Beyond the Basket: Top Restaurants and Grocers Driving Talabat’s April 2025 Orders

It’s been a while since I last analysed Measurable AI’s UAE food delivery datasets and authored a piece on who is winning the UAE food delivery wars way back in 2022 (sheesh, how time flies!). In light of Talabat’s IPO last December (the biggest in the UAE for 2024) and further growth in Measurable AI’s Middle Eastern panels, I figured it’s about time I revisit the leading food delivery aggregator in the Middle East again.

Taking a deep dive into Measurable AI’s e-receipt food delivery dataset for UAE where Talabat is headquartered, I analysed our Talabat dataset for April 2025 (because we don’t publish the most recent data insights – contact us for the latest findings). My findings are as follows.

What Are The Most Popular Restaurants in the UAE Food Delivery Market?

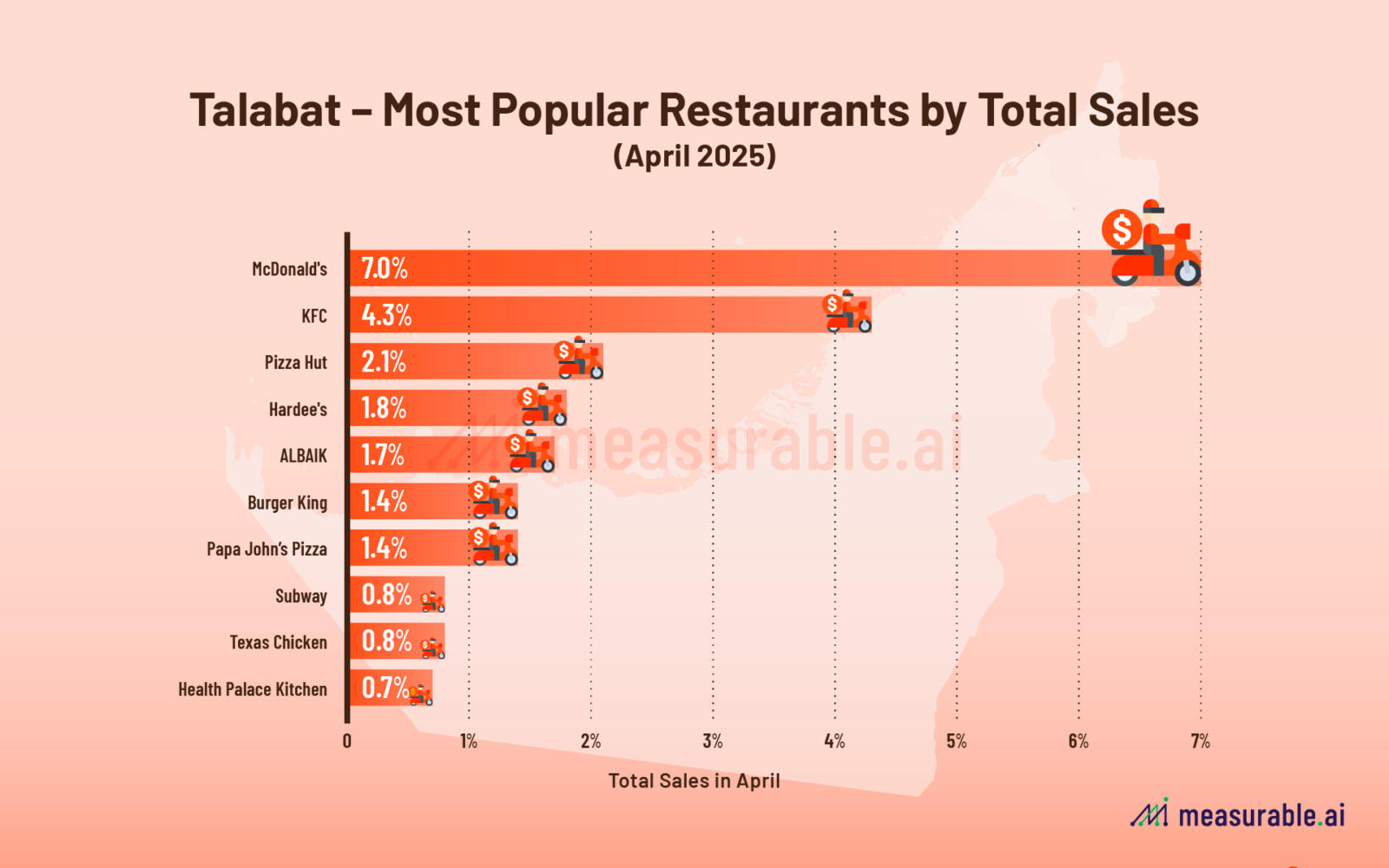

Looking at our April data for Talabat UAE, the top three restaurants ranked in pecking order by Total Sales are McDonald’s, KFC and then Pizza Hut.

