2022 Indonesia Ride-sharing Race: Gojek vs Grab

There is Fast and Furious when it comes to the ride-sharing business.

Here’s an update on the ride-sharing race between the two biggest companies in Southeast Asia: Gojek versus Grab for the first half of 2022. After the past challenging years for mobility amid the pandemic, both companies have seen some rebound in ride-sharing business in Indonesia, Southeast Asia’s largest market. What’s the score now?

[2023 Updated] Inside the Duopoly: Gojek vs Grab on Indonesia’s Ride-Hailing Market

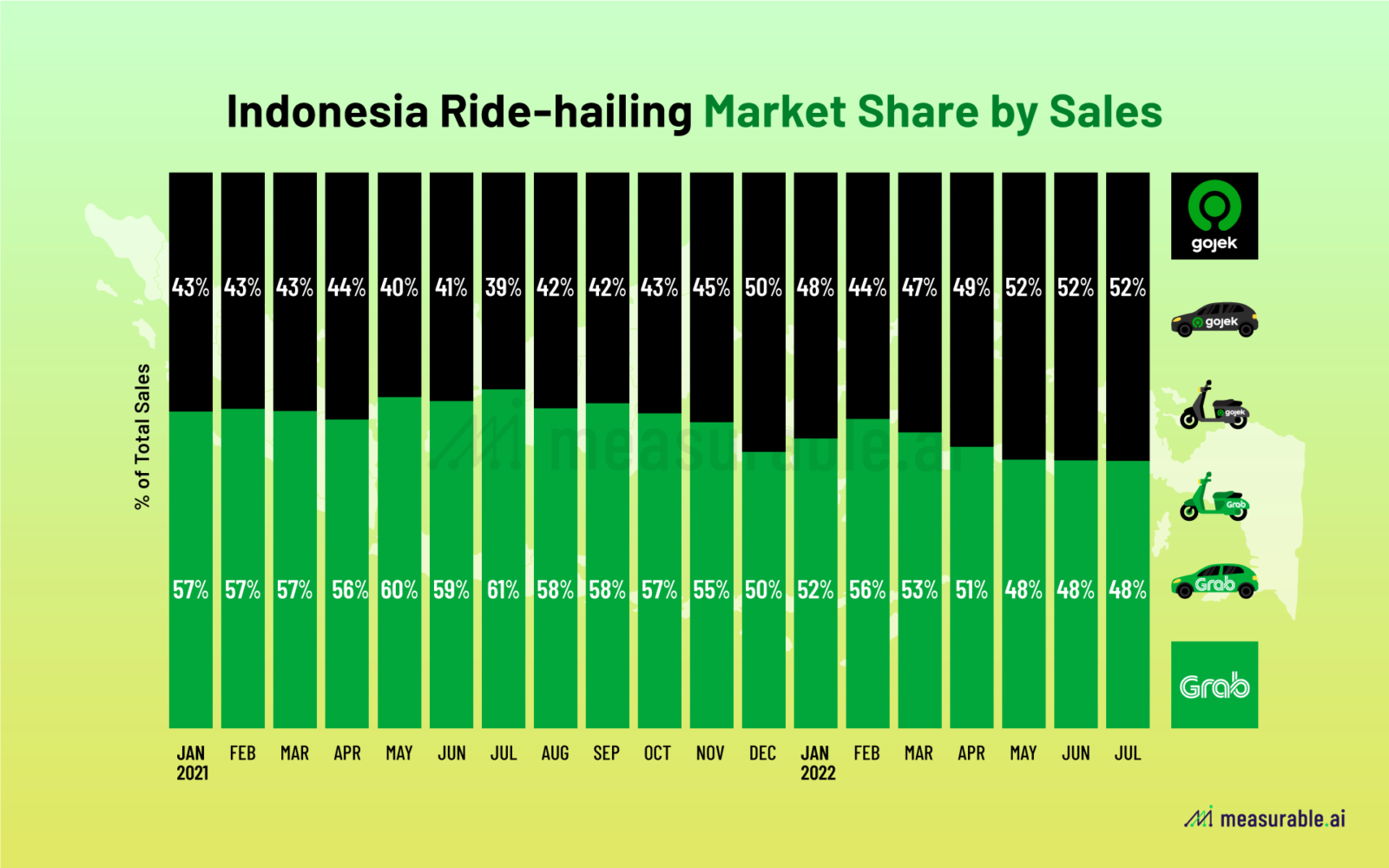

Indonesia Ride-hailing Market Share: A Tight Race

According to Measurable AI’s e-receipts data, the Indonesian ride-sharing market share remained stable across the year of 2021, with Grab capturing 57% of the market by sales. However, starting in 2022, Grab’s advantage shrunk slightly, and as of July 2022 Gojek took the leading spot capturing around 52% of the market share in mobility spending.

