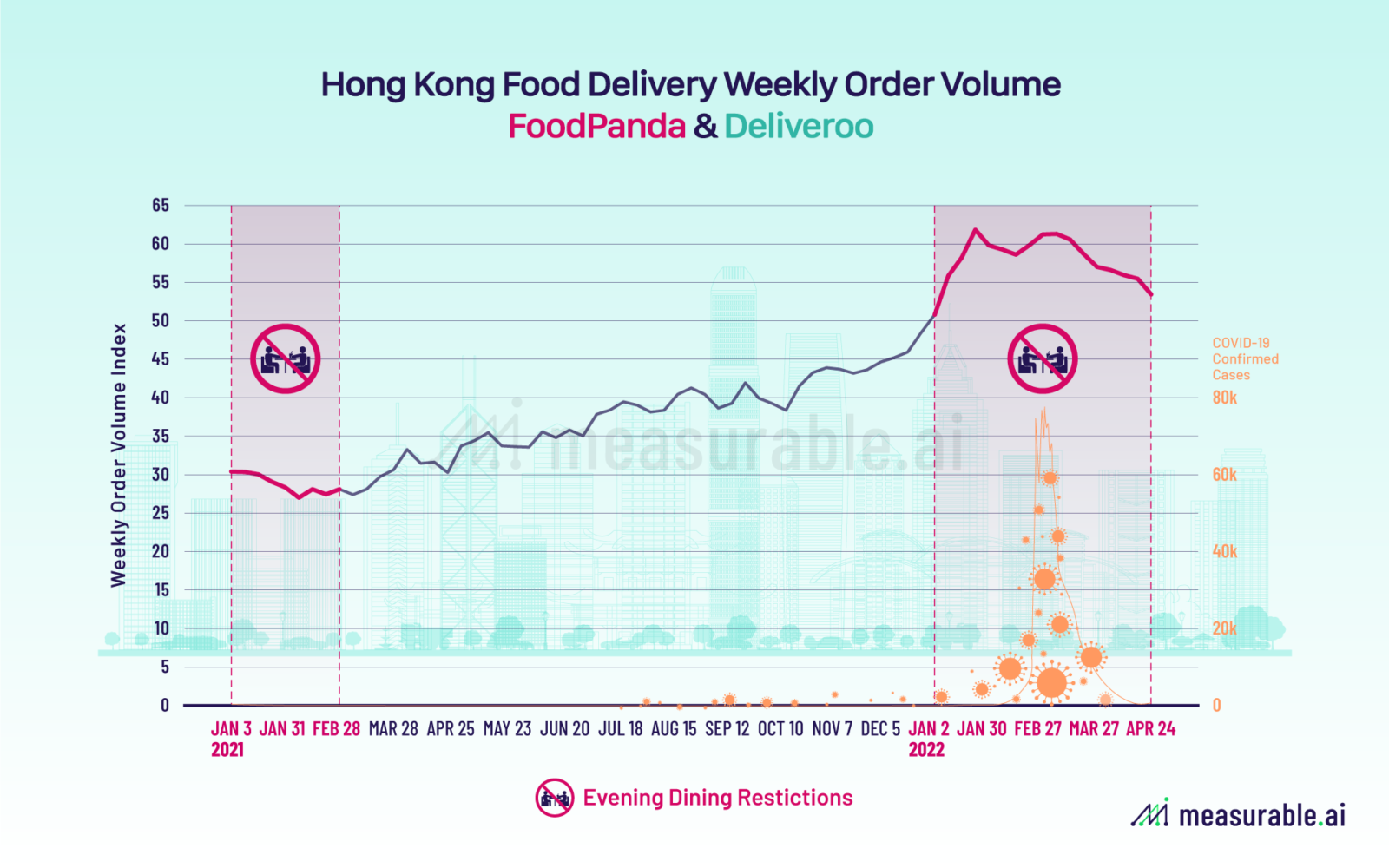

Throughout the past years, Hong Kong people have experienced several bans on restaurant dining after 6pm. The Measurable AI granular dataset reveals that the average weekly order volume of Hong Kong food delivery platforms (Foodpanda + Deliveroo combined) – has continued to rise since 2021. Under the 5th wave (Omnicron), the weekly order volume hit a record high from January to February 2022, double of what was recorded a year ago.

In Hong Kong, while Deliveroo was initially leading the race in the early days, throughout 2020 to 2021 when covid swept over the city, the food delivery market transformed more into a tie between Foodpanda and Deliveroo who both shared about half of the market by revenues. At the end of 2021, we witnessed UberEats quitting the market with less than 5% of the market share, leaving only Foodpanda and Deliveroo competing with each other.