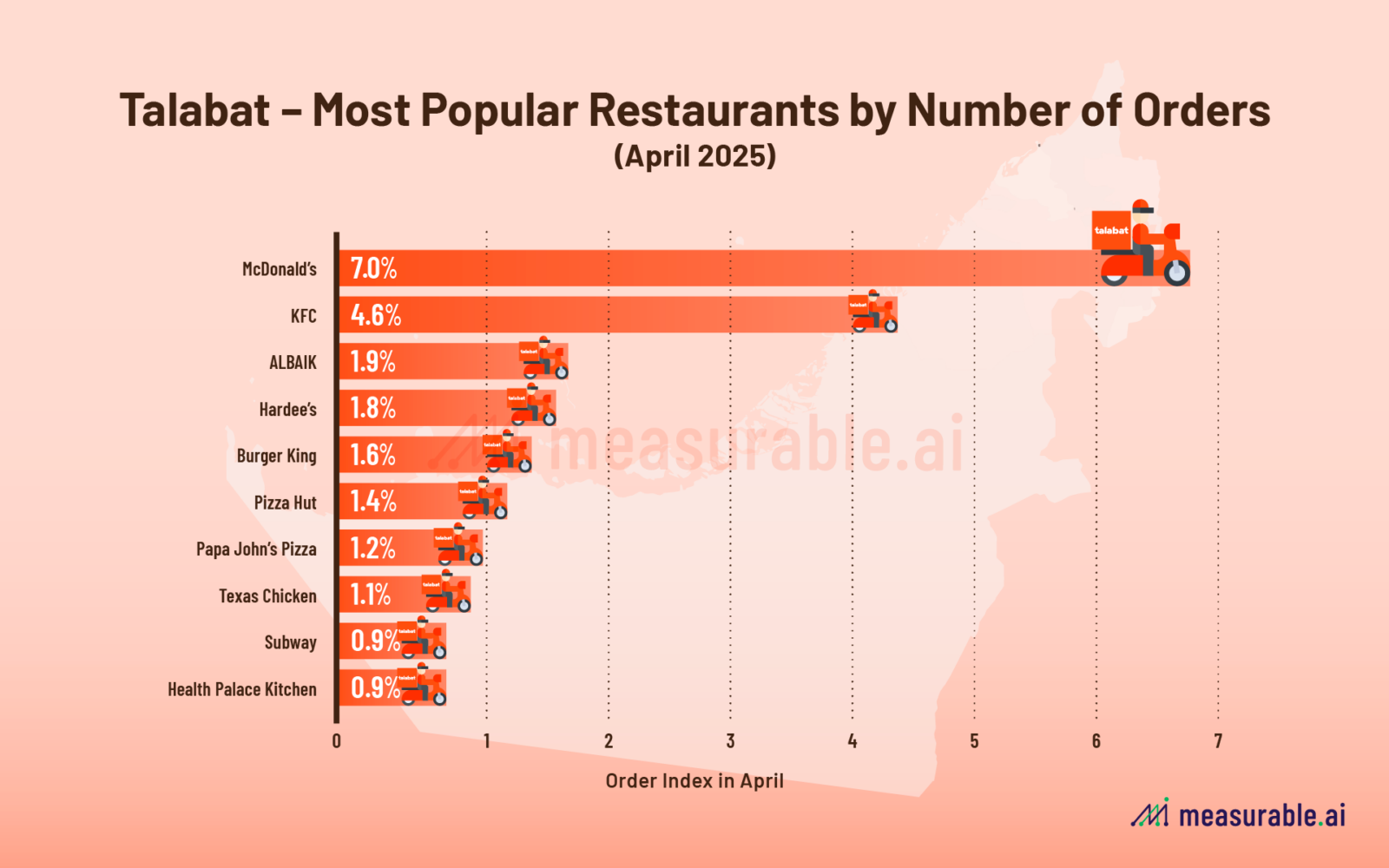

If we rank these restaurants by total number of orders for the month of April, Mcdonald still ranks first, followed closely by KFC and then Albaik.

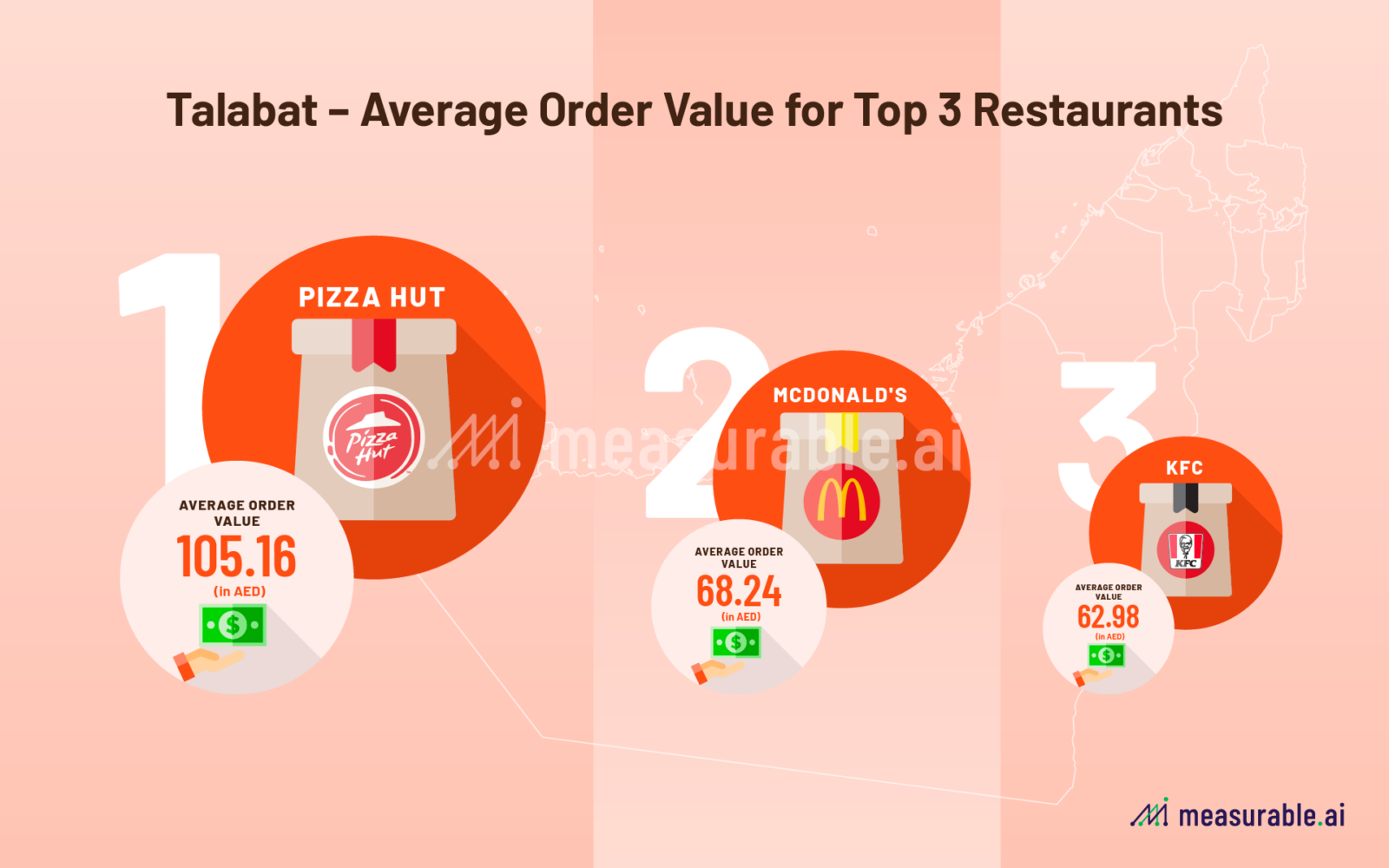

Amongst the top three restaurants by sales, customers spend the most at McDonald’s at 69.22 AED (18.85 USD), followed by Albaik 65.89 AED (17.94USD), then KFC at 59.25 AED (16.13 USD). KFC customers spend about $2.72 USD less on average compared to McDonald’s customers on the Talabat platform.

