[$HUYA]Chinese Gaming Live-Stream Platform Huya beats Douyu in Revenue, With Fewer Paying Users

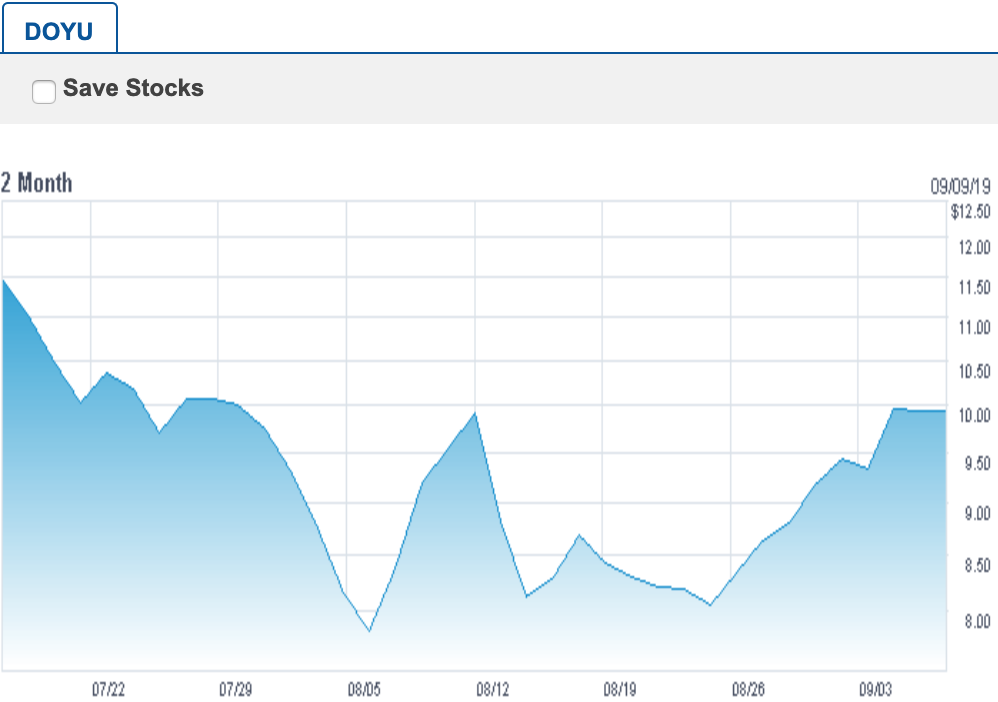

Since major player Panda TV gone bankrupt in March, the Chinese gaming broadcast industry was left with Huya (Nasdaq: HUYA) and Douyu (Nasdaq: DOYU) competing neck and neck. In July this year, Douyu got listed on Nasdaq and revealed in its Q2 report that the company is catching up with Huya’s 56 million MAU with its new 50 million record. But then, can the newbie Douyu also catch up with Huya, the first ever gaming live-stream stock, in terms of stock prices?

Huya and Douyu are popular live-stream platforms in China focusing on gaming broadcasts, available on both web and mobile. The pair of rivals strive for viewers by snatching exclusive streaming rights of tournaments and the nation’s hottest gamers.

The major portions of their income come from in-app purchases (IAP), where users obtain in-app currencies to buy virtual gifts for their favourite streamers. Both companies are backed by Chinese tech giant Tencent.

Live broadcasts of popular games (e.g. League of Legends, DOTA2, CS:GO) on Douyu

As disclosed by their financial reports, Huya’s got a revenue of 2 billion with 170 million of net profit recorded. This is the 7th consecutive quarter Huya has recorded profit in. While Douyu has got a 1.8 billion revenue with 20 million of net profit, falling way behind Huya.

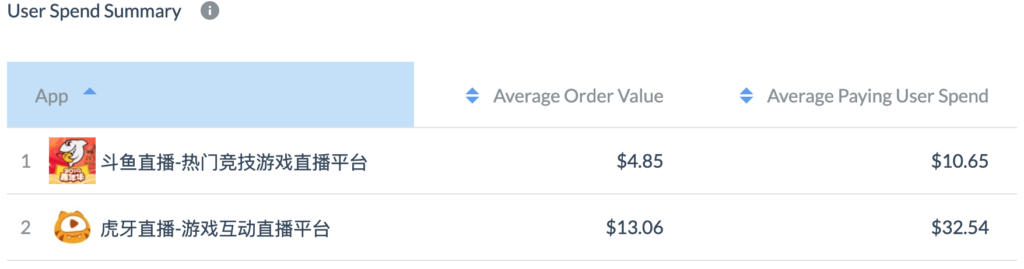

Similarly, from Measurable AI’s data, we can see that Huya has always led Douyu in IAP revenue over the first half of 2019, while having a significantly smaller amount of paying users than Douyu.

Huya’s much higher average paying user spend contributes to this seemingly interesting phenomenon. MAI’s data below shows us that Huya’s paying users spend 3 times more than Douyu’s on average.

With Huya stably growing revenue and high user spend, we can definitely expect a positive prospect on the company, while Douyu might have to work a little harder to catch up with its big brother’s pace. Stay tuned for a detailed report comparing business strategies of Huya and Douyu.

About Measurable AI

Measurable AI is your data powerhouse that provides accurate, real-time and actionable consumer insights. By scanning and identifying billions of actual online spender’s email receipts, Measurable AI transforms them into valuable consumer insights, which updates daily right after the purchases happen.

Cara Lui is a blog-writer specializing in analytical industry trends and new discoveries of Mobile Apps with the assistance of the MAI Insights’ real-time online consumer data panel.

![]()

Mark Wally

April 4, 2022 at 2:22 PMWhere do Chinese gamers stream?

Huya has become the largest streaming platform for eSports streaming in China. As of December 2021, the game streaming app had amassed about 28.2 million of monthly active users in the country. Twitch, Youtube, Facebook, and Mixer are the platforms having the highest number of eSports viewership outside China.