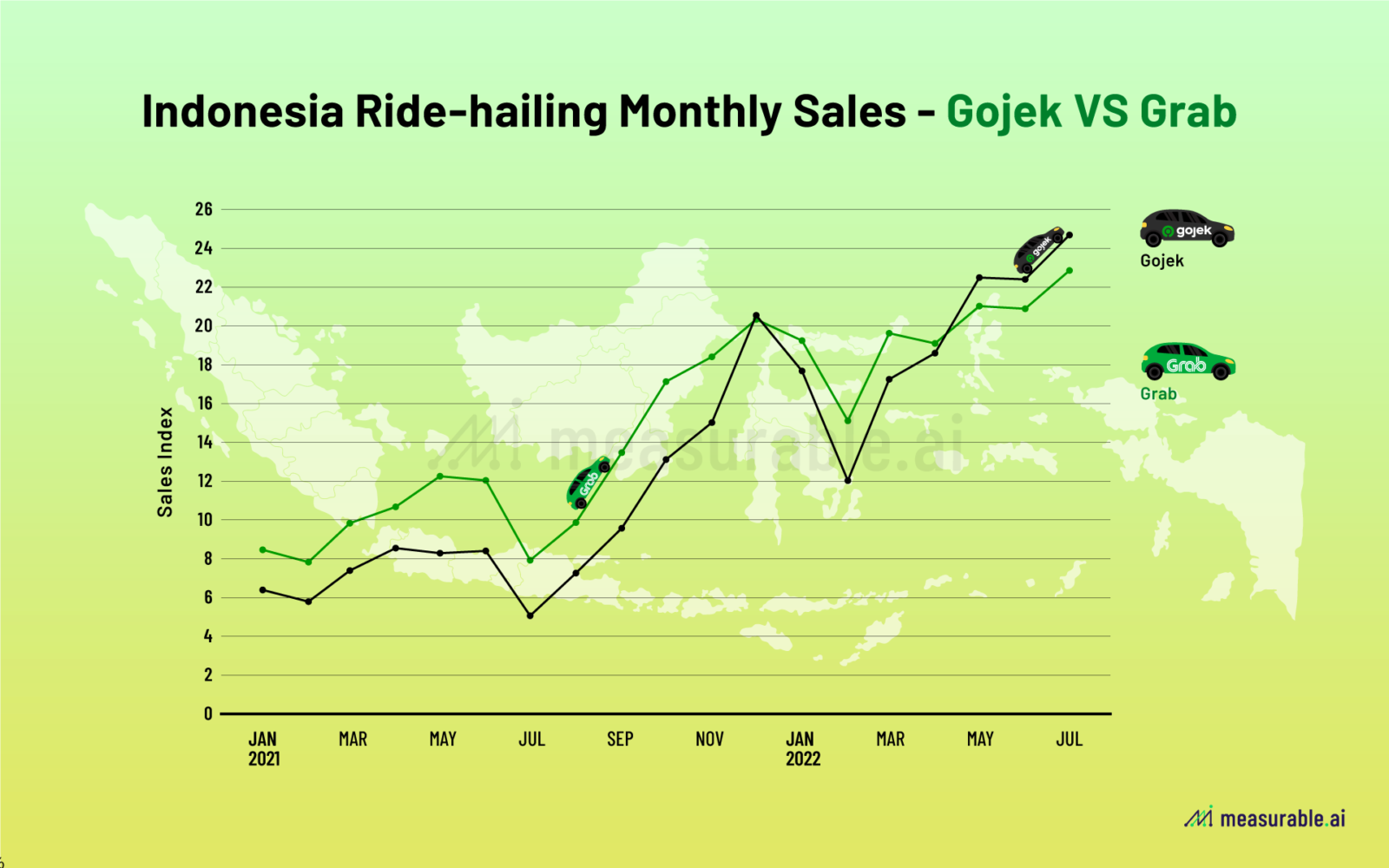

The race has been tight for both companies before and after the recovery in the mobility sector. During August to December 2021 Grab and Gojek’s sales both experienced an upsurge. Going into 2022, the uptrend remains, and the spending for both apps are getting closer each week.

Incentives to Users: Which Company Subsidizes Their Rides More?