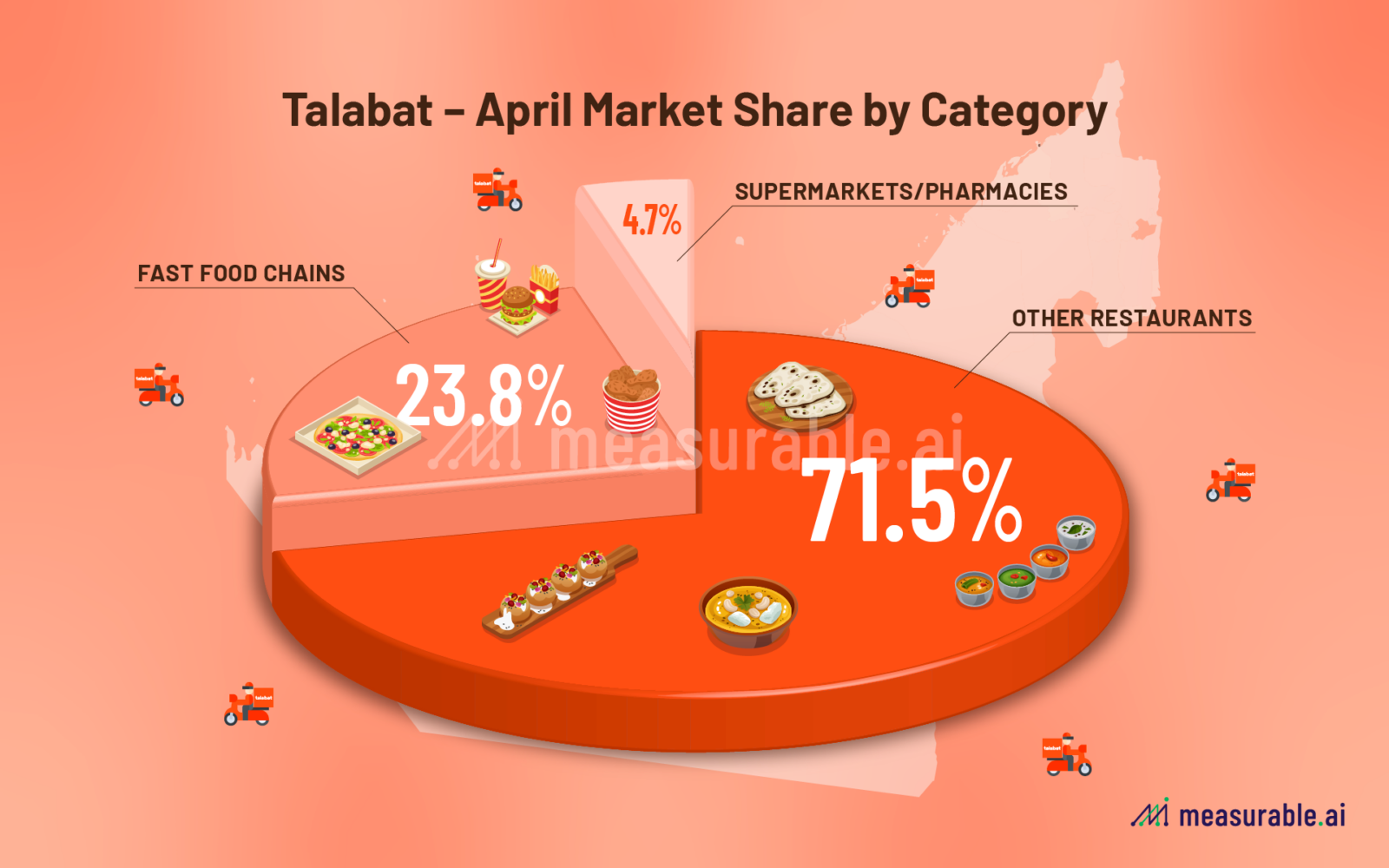

Diving further, I was curious to understand the percentage of sales derived from different categories such as fast food outlets, restaurants and supermarkets/pharmacies on Talabat for April 2025. Based on Measurable AI’s dataset, the bulk of revenues comes from restaurant orders at ~71.5%, with roughly ~23.8% of sales coming from the fast food chains and ~4.7% from supermarkets and pharmacies.

Which Items Are Most Frequently Ordered from the Top Restaurants?