Entering 2022:

According to Measurable AI’s transactional consumer panel, in the first half of 2022, Foodpanda has been growing rapidly, leading the Hong Kong food delivery market share by revenue at around 63% versus 37% (as of June 2022).

Food Delivery User Loyalty and Behaviour

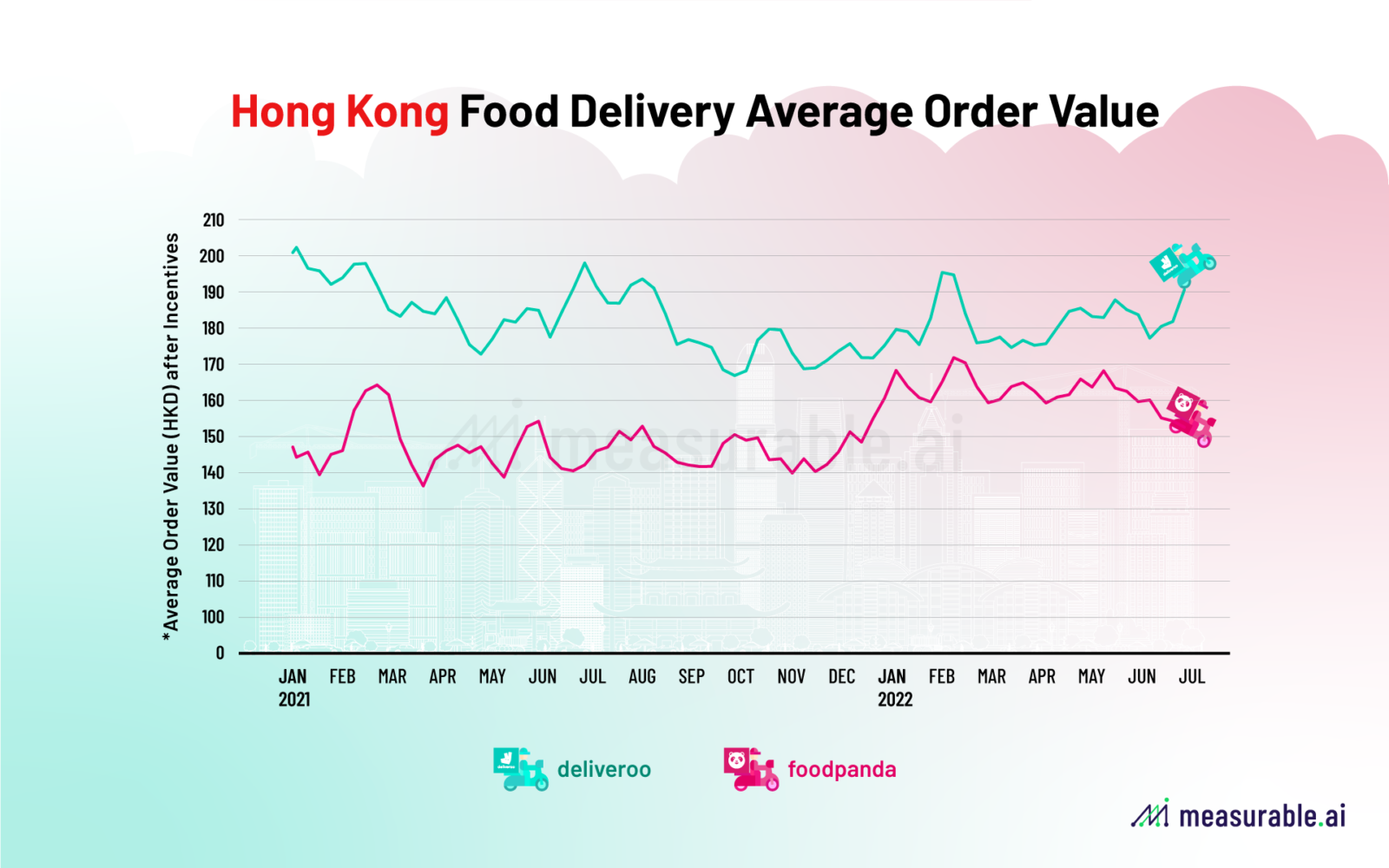

In terms of consumer behavior, Deliveroo’s user AOV remains higher than its rival, hovering around 180 HKD (2021 – 2022 June). As for Foodpanda users, the average spend is around 155 HKD per order after incentives over the past two years (2021 – 2022 June). That said, there’s still a gap between the two companies’ user AOV, though it’s getting a bit smaller this year.