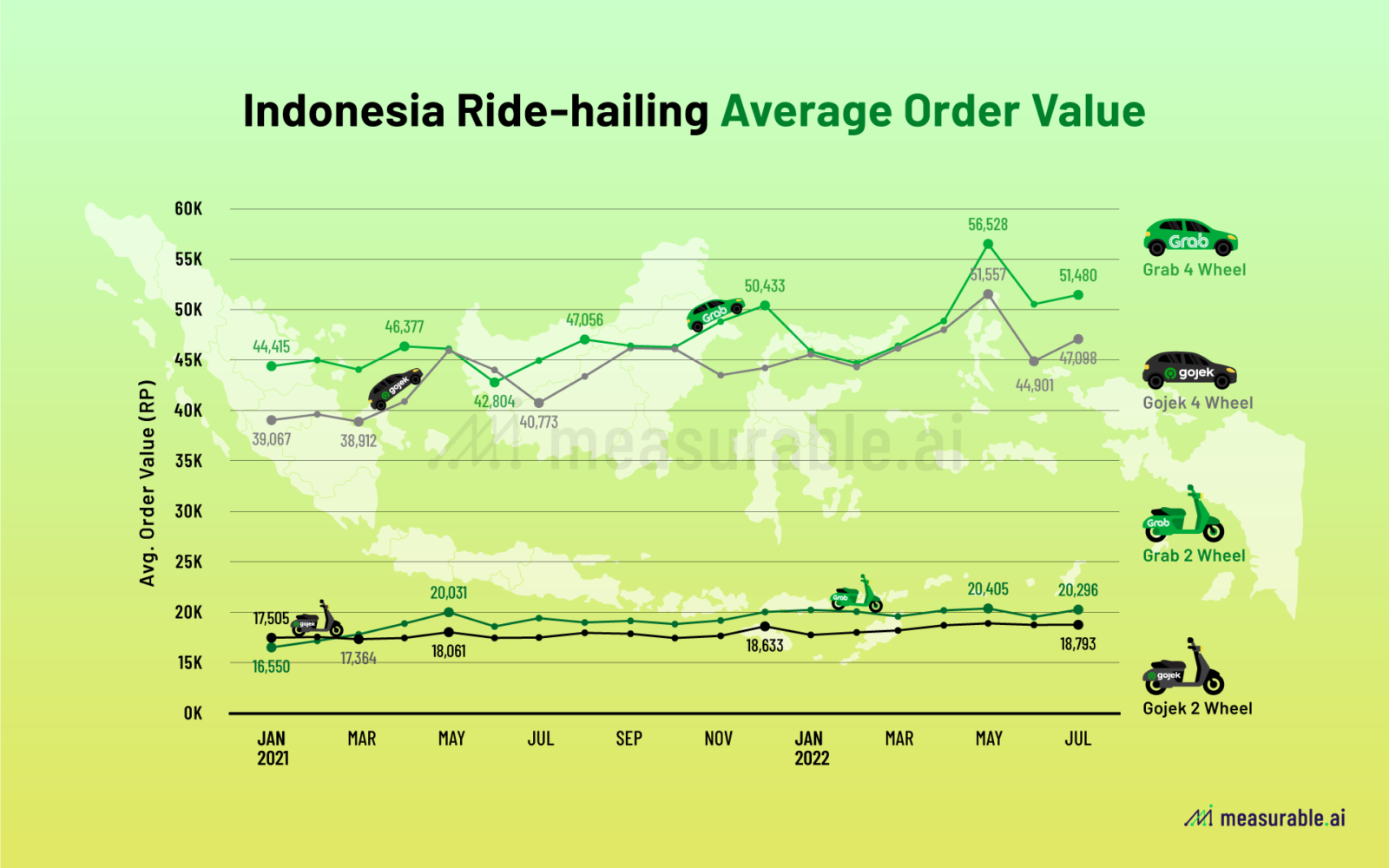

Are rides getting more expensive in Indonesia? While our Latin America e-receipt panel revealed rides were indeed getting more expensive in Brazil and Mexico (read our post on LatAm ride-hailing post surge), Our Indonesia panel indicates this is not the case for Indonesia.

In fact, Grab and Gojek’s cost per ride has not changed much throughout the past two years.

Grab’s overall AOV on either its 4-wheel or 2-wheel rides is only marginally higher than Gojek’s. Grab’s AOV on four-wheel rides saw some growth over the year of 2021, and now hovers around 49,000 RP, which is slightly higher than Gojek at around 47,000 RP this this year (as of July 2022).