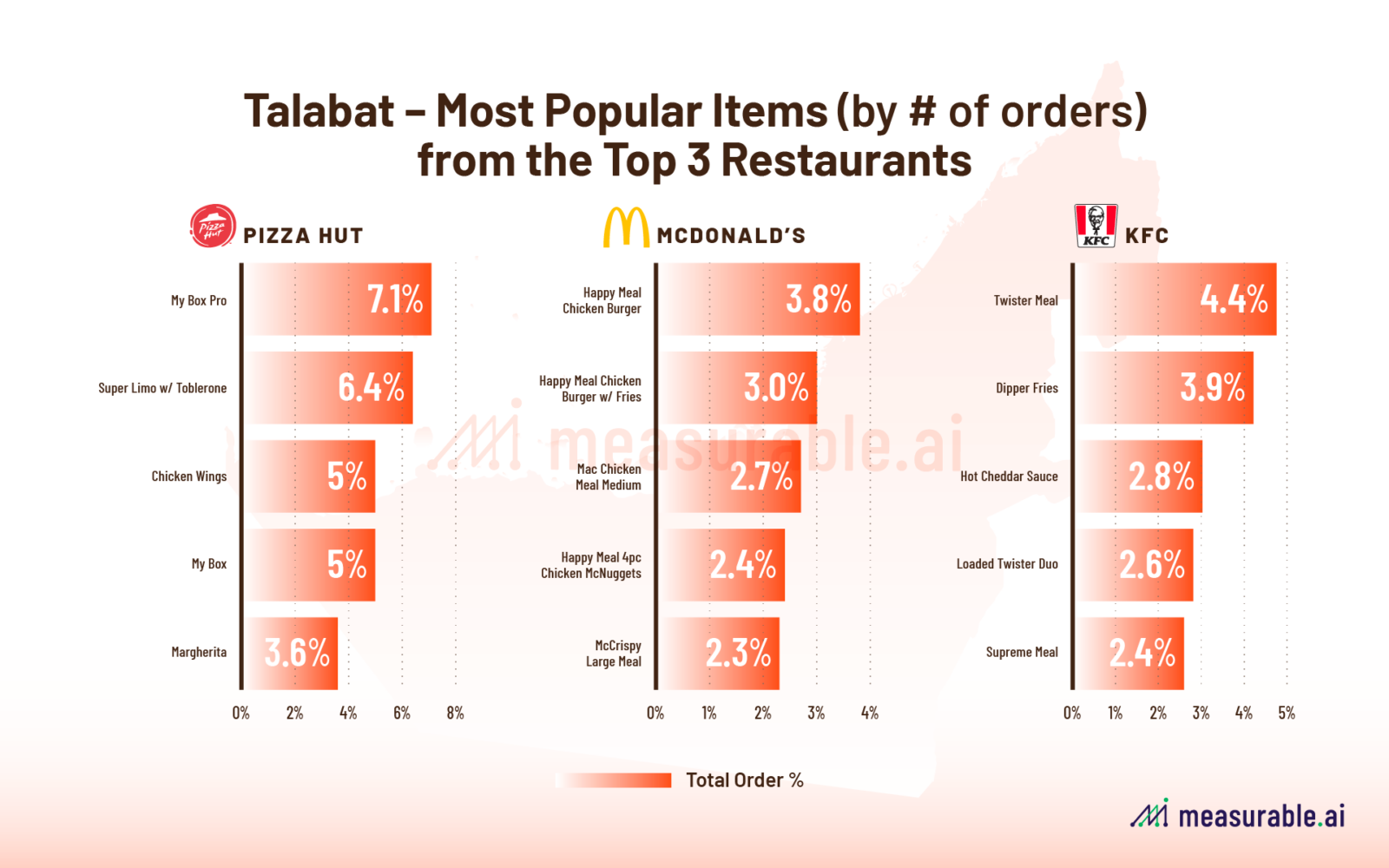

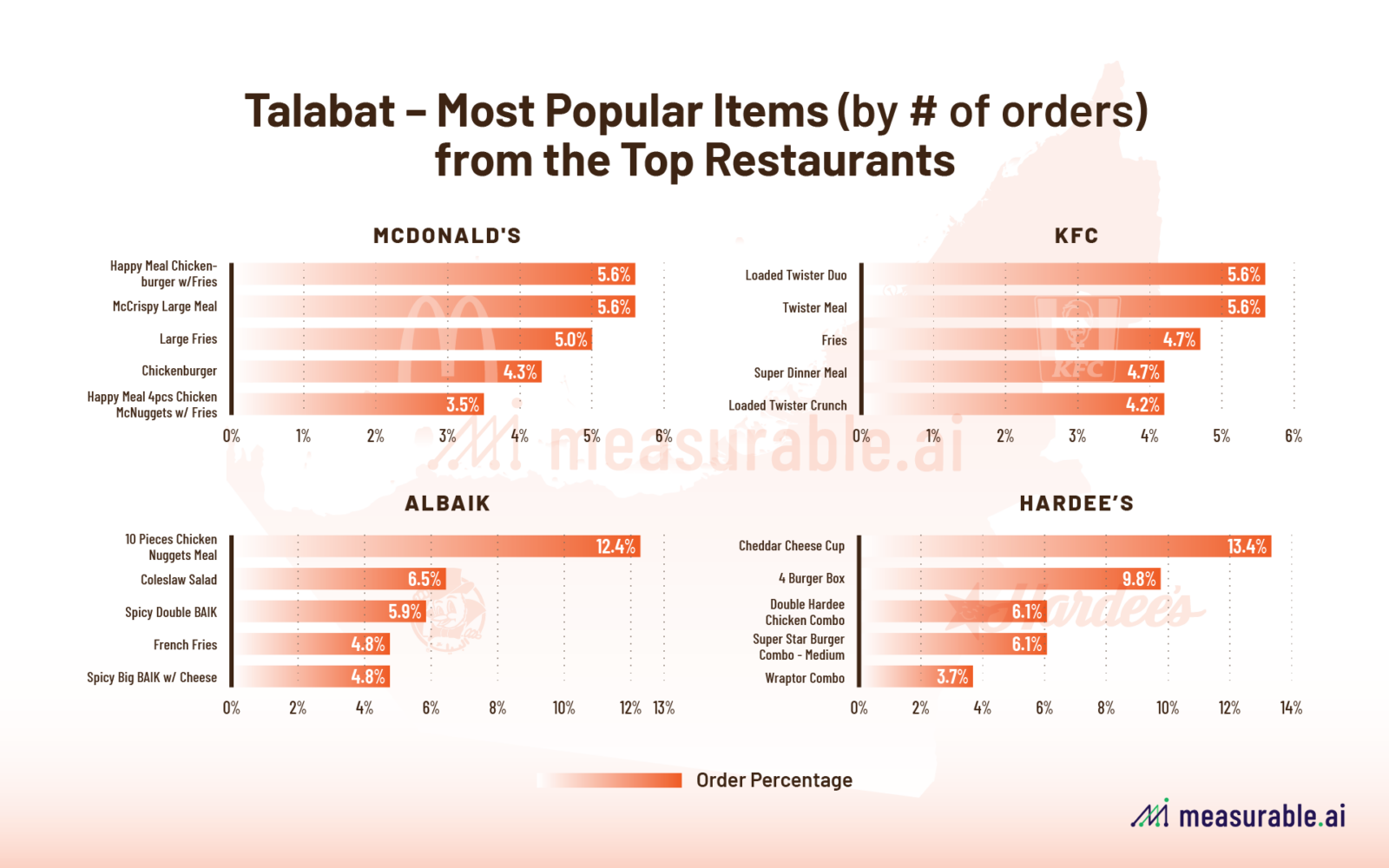

Unsure of the taste buds amongst the UAE population, I was curious to understand what the top five selling items (by quantity ordered) were amongst the big international fast food chains Pizza Hut, McDonald’s and KFC. For Pizza Hut, the customisable My Box Pro meal set was the most popular item, while for McDonald’s it was the Happy Meal and for KFC the Twister Meal.

The top five items ordered on Talabat delivery for April are visualised as follows:

What About the Sauces?

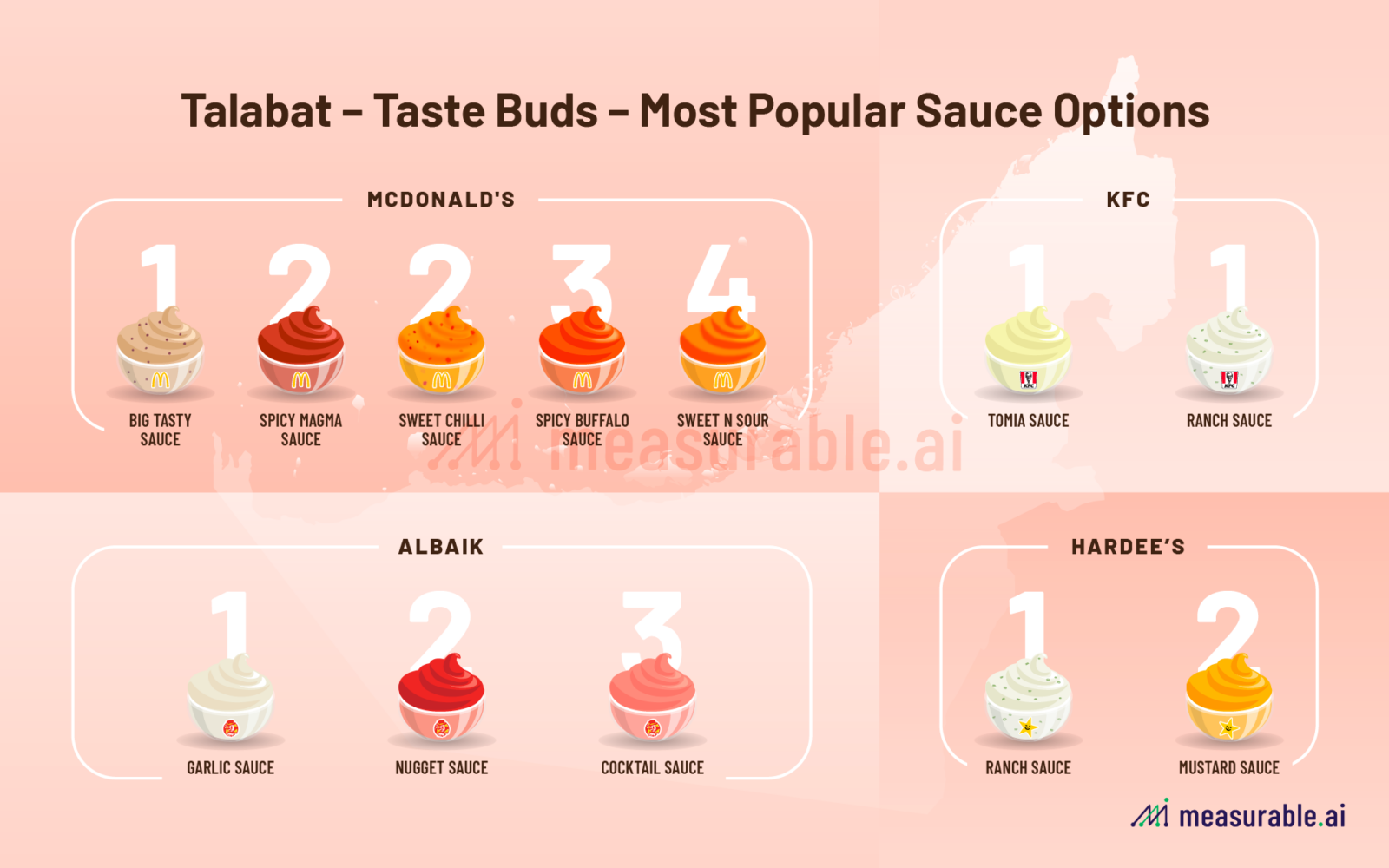

In a similar vein, I wanted to understand the top selling sauces selected amongst the UAE population utilising Talabat’s services when they order fast food. Again, my findings are visualised below:

Doing a quick dive once again into Measurable AI’s Talabat dataset for UAE in April, our data reveals that McDonald’s offers the most diverse sauce selection, with Big Tasty Sauce (rich umami, smoky, savoury) being the clear winner. Albaik’s customers meanwhile preferred the Garlic Sauce followed by the Nugget Sauce (garlic mayo-based, slightly spicy). KFC Talabat patrons seem to show an equal liking between Tomia and Ranch sauces while Hardee’s preferred Ranch first then Mustard.

How about Grocery Delivery?

