Five Fun Facts about Indonesia Food Delivery

Indonesia has emerged as Southeast Asia’s largest online food delivery market, with its huge population and growing adoption in digital economy. At Measurable AI, we build and own a unique consumer panel and are the largest proprietary e-receipt data provider for online delivery for the emerging markets including Indonesia. Thanks to our unique dataset, we are able to look deeper into not only the macro industry trends, and also the fun details behind consumers’ evolving behaviour on food, delivery service and more.

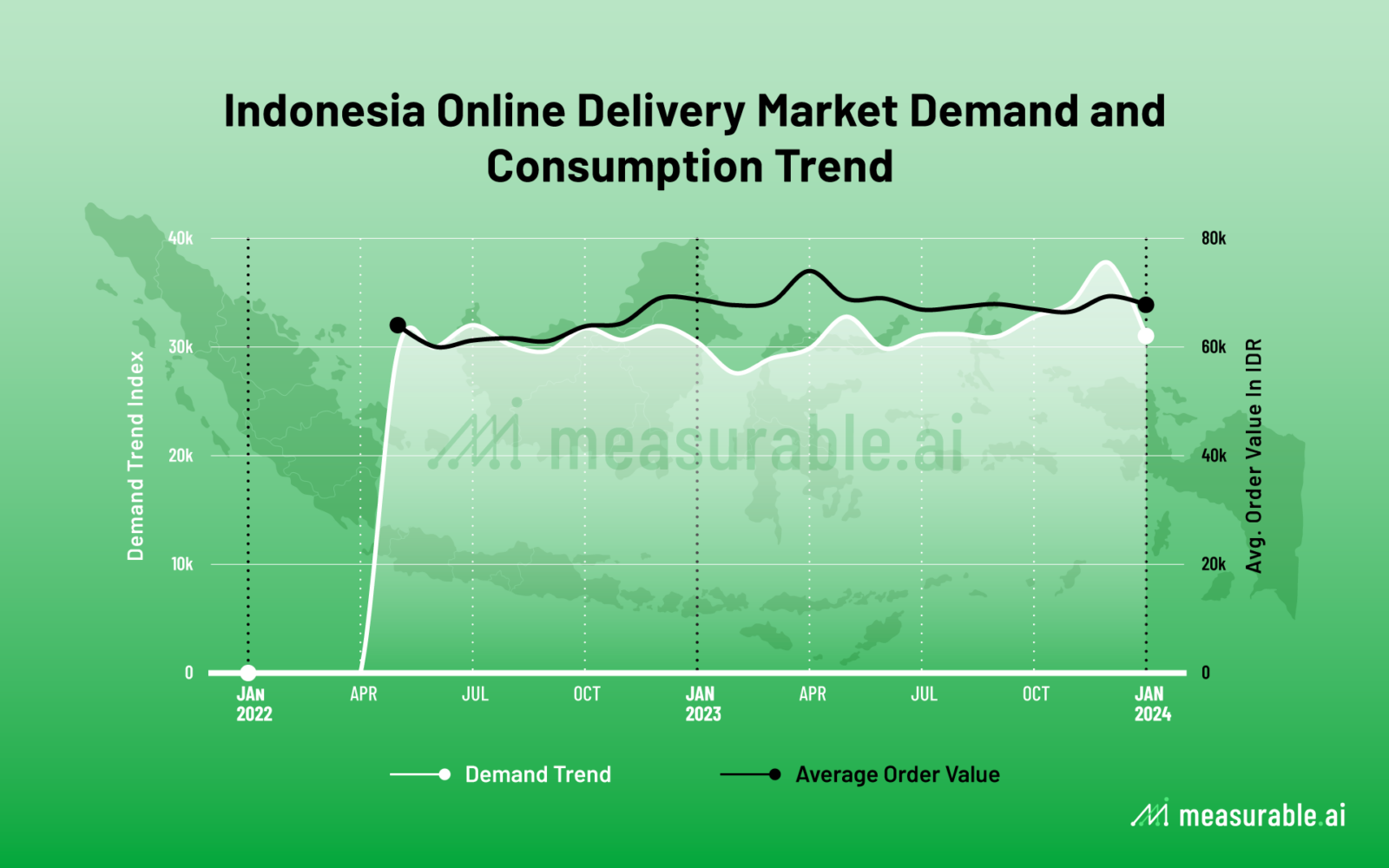

To start, let’s take a look at the Indonesian online delivery market as a whole. According to Measurable AI’s transactional data on Indonesia’s major on-demand food delivery companies, the order volume has shown steady growth over the last two years, boasting an impressive YOY growth rate of 18.2%.

Furthermore, amidst the pressure for profitability for online delivery companies, the Average Order Value (AOV) after incentives in the Indonesian food delivery sector has also experienced a modest rise, moving from approximately 63,000 to over 68,000 IDR. For more detailed information on the overall market demand and consumption trend from 2019 to 2014, sign up for Measurable AI’s latest digital economy report.