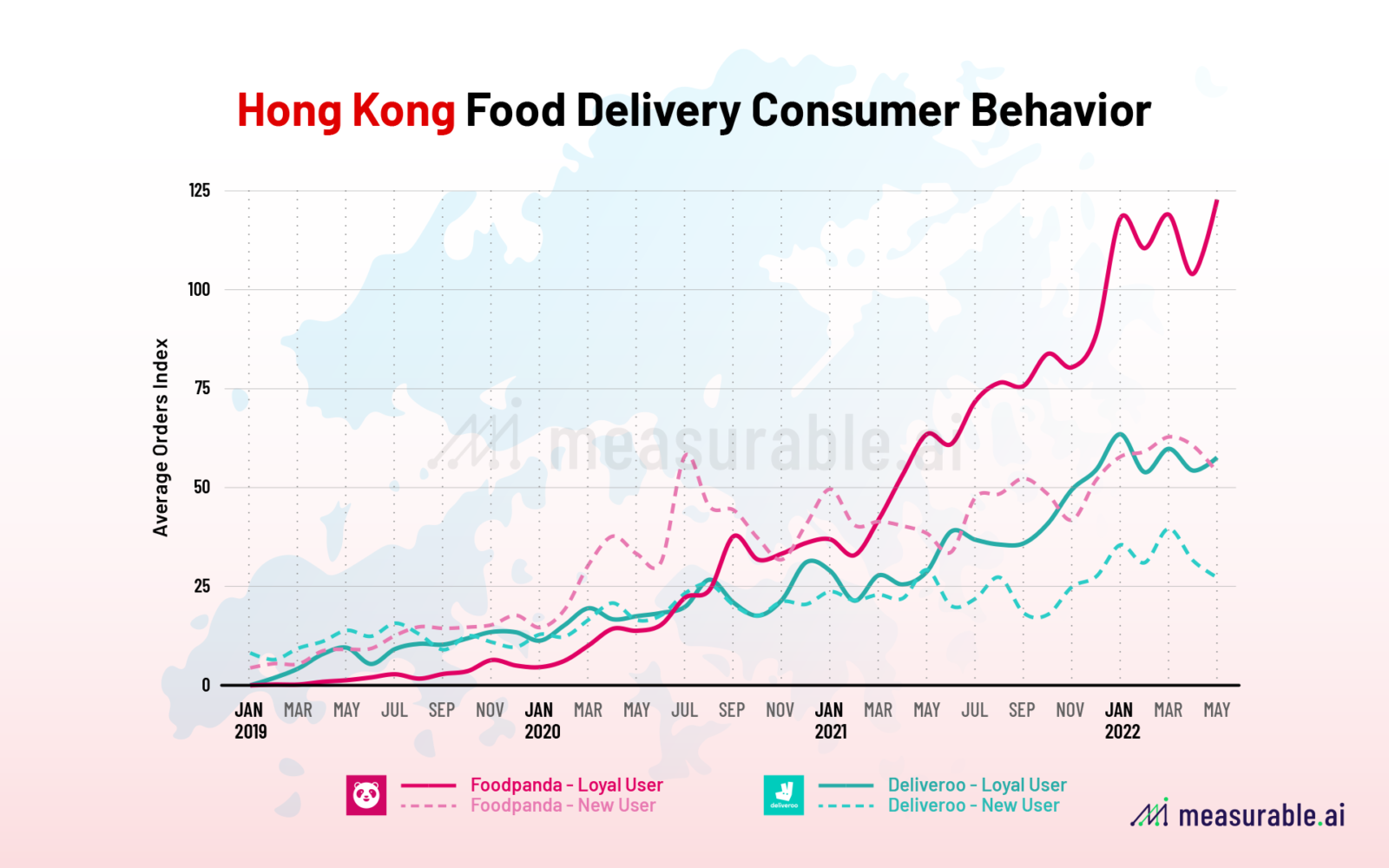

Despite the competition, food delivery users are getting loyal throughout the years. In our former analysis on consumer behavior, Measurable AI’s e-receipts data shows that both Foodpanda and Deliveroo’s loyal users’ order volume in Hong Kong started to outgrow those from new users during the transition between late 2020 and early 2021. This uptrend momentum of loyal users also keeps growing in 2022.