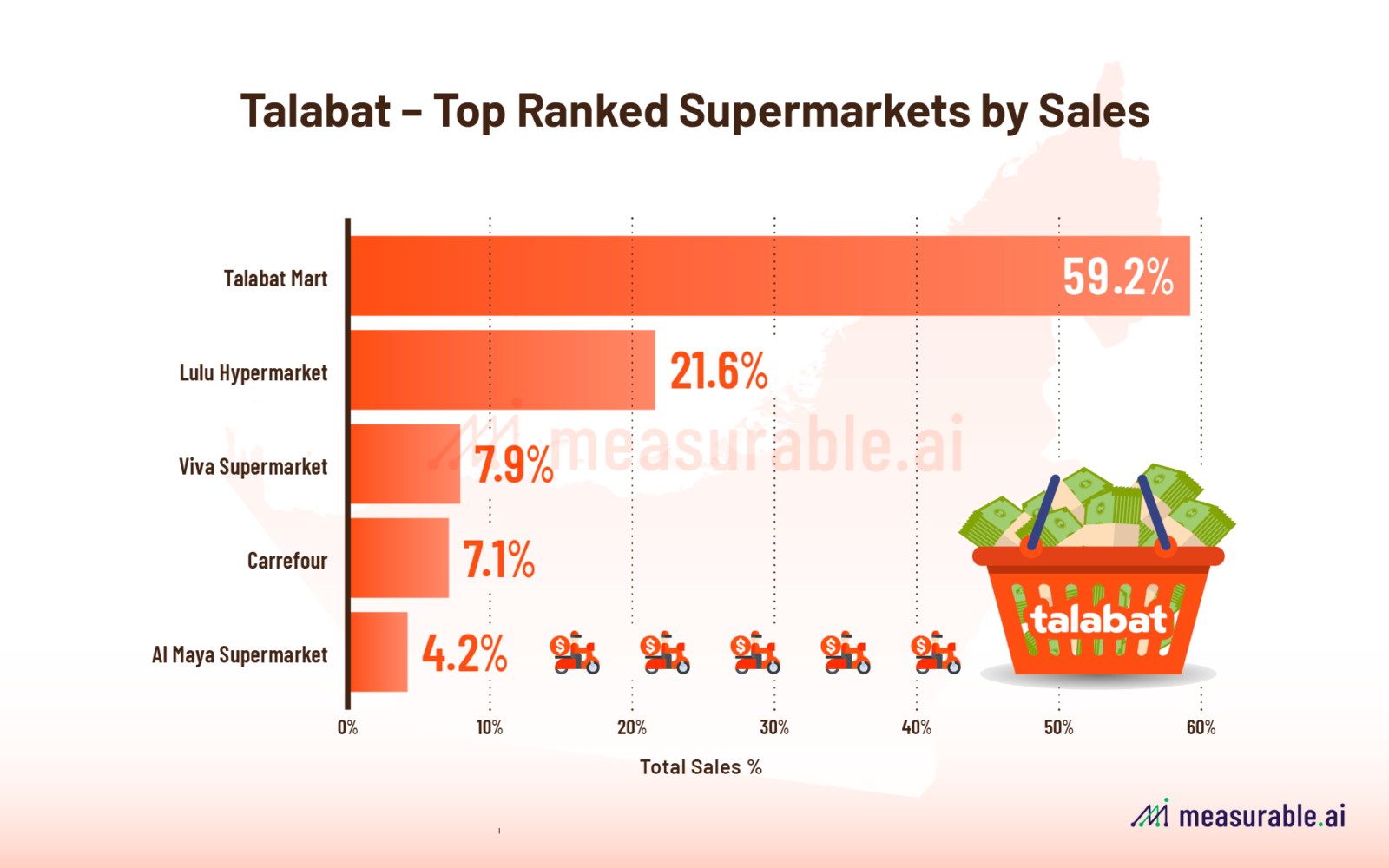

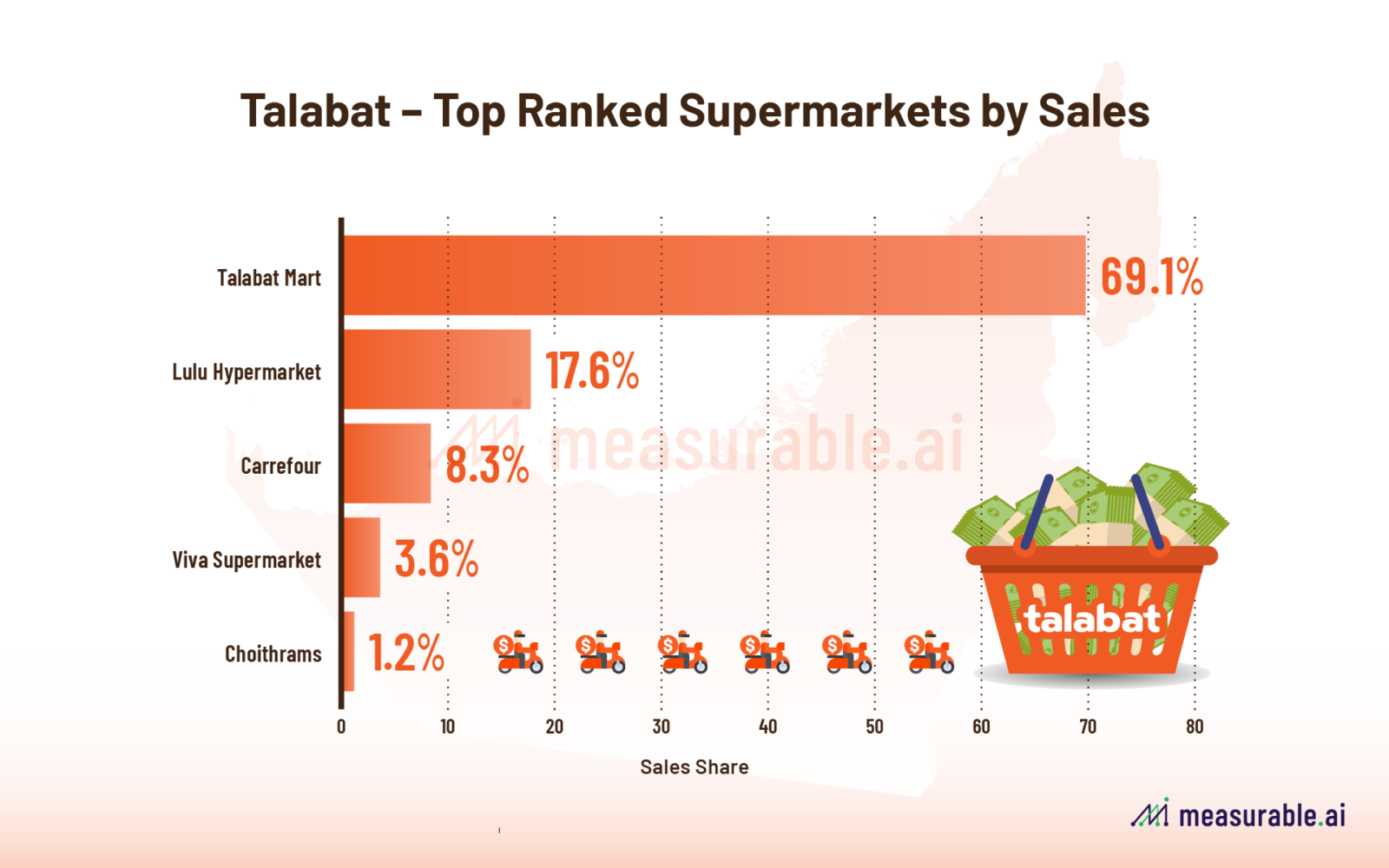

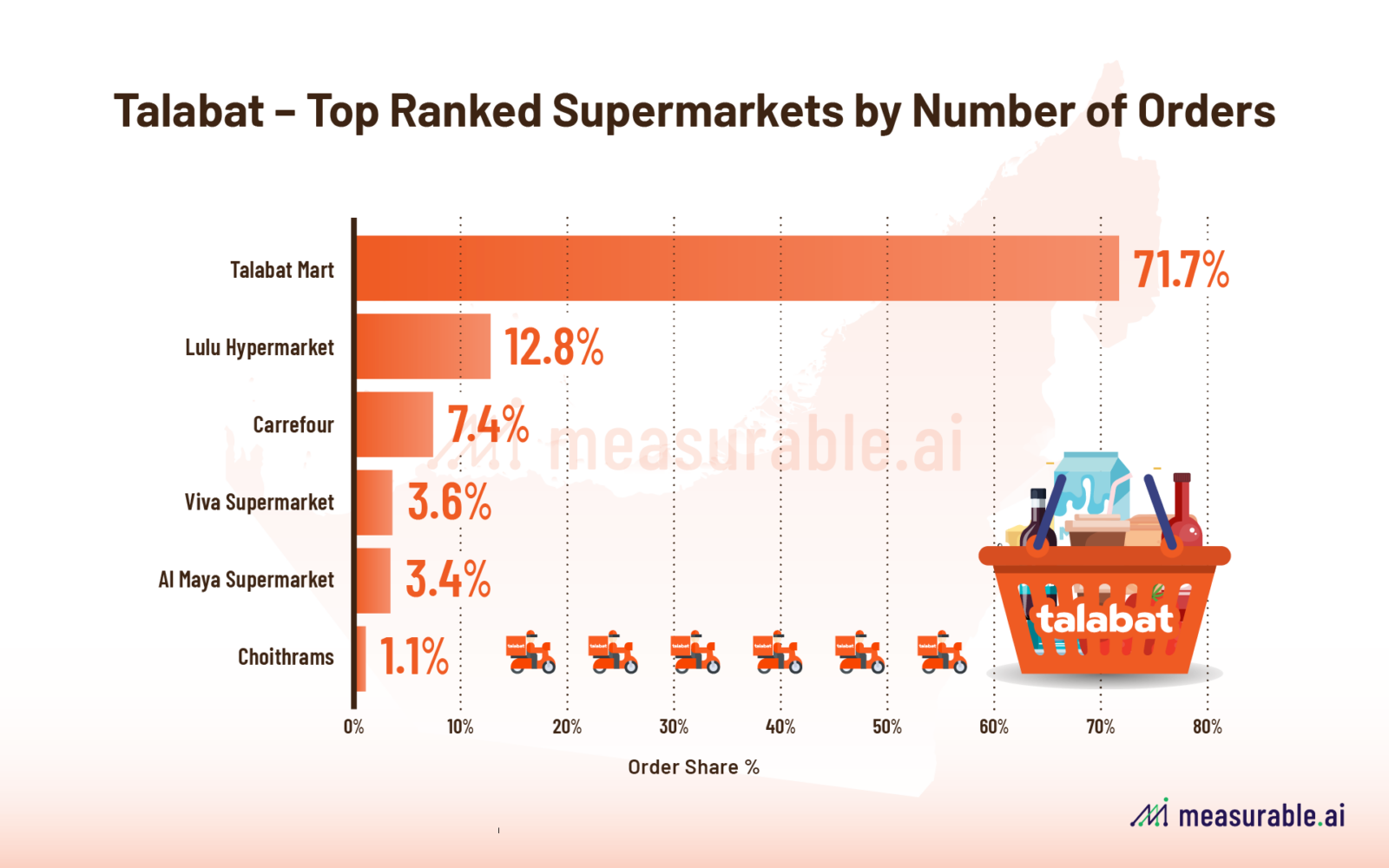

Curious to move beyond the food delivery spectrum from restaurants, I wanted to see how groceries fare when it comes to delivery on Talabat. From our April dataset, when ranked by sales, the top performing online grocery by far is Talabat Mart at ~59.2%, then Lulu Hypermarket (~21.6%) and