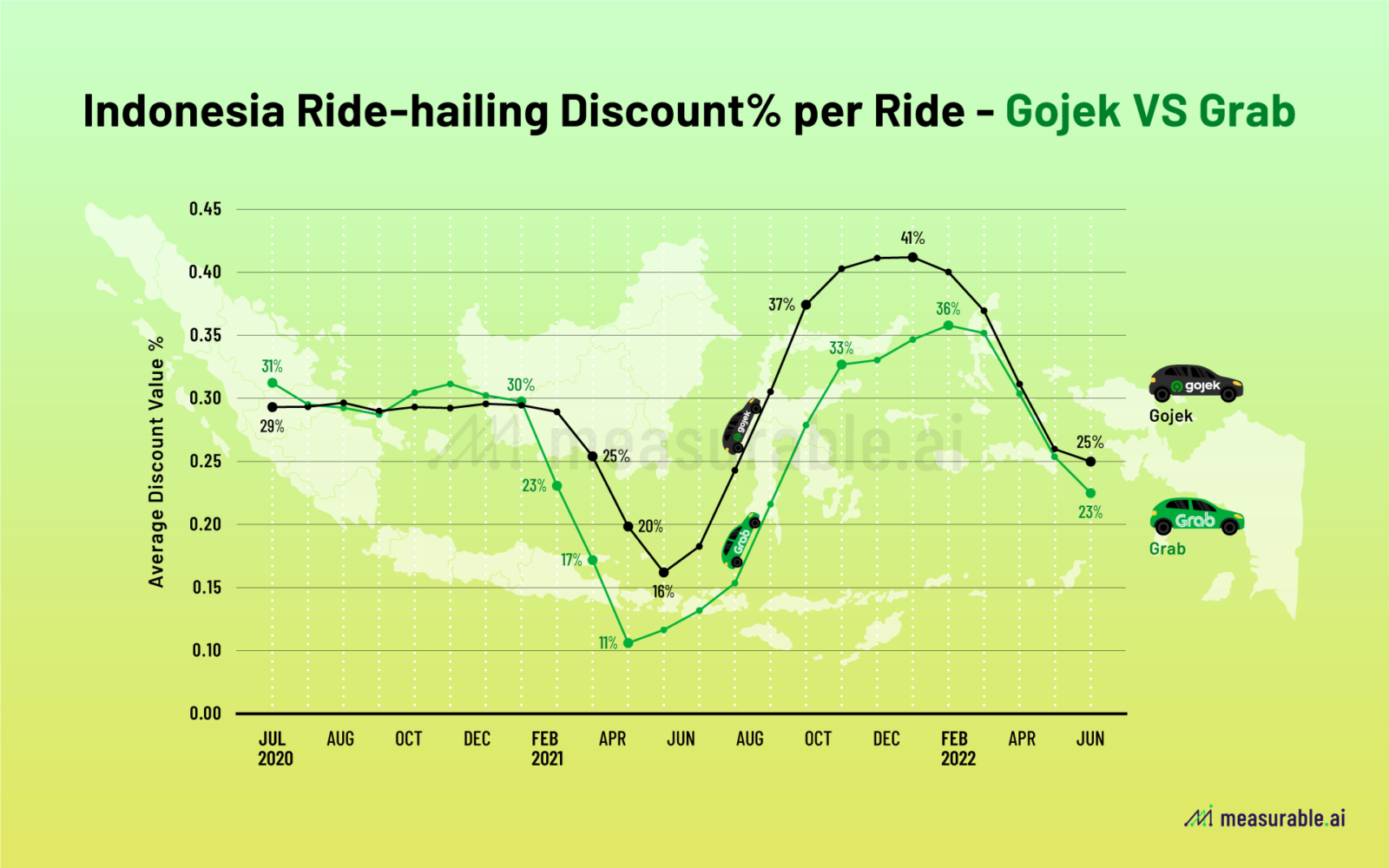

However, the incentives from both platforms on each ride have fluctuated across time. Based on the granular transactional data from Measurable AI, we dive deeper into the incentive structure underpinning both ride-hailing platforms.

Gojek and Grab’s discount value per ride have hovered around 30% until discounts plummeted during the middle of 2021 when Indonesia was hit by the pandemic. After that, Gojek became more aggressive in incentivizing users. From 1Q22, Gojek’s discount % per ride rose to around 40%. Meanwhile Grab kept the same discount % at where it was before the dip.

Entering into Q2 this year, both platforms slowed down at giving away promotions, and in July, the discount rate per order for Grab arrived at around 23%.