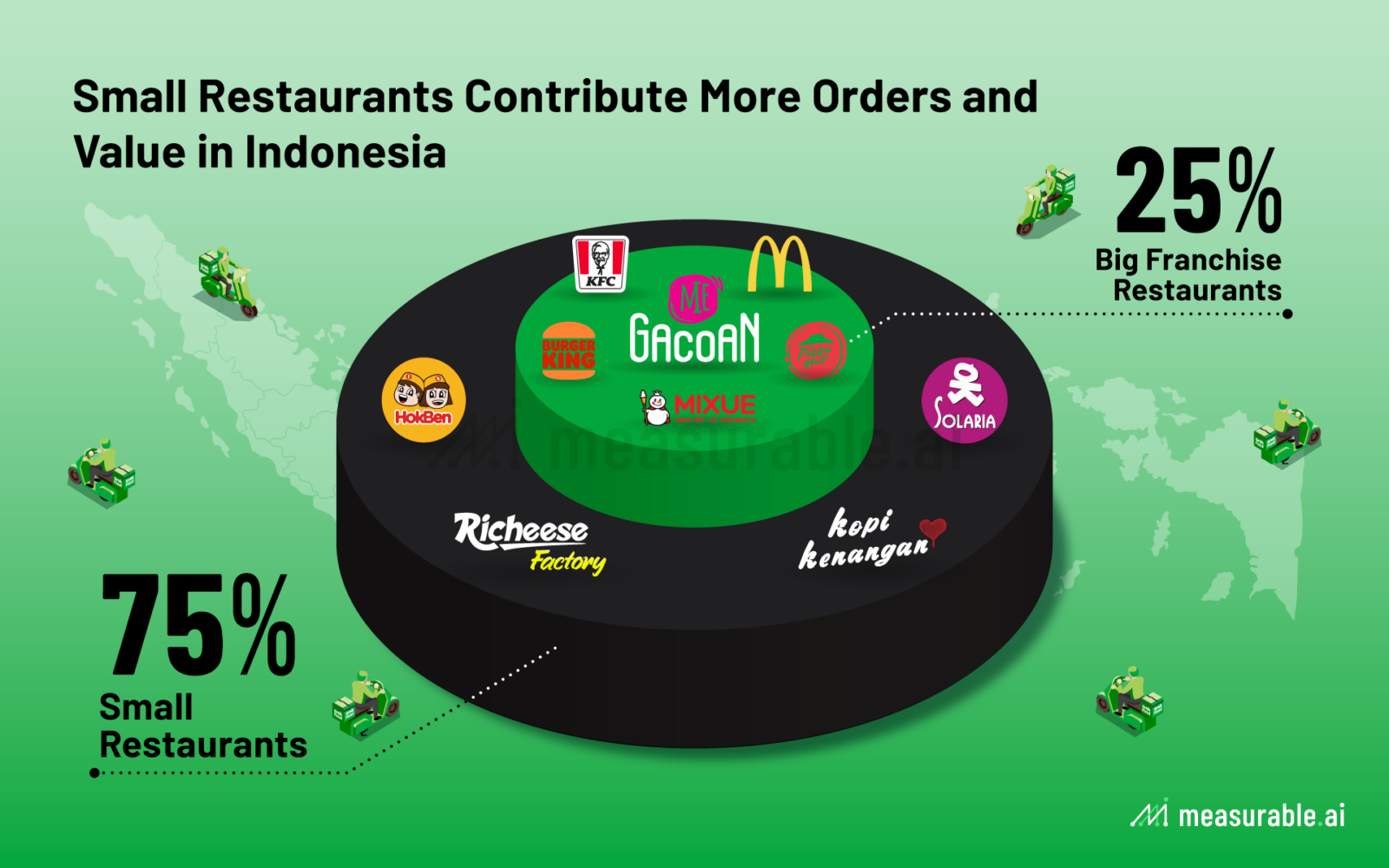

Small Restaurants > Big Franchises

Indonesian food is as diverse as its islands. Our data reveals that on platform GrabFood Indonesia, a huge variety of small restaurants contribute the majority of the orders and GMV for the online deliveries in Indonesia. In January 2024, around 75% of the orders came from small merchants (independent restaurant owners), while the rest from local or global franchise restaurants such as Mie Gacoan, KFC. This is an interesting finding because in many of the markets that Measurable AI tracks, big franchise restaurants especially fast food restaurants usually contribute the most of the orders and value on food delivery platforms, but in Indonesia it’s the other way around.

Our granular food delivery dataset also shows that among the big franchise restaurants on GrabFood platform, the most popular one is Mie Gacoan. Other popular franchises include local restaurants Richeese Factory, Kopi Kenangan, HokBen and Solaria. It’s also noted that Chinese tea brand Mixue also makes the top 10 most ordered franchise restaurants on Grab in the same time period, and shares similar volume as local coffee chain Kopi Kenangan.

10 Top Dishes in Indonesia on Food Delivery

At Measurable AI, we’re not just data geeks, we’re foodies too. Lastly, after analysing the item-level granular dataset, we now announce the list of the most ordered dishes! Regardless of the restaurants, these are the mostly ordered food items by Indonesian food delivery users. Can you guess the top 3 Hidangan Teratas di Indonesia?

Ta-da! As listed in the chart below, the top 3 dishes in Indonesia on food delivery are Chicken, Dish with rice, and Noodles (Ayam, Nasi dan lauk, and Mie). So, the next time you’re in Indonesia, you know what to order.

Stay hungry, and keep ordering.

To unlock more detailed user behaviour analysis including user loyalty/retention rate, overlap analysis, and incentive trend, please schedule a demo with us.

About Measurable AI

Charlie Sheng is a serial entrepreneur, and a dedicated communicator for technology. She enjoys writing stories with Measurable AI’s very own e-receipts data. You can reach her at [email protected].

At Measurable AI, we build and own a unique email receipt consumer panel and have become the largest transactional email receipt data provider for the emerging markets. We are well regarded for the granular insights that can be extracted from our comprehensive datasets across the digital economy, including travel, e-commerce, digital entertainment, food delivery and ride-hailing.

Check out our latest reports: 2024 Digital Economy Annual Report, 2019-2022 Food Delivery Annual Report for Asia, Asia & Americas Ride-hailing Report 2019-2023.

*The Content is for informational purposes only, you should not construe any such information or other material as investment advice. Prior written consent is needed for any form of republication, modification, repost or distribution of the contents.

![]()