then Viva Supermarket (~7.9%) and Carrefour (~7.1%) come in quite close together.

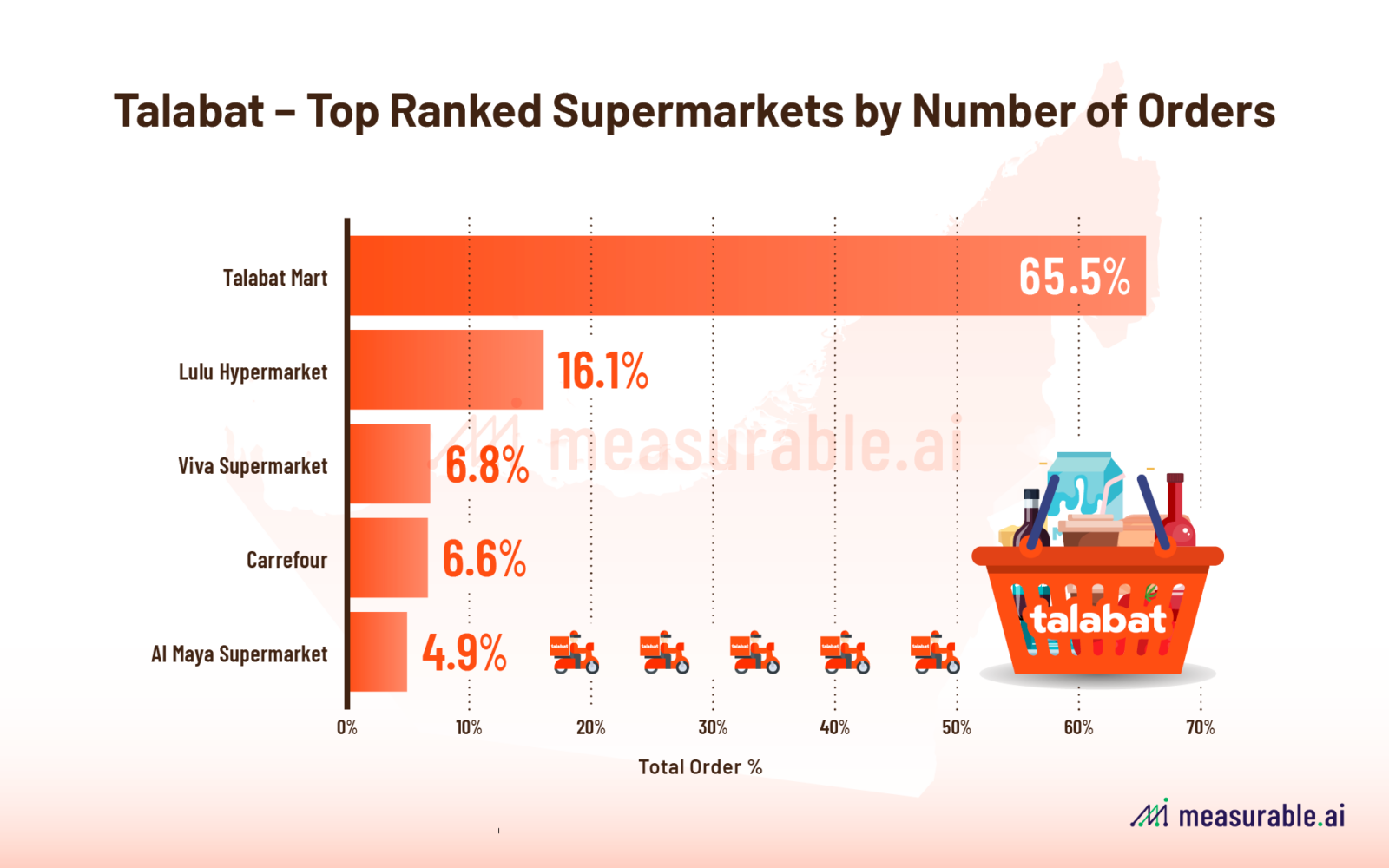

When ranked by total number of orders, the results are rather similar. Talabat Mart leads by far, accounting for 65.5% for April orders, then Lulu Hypermarket at ~16.1% (with a lot of catchup to do), while Viva Supermarket (~6.8%) and Carrefour (~6.6%) again coming in close together.

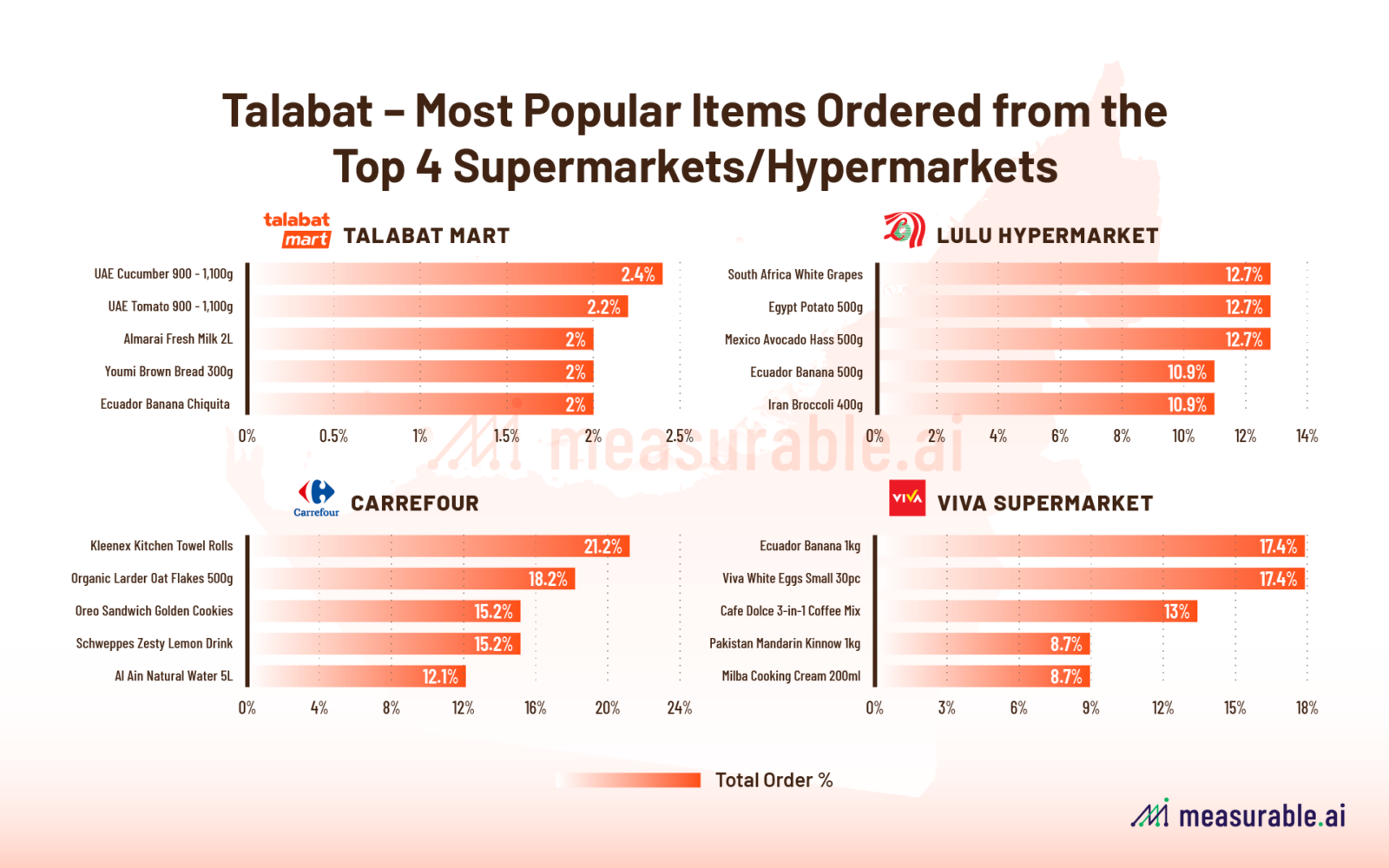

I also took a quick look at the most popular items from the top four supermarkets to see what were the most popular items ordered online. Results are as follows.

What Are The Peak Delivery Days and Times For Talabat Food Delivery?

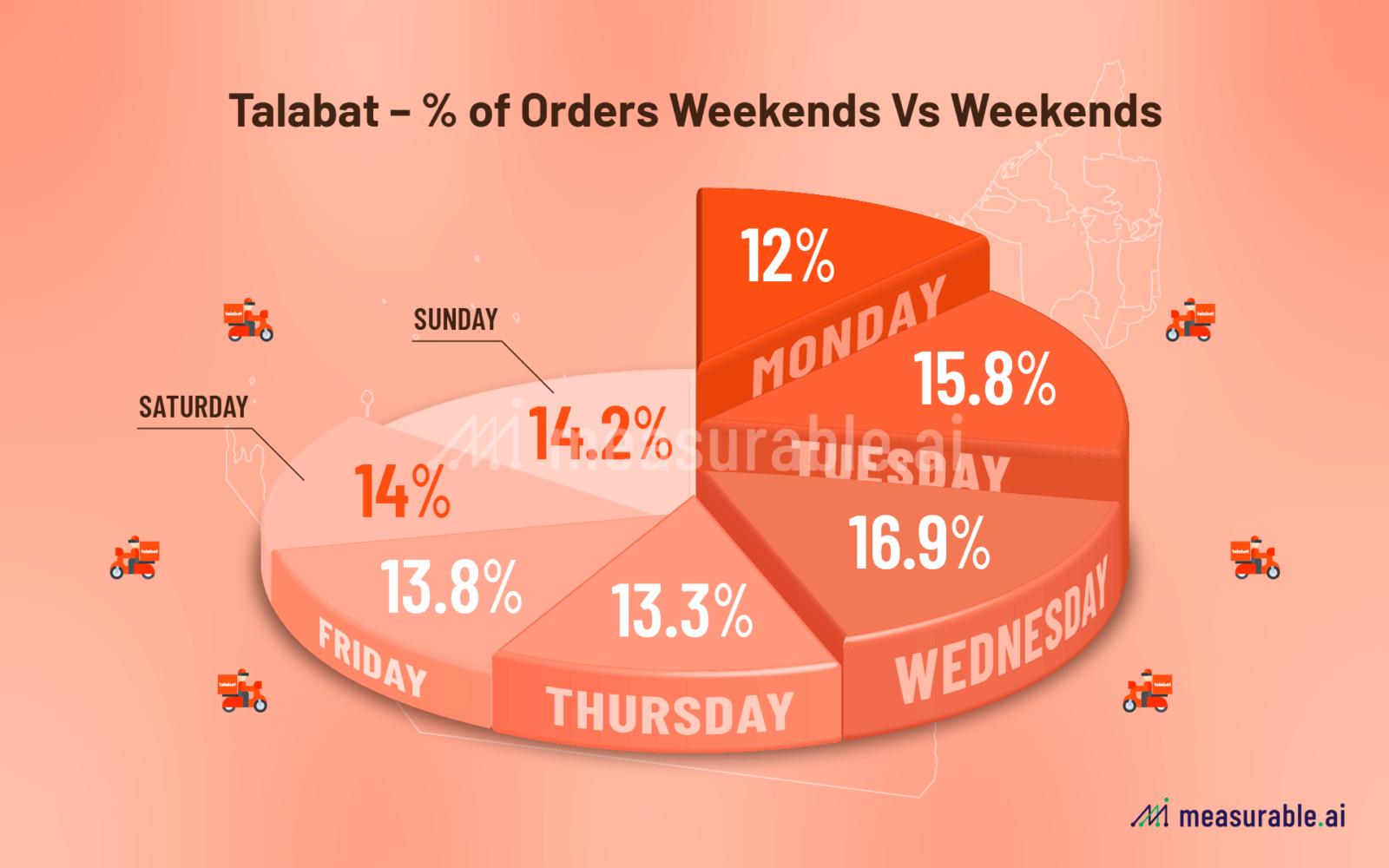

For Talabat, in the month of April, most orders happen on weekdays as opposed to weekends with the peak happening on Wednesday, followed by Tuesday.

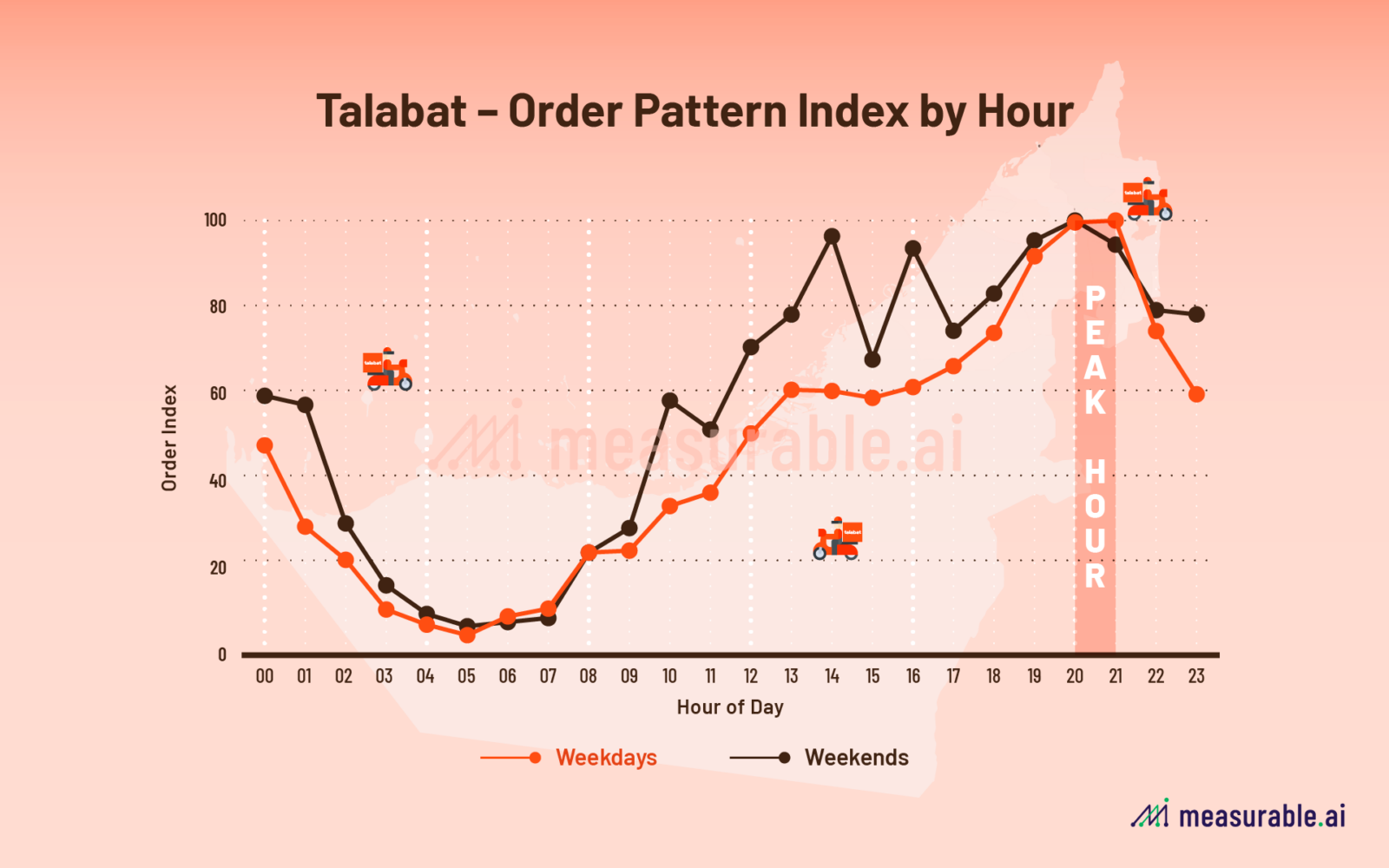

Most food delivery orders happen around the 6-10pm mark (dinner time so makes sense). The absolute peak was at 8pm. There is also a noticeable lull in early morning hours between 3am-8am which is pretty much expected. Ordering activity picks up again during lunch hours with a steady increase towards the evening peak.

Some other interesting observations:

- weekend ordering patterns tend to start later in the day

- weekday orders show stronger peaks during lunch hours

- both periods show strong evening peaks, but with slightly differing timing (looks like people like to binge more late night (post 10pm) on weekends which makes sense)

What About Grocery Deliveries on Talabat?

I was also curious to take a look at the supermarket sector and how they performed on the food delivery apps in UAE. So on closer inspection, here are the top ranked supermarkets:

By both total sales figures and number of orders, Talabat Mart leads the race, followed by Lulu Hypermarket and then Carrefour.

It seems like Dubai water is the most popular item delivered on both Talabat Mart and Carrefour. For Lulu hypermarket and Al Maya, it is onions.

The most popular items ordered (by number of orders) from each store are as follows:

If you are curious to find out about the latest market share between the key food delivery players in UAE (or MENA for the matter) or simply want to understand more about seasonal trends in the food delivery market, please feel free to reach out to Michelle at [email protected].

ABOUT US

Michelle Tang is a Managing Director at Measurable AI who is responsible for new business and strategic partnerships at the firm. Curious as she is, she throughly enjoys analysing data to unearth interesting insights and trends that help drive more informed business decisions.

For those interested in the food delivery sector for other regions, feel free to check out our latest annual report or request a full coverage list or sample datasets by writing to [email protected].

Measurable AI is the leading granular e-receipt provider for consumer intelligence in the emerging markets with a core focus in South East Asia, Middle East, India and Latin America. We cover the digital economy with the major sectors being ride hailing, food delivery, e-commerce and digital payments.

*The Content is for informational purposes only, you should not construe any such information or other material as investment advice. Prior written consent is needed for any form of republication, modification, repost or distribution of the contents.

![]()