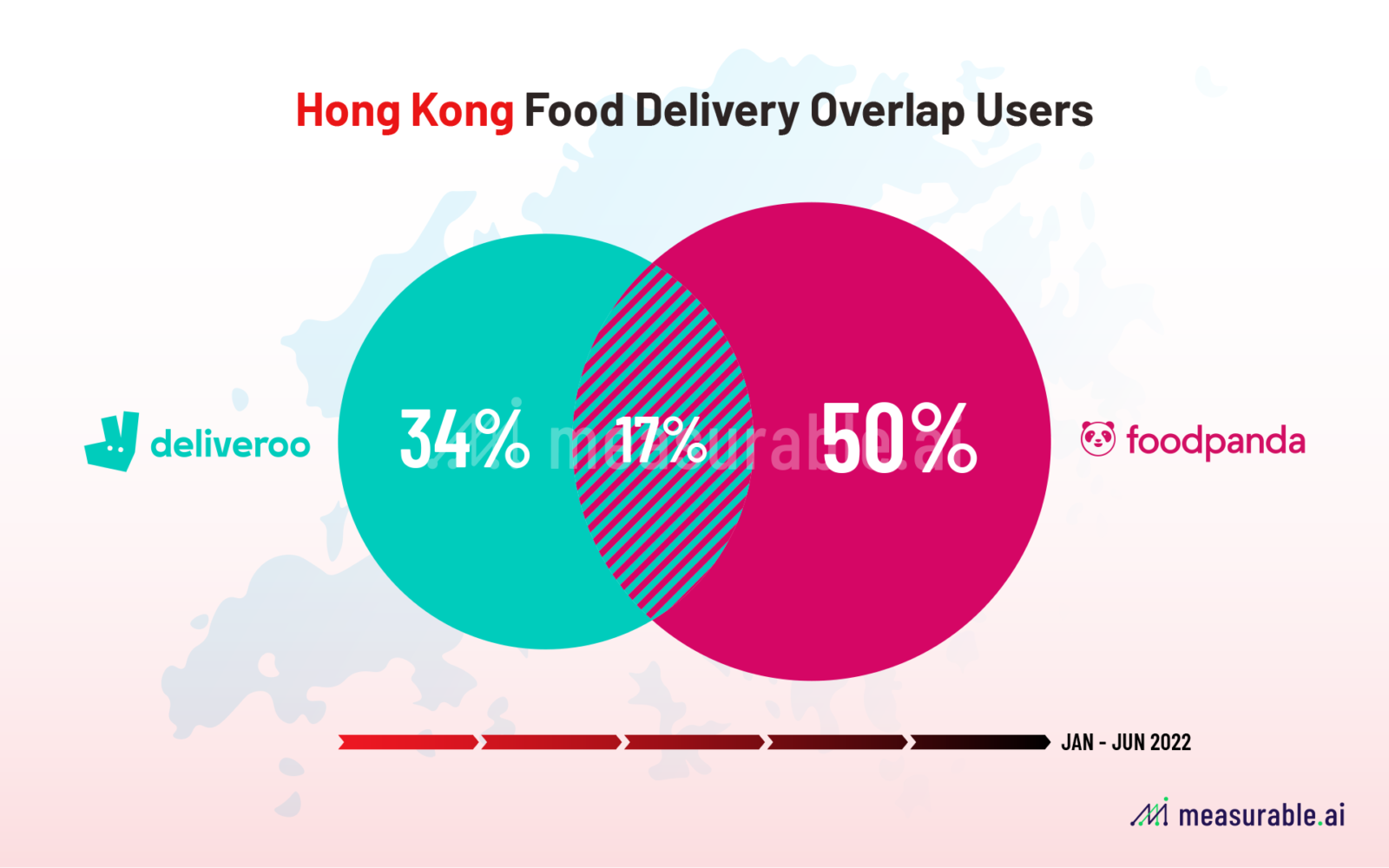

In terms of user overlapping, around 17% of the Hong Kong food delivery users use both apps in the first half of 2022.

Other than the two major players, some local players share a marginal piece of the market in the food delivery and quick commerce space, including e-commerce company HKTV Express, Food review app Openrice, and Yuu – a reward app from a Hong Kong conglomerate. Despite the competition in Hong Kong food delivery market, this month Chinese food tech company Meituan also announced its possible operation in Hong Kong. Follow our insights blog and newsletter to keep up with this heated competition. Or if you are a hedge fund, corporation or in research and looking for the most up-to-date transactional data insights at [email protected].

To be Continued…

At Measurable AI, we build and own a unique consumer panel and are the largest transactional email receipt data provider for the emerging markets. We are well regarded for our comprehensive alternative dataset across the digital economy, particularly for our consumer insights relating to the food delivery industry.

ABOUT US

Charlie Sheng is a serial entrepreneur, and a dedicated communicator for technology. She enjoys writing stories with Measurable AI’s very own e-receipts data.

You can reach her at [email protected].

Measurable AI is a leading alternative data provider for food-delivery, ride-hailing, and e-commerce in emerging markets. Covering Southeast Asia, Latin America, India, Middle East and more.

*The Content is for informational purposes only, you should not construe any such information or other material as investment advice. Prior written consent is needed for any form of republication, modification, repost or distribution of the contents.

![]()