Meituan’s Food Delivery Debut in Hong Kong: Keeta vs Deliveroo vs Foodpanda

Chinese super app Meituan (3690.HK) launched its food delivery brand Keeta in Hong Kong on May 22nd, marking its first market expansion outside mainland China. Back home, Meituan is competing with Ele.me from Alibaba’s (9988.HK) on food delivery, and Didi Global for ride-hailing. Meituan’s food delivery service is leading in the Chinese market with over 60% of the market share.

At Measurable AI, we build and own a unique consumer panel and are the largest transactional email receipt data provider for the emerging markets. We are well regarded for our comprehensive dataset across the digital economy including the food-delivery industry.

Before Keeta’s Arrival: The Foodpanda and Deliveroo Duel

In Hong Kong, Meituan’s Keeta enters a battlefield commanded by Foodpanda (DHER.DE) from Germany and Deliveroo (ROO.L) from the UK. Our unique e-receipt data from Measurable AI reveals that in May 2023 (pre-Keeta launch), Foodpanda held around 64% of the market share, ahead of Deliveroo’s 36% in terms of overall order volume (including both pickup and delivery orders).

To rewind the food delivery market in Hong Kong in the past five years: there were three players – UberEats, Foodpanda, and Deliveroo – once vied for dominance. Deliveroo used to lead the pack with over 60% of the market share in 2019. However, the pandemic shifted the game, with Foodpanda and Deliveroo splitting the market almost equally, and UberEats scooping up a modest 5% before bowing out at the end of 2021. Post-UberEats, Foodpanda gained momentum, securing over 60% of the market share by revenues from 2022.

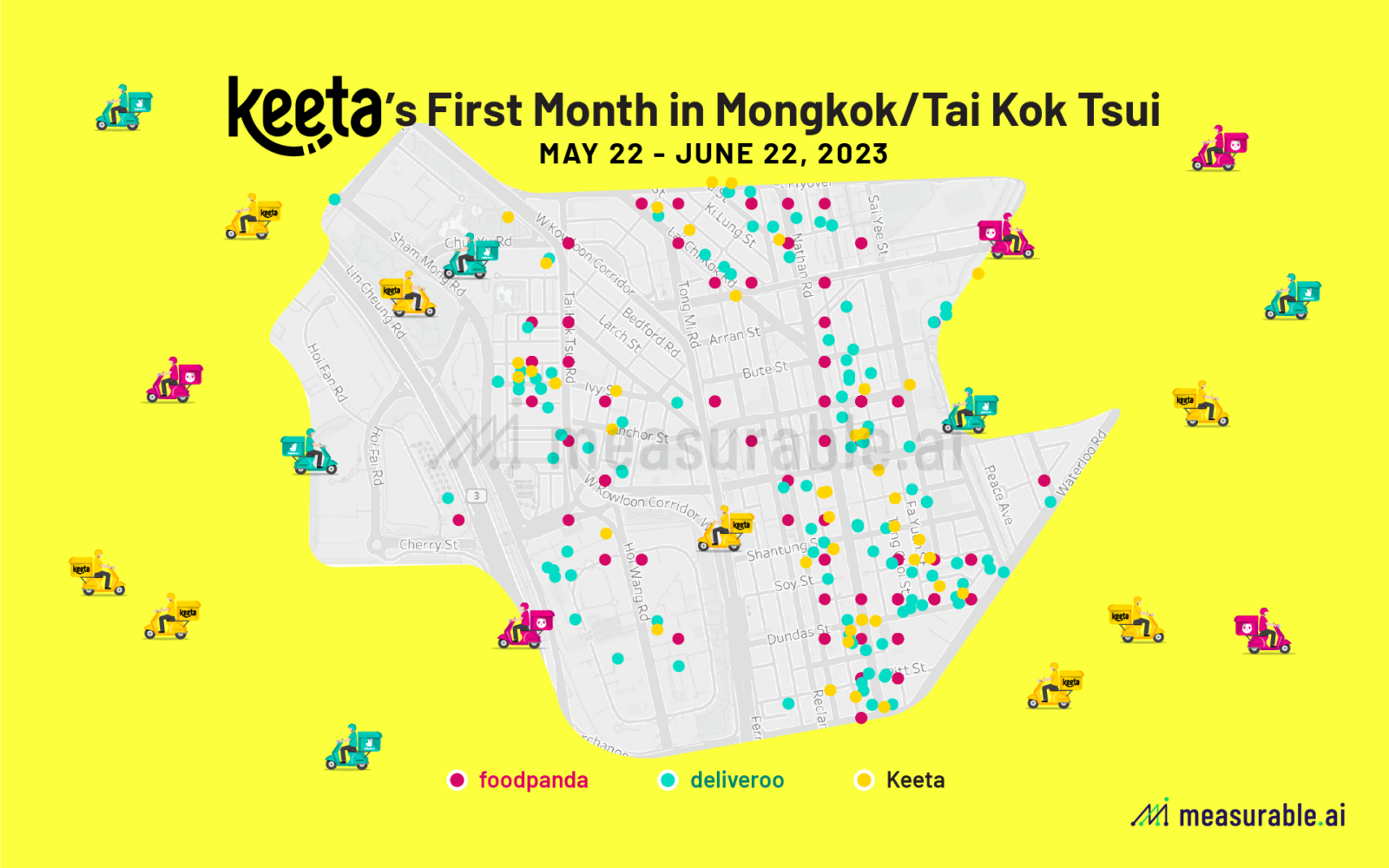

Keeta’s First Month in Mongkok / Tai Kok Tsui

Keeta made its first splash in Kowloon – specifically the bustling Mongkok / Tai Kok Tsui area. Delving into the granular e-receipt data from Measurable AI, we analyzed the orders from the three food delivery apps during Keeta’s inaugural month, from May 22 to June 22, 2023 in this specific region. Only delivery orders from this region where Keeta is available were considered, given that Keeta hasn’t launched the self-pickup service in app.

According to Measurable AI’s data on delivery orders (since Keeta hasn’t launched pickup service), Keeta takes around 20% of the market share in Mongkok / Tai Kok Tsui in its first month in Hong Kong in terms of delivery only order volume. Deliveroo and Foodpanda claimed around 36% and 44%, respectively. It’s important to highlight that these orders in the specific Mong Kok / Tai Kok Tsui region constitute around 5.4% of the total orders of Deliveroo in that month, and a mere 2.8 % for Foodpanda. When focusing solely on delivery orders, these figures only account for 8.4% and 4.4% of Deliveroo and Foodpanda’s totals, respectively.

Follow-up: Keeta’s Second Month in Hong Kong

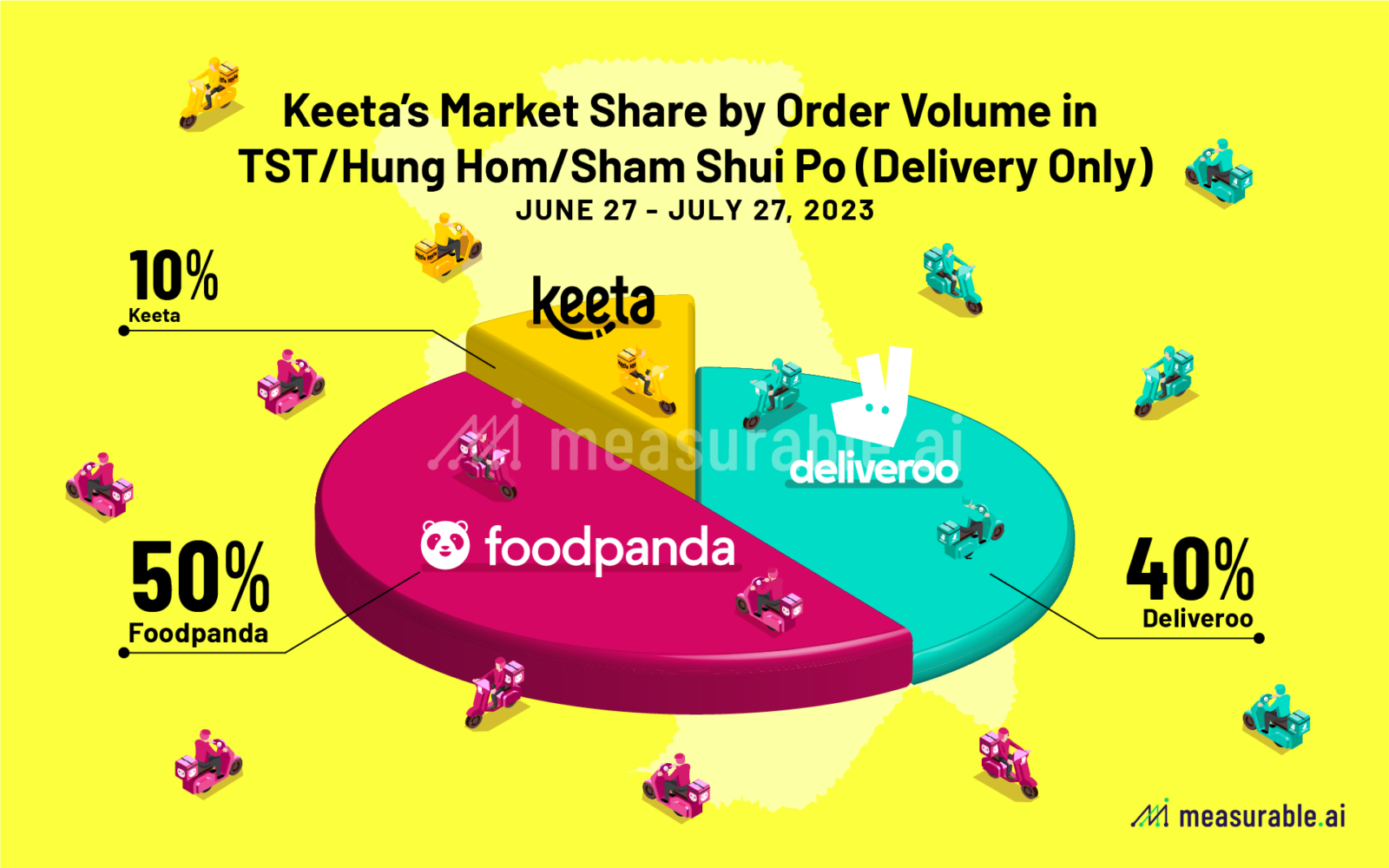

Not long after, in a bold move, Keeta quickly expanded its service range to include more regions within Kowloon, namely Tsim Sha Tsui, Hung Hom, and Sham Shui Po.

According to Measurable AI’s data on delivery orders (given that Keeta still hasn’t yet introduced a pickup service),Within a span of just its second month (from June 27 to July 27) in the Hong Kong landscape, Keeta managed to carve out an impressive 10% share in terms of delivery-only order volume. Deliveroo and Foodpanda claimed around 40% and 50%, respectively.

LATEST UPDATE (2023 December)

As of 2023 December (which is six months after Keeta’s debut), when including all services, Keeta’s market share by GMV actually stood at around 15% in Q4. In December, Keeta’s growth was unprecedented, it managed to own around 21% of market share in terms of GMV, with Foodpanda leading at 54% and Deliveroo at approximately 25%. Read our latest report: Watch Out! Keeta’s Rapid Rise in Hong Kong for more details.

It will be intriguing to monitor the shifts and growth in market shares as Keeta expands to other regions and continues its operations in Hong Kong. Stay tuned as we continue to monitor the Hong Kong food delivery race between Keeta, Foodpanda, and Deliveroo in our upcoming blog post with Measurable AI’s unique consumer panel.

About Measurable AI

Charlie Sheng is a serial entrepreneur, and a dedicated communicator for technology. She enjoys writing stories with Measurable AI’s very own e-receipts data. You can reach her at [email protected].

At Measurable AI, we build and own a unique email receipt consumer panel and have become the largest transactional email receipt data provider for the emerging markets. We are well regarded for the granular insights that can be extracted from our comprehensive datasets across the digital economy, including travel, e-commerce, digital entertainment, food delivery and ride-hailing.

Check out our latest Reports: 2019-2022 Food Delivery Annual Report for Asia, Asia & Americas Ride-hailing Report 2019-2023.

*The Content is for informational purposes only, you should not construe any such information or other material as investment advice. Prior written consent is needed for any form of republication, modification, repost or distribution of the contents.

![]()