Two-wheel > Four-wheel

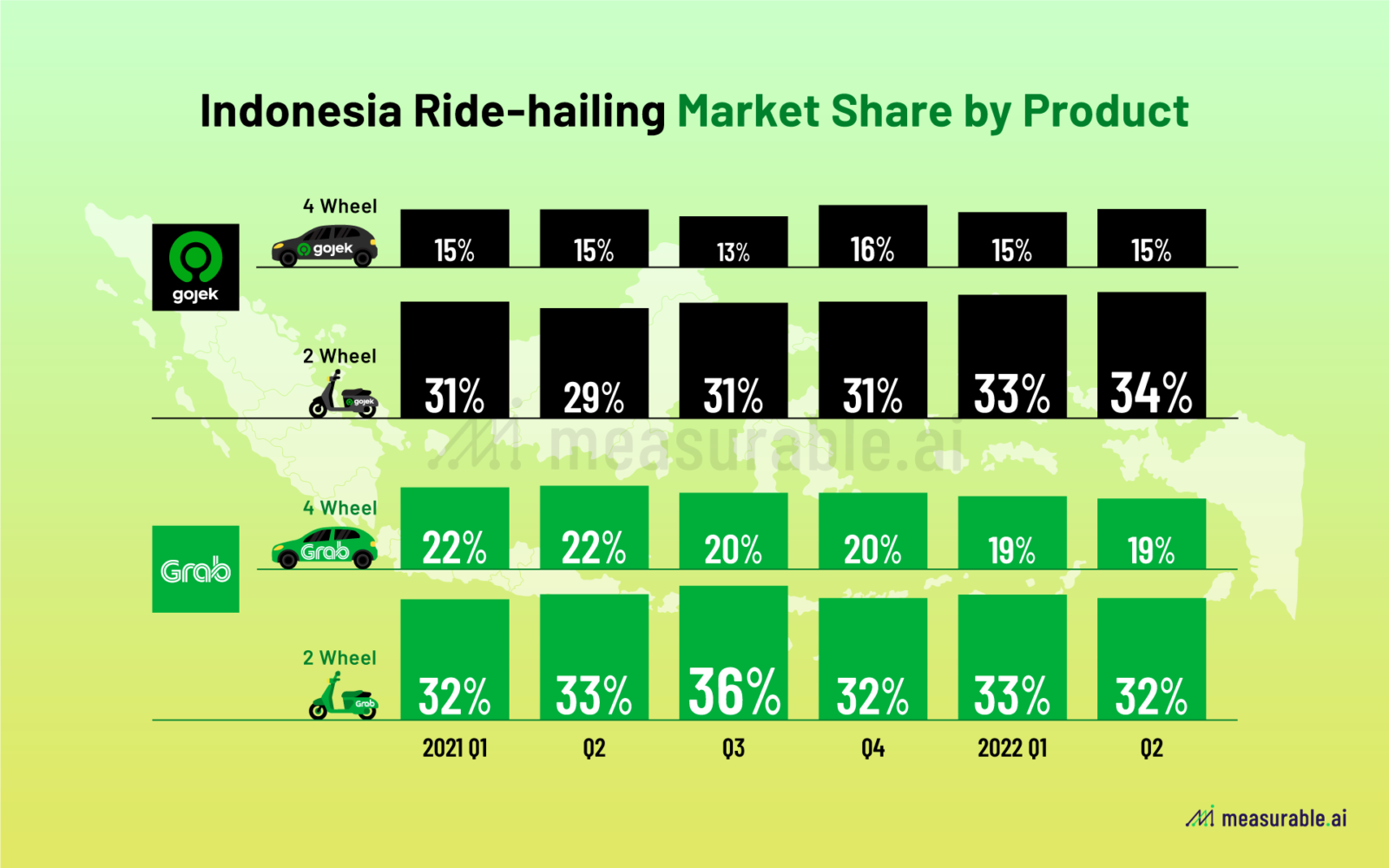

In Indonesia, 2-wheel rides are more dominant on both platforms in terms of order volume. Grab and Gojek’s 2-wheel rides constitute around 32-33% of the total market share respectively by order volume. On 4-wheel rides, as of 2Q22, Grab’s 4-wheel rides owned a slightly bigger share of the market by order volume at around 19%, compared to Gojek’s 15%.

Follow our insights blog and newsletter to keep up with the heated competition between the two super apps in Southeast Asia. Or if you are a hedge fund, corporation or in research and looking for the most up-to-date transactional data insights at [email protected].

At Measurable AI, we build and own a unique consumer panel and are the largest transactional email receipt data provider for the emerging markets. We are well regarded for our comprehensive alternative dataset across the digital economy, particularly for our consumer insights relating to the ride-hailing industry.

ABOUT US

Charlie Sheng is a serial entrepreneur, and a dedicated communicator for technology. She enjoys writing stories with Measurable AI’s very own e-receipts data.

You can reach her at [email protected]

Measurable AI is a leading alternative data provider for food-delivery, ride-hailing, and e-commerce in emerging markets. Covering Southeast Asia, Latin America, India, Middle East and more.

*The Content is for informational purposes only, you should not construe any such information or other material as investment advice. Prior written consent is needed for any form of republication, modification, repost or distribution of the contents